IGL shares dive 10% as Jefferies downgrades stock after Delhi EV policy

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

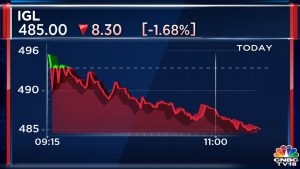

Indraprastha Gas shares slumped over 10% today after global brokerage Jefferies double-downgraded the stock to ‘Hold’ from ‘Buy’, and trimmed its target price to Rs 465 from Rs 565 earlier.

City Gas Distribution (CGD) companies such as Indraprastha Gas (IGL) and Mahanagar Gas (MGL) continues to witness selling pressure in Friday’s (October 20) trade after the Delhi government approved the electric vehicle (EV) policy for cab aggregators and delivery services.

IGL shares slumped over 10% to trade at Rs 410.90, its lowest level since April this year, on the back of heavy volumes. In the last two trading days, the stock has tumbled 13%.

The scrip has gained 8% during the last one year and lost 2% so far this year. In terms of technicals, the large cap stock is trading lower than the 5-day, 20-day and 50-day, 100-day and 200-day moving averages.

Speaking to CNBC-TV18 today, Delhi Transport Minister Kailash Gahlot said that all cab aggregators have been asked to move to EVs gradually. After 2030, all cab aggregators will have to switch to EVs, he pointed out.

This is the final policy, it is not a draft, Gahlot said, adding that the draft was put out two months back.

He further said the idea is not to shut CNG pumps completely. “CNG is not absolutely a non-polluting fuel. Zero non polluting vehicle is EVs and not CNG”

The Delhi Transport Minister said the priority is to ensure clean air and reduce pollution in Delhi in whatever way possible. “Aim is to target commercial vehicles to reduce pollution,” he said.

Gahlot said that the government is giving enough subsidy for EVs in Delhi. “We are now at 10% EVs of the total vehicles in Delhi.”

Jefferies downgrades Indraprastha Gas stock

Jefferies, meanwhile, has double-downgraded the Indraprastha Gas stock to ‘Hold’ from ‘Buy’, and trimmed its target price to Rs 465 from Rs 565 earlier.

The global brokerage firm said the Delhi government has submitted to the Delhi Lieutenant Governor for final approval of an electric vehicle policy aimed at accelerating the adoption of EVs for cab aggregators and delivery services.

Jefferies estimated a potential 30% hit on IGL volumes from FY25 onwards, with new general advisories (GAs) are unlikely to offset the slowdown in the NCR, which makes up 88% of IGL’s volumes.

The brokerage has downgraded FY25 and FY26 EPS (earnings per share) by 7% to 9%, adding that lower valuation multiple to factor in growing EV risk.

The company’s expansion into new areas and potential acquisitions offer growth opportunities, but these might not fully offset a slowdown in the NCR region, Jefferies noted.

In a bearish case, Jefferies anticipates a 21% decline in the target price to Rs 380 a share. This could happen if EV adoption succeeds by 2024-25, leading to reduced CNG volume growth starting from FY24E.

Other potential factors include the removal of cost advantages for domestic CNG gas and competition from a third-party marketer in Delhi/NCR, impacting profit margins due to gas sales in a regulated environment, according to Jefferies.

IGL supplies CNG to automobiles and piped cooking gas to household kitchens in Delhi and adjoining towns.

With the implementation of this proposed EV transition policy, the Delhi government intends to reach a 50% adoption rate within the next three years and ultimately transition to 100% electric fleets in the next five years. By April 1, 2030, all aggregators must have an all-electric fleet.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter