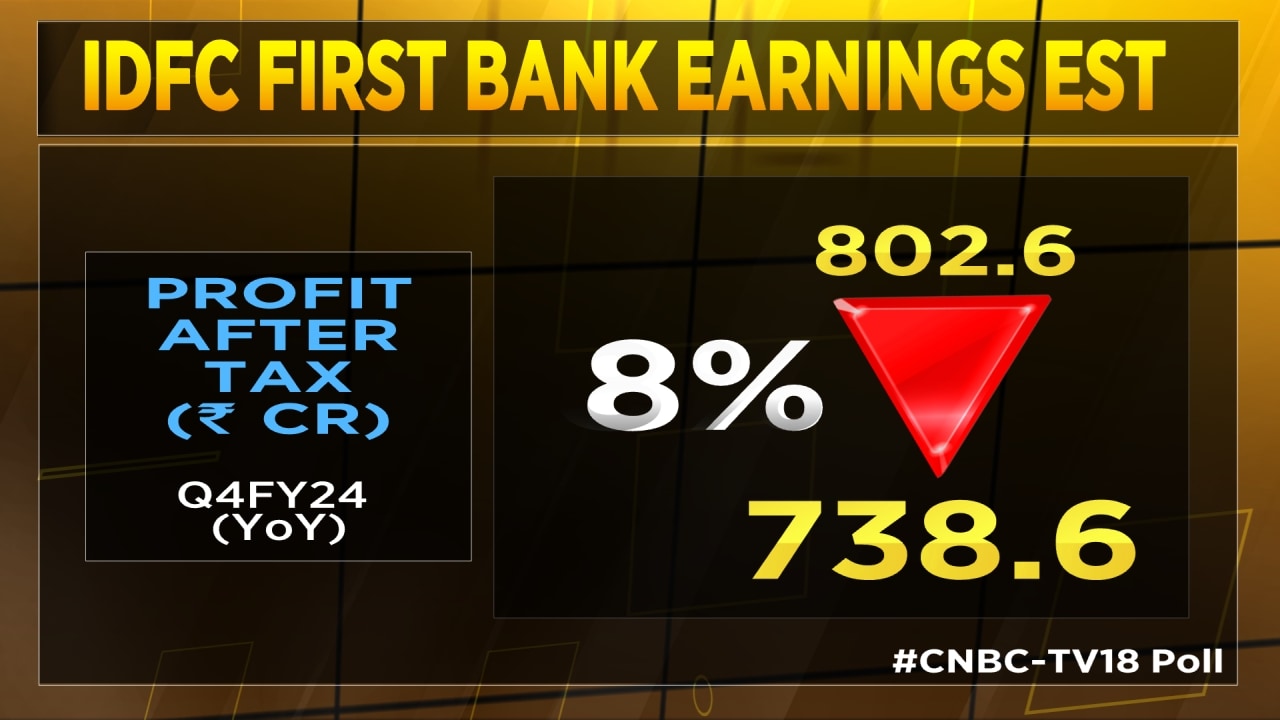

IDFC First Bank Q4 earnings preview: Analysts predict 25.2% surge in NII, 8% dip in PAT

Summary

According to a CNBC-TV18 poll, analysts anticipate the bank’s net interest income (NII) to rise by 25.2% year-on-year, but profit after tax may dip by 8%. Broking firm Motilal Oswal expects deposit growth to be strong at 32.8% YoY. Additionally, the firm anticipates a rise in loan growth, pegging it at 23% on a YoY basis.

IDFC First Bank is set to report its financial performance for the quarter ended March 2024 (Q4FY24) on Saturday, April 27.

According to a CNBC-TV18 poll, analysts anticipate the bank’s net interest income (NII) to witness a significant uptick, projecting a robust growth of 25.2% year-on-year (YoY) to reach ₹4,502.2 crore. Moreover, sequentially, the NII is expected to climb by approximately 5%.

However, the profitability may take a slight dent as the profit after tax for Q4FY24 is anticipated to dip by 8% to ₹738.6 crore compared to ₹802.6 crore reported in the corresponding quarter of the previous fiscal year.

However, broking firm Motilal Oswal expects deposit growth to be strong at 32.8% YoY, coupled with a sequential increase of 5.3%. Additionally, the firm anticipates a rise in loan growth, pegging it at 23% on a YoY basis.

According to Morgan Stanley, the bank may see improvements in certain key metrics. They anticipate net interest margin (NIM) to witness a positive uptick, potentially improving by 41 basis points. However, this optimism is tempered by expectations of a 17 basis points increase in credit costs compared to Q4FY23.

Meanwhile, the street expects IDFC First Bank’s asset quality to remain stable or improve on a sequential basis. In Friday’s trading session, the stock of IDFC First Bank rose by 1.56% to close at Rs 84.70.

The Mumbai headquartered bank has a market capitalisation of ₹59,964.28 crore and has delivered a negative return of around 1% in the past six months.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter