ESAF Small Finance Bank to raise ₹135 crore via bonds on private placement basis

Summary

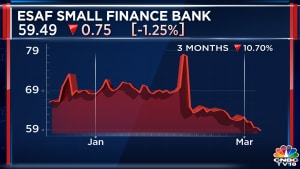

ESAF Small Finance Bank reported an over three-fold increase in net profit at ₹112 crore for the third quarter ended December 2023 on rise in core income. Shares of ESAF Small Finance Bank Ltd ended at ₹59.49, down by ₹0.75, or 1.25%, on the BSE.

Thrissur-based ESAF Small Finance Bank Ltd on Monday (March 11) said its board of directors has announced plans to raise funds up to ₹135 crore through the issue of bonds on a private placement basis.

The bank’s board has approved the proposal to issue listed, rated, taxable, unsecured, transferable, redeemable, fully paid-up, Basel II Compliant Lower Tier II subordinated bonds. These bonds will be in the form of non-convertible debentures (NCDs) and will be issued on a private placement basis, according to a stock exchange filing.

“We hereby inform that the Board of Directors of the Bank, in its meeting held on Friday, March 08, 2024, has, inter alia, considered and approved the proposal to raise funds by way of issuance of Listed, Rated, Taxable, Unsecured, Transferable, Redeemable, Fully Paid-Up, Basel ll Compliant Lower Tier ll Subordinated Bonds in the form of Non-Convertible Debentures (Tier ll Bonds), aggregating upto ₹135 crore (One Hundred and Thirty-Five Crores) on a Private Placement basis,” the bank said.

This decision was made during a board meeting held on Friday, March 8, 2024.

ESAF Small Finance Bank reported an over three-fold increase in net profit at ₹112 crore for the third quarter ended December 2023 on account of improvement in core income. The bank had posted a net profit of ₹37 crore for the year-ago period.

Total income increased to ₹1,094 crore in the December quarter from ₹782 crore a year ago, the bank said in a regulatory filing. Interest income also improved to ₹974 crore from ₹701 crore in the third quarter of the previous fiscal.

Net interest income rose to ₹597 crore from ₹451 crore in the corresponding period of the preceding year. On the asset quality front, the bank recorded an improvement with gross NPAs (non-performing assets) declining to 4.16% from 7.24% at the end of the December quarter FY23. Similarly, net NPAs also declined to 2.19% from 3.73% in the previous year.

Shares of ESAF Small Finance Bank Ltd ended at ₹59.49, down by ₹9.56, or 13.85%, on the BSE.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter