Software companies put up their worst show since FY18

Summary

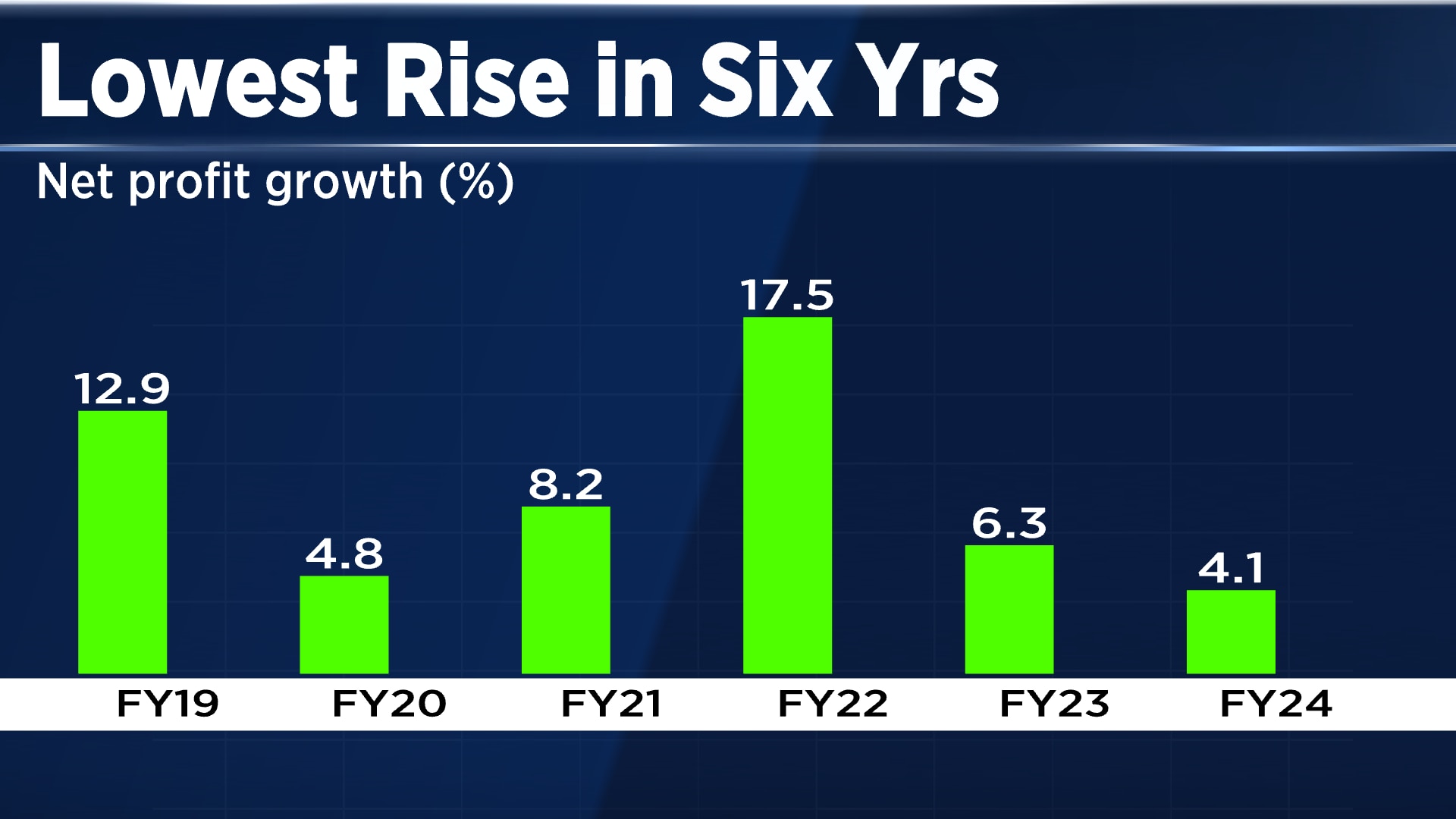

Six software firms which form part of the Nifty50 Index saw their aggregate earnings increase by 4.1% to ₹1.06 lakh crore in FY24. That compares with the 6.3% rise reported in the previous year.

The combined net profit of the country’s largest information-technology firms grew at the slowest pace in six years after clients across the globe cut back their discretionary spending due to an uncertain business environment. What is more worrying is that the sector is not out of the woods yet as most of them have lowered their margin aspiration for the next year as well.

Six software firms which form part of the Nifty50 Index saw their aggregate earnings increase by 4.1% to ₹1.06 lakh crore in FY24. That compares with the 6.3% rise reported in the previous year. The growth in the bottom line for the year was the lowest after 2018 when they together reported a 3.5% rise, according to data collated by CNBC-TV18. In fact, the net profit has been growing at a single digit over the last seven years, except FY19 and FY22 in which their aggregate profit surged by 13% and 18%, respectively.

While the net profit of Wipro and Tech Mahindra continued to decline for the second year in a row, the growth has almost halved for HCL Technologies. Similarly, Tata Consultancy Services (TCS) reported 9% growth in FY24 against an increase of 10% in FY23. The two largest IT firms — TCS and Infosys — account for 68% of the aggregate profit and close to 60% of the total revenue of the sample.

Also Read: Synopsys to buy engineering software firm Ansys in $35 billion deal

Further, the revenue of these IT companies increased by 5% in FY24 to ₹6.8 lakh crore. In contrast, the six companies — TCS, Infosys, HCL Technologies, Wipro, Tech Mahindra and LTIMindtree — together had reported 19% growth in their top-line in FY23.

Vetri Subramaniam, Chief Investment Officer at UTI AMC, argues that the global picture is more tricky as there has been a very big shift in the kind of expectations for interest rate policy by the US Federal Reserve. According to him, one should watch out for management commentaries of these companies with respect to their growth strategy and hiring. “Tech capex spending in the US hopefully signals better times for the Indian IT sector,” said Subramaniam.

Even though TCS expects the current fiscal year will be better than the previous one, the second-largest outsourcing provider — Infosys has cut its FY25 revenue target to 1 % to 3% on a constant-currency basis. That was a revision from its earlier guidance of 4% to 7% a year ago due to prevailing weak demand in the sector.

Also Read: Alphabet in talks to acquire marketing software firm HubSpot

The gauge for IT stocks — the Nifty IT index has declined as much as 5.2% so far in 2024, against 3.2% gains generated by the benchmark Nifty50 during the same period.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter