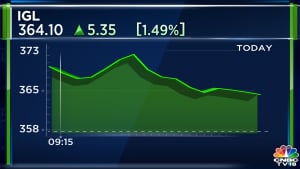

CLSA upgrades IGL, raises price target on both IGL and MGL on favourable regulatory regime

Summary

CLSA’s implies a potential upside between 30-36 percent on IGL and MGL respectively.

Brokerage firm CLSA upgraded Indraprastha Gas to buy while raised its price target on both IGL and its peer Mahanagar Gas, driven by more favourable regulatory regime and pricing power.

The brokerage has upgraded state-owned IGL to ‘Buy’ and raised its price target to Rs 585 from Rs 420 earlier, reflecting potential gains of around 37 percent.

CLSA also raised the Earning Per Share (EPS) forecast to 6-15 percent led by expected double-digit volume growth.

The brokerage on the other hand maintained its ‘Buy’ call on MGL and hiked the price target to Rs 1,260 per share, implying an upside of around 30 percent from the current trading price.

CLSA also raised the price-to-earnings (PE) multiple from 11x to 13x for MGL. The brokerage in a note mentioned that regulatory regime is expected to become more favourable for city gas distributors starting April, and pricing power would return.

CLSA noted that the gas pricing formula has proposed a price ceiling at $6.5 per mmBtu, which will drive a 24 percent cut in the price of domestic gas on April 1, 2023.

Also, despite the price hike CNG is still a favoured fuel and a push by OEMs should drive volume growth, it noted.

CLSA earlier had stated that a sharp 50 percent decline in spot LNG prices to $14 per MMBtu is a clear positive for most Indian gas companies.

The brokerage expects Indian city gas distributors like IGL, MGL and Gujarat Gas Ltd to see strong margins in the last quarter of the current fiscal due to the halving of spot LNG prices compared to that in December.

IGL supplies CNG and pipe natural gas to homes and industrial consumers in the Delhi-National Capital Region (NCR) and adjoining areas.

Shares of IGL are trading 3.3 percent higher at Rs 441, while those of MGL are trading 1.2 percent higher at Rs 982.10.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter