RBI Monetary Policy 2024: Interest rates unchanged for the seventh time in a row

Summary

The RBI Monetary Policy Committee also left the Marginal Standing Facility (MSF) and Standing Deposit Facility (SDF) rates unchanged at 6.75% and 6.25%, respectively.

The Reserve Bank of India (RBI) Monetary Policy Committee (MPC) has left its key lending rate (repo rate) unchanged at 6.5%, in line with market watchers’ and economists’ expectations. This was the seventh straight instance of the policy rates left unchanged by India’s central bank.

A CNBC-TV18 poll had expected the RBI MPC to maintain a status quo.

The decision to keep the rates unchanged was taken with a 5:1 majority. The RBI MPC decided by a 5:1 majority to remain focused on “withdrawal of accommodation”.

The RBI MPC also left the Marginal Standing Facility (MSF) and Standing Deposit Facility (SDF) rates unchanged at 6.75% and 6.25%, respectively.

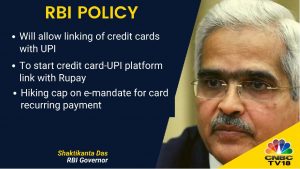

Speaking to CNBC-TV18’s Shereen Bhan on the sidelines of the World Economic Forum (WEF) 2024 at Davos in January this year, governor Shaktikanta Das had quashed hopes of an early rate cut. The governor had explained that price stability is the bedrock for sustainable growth, and a premature pivot in policy can prove costly for the economy.

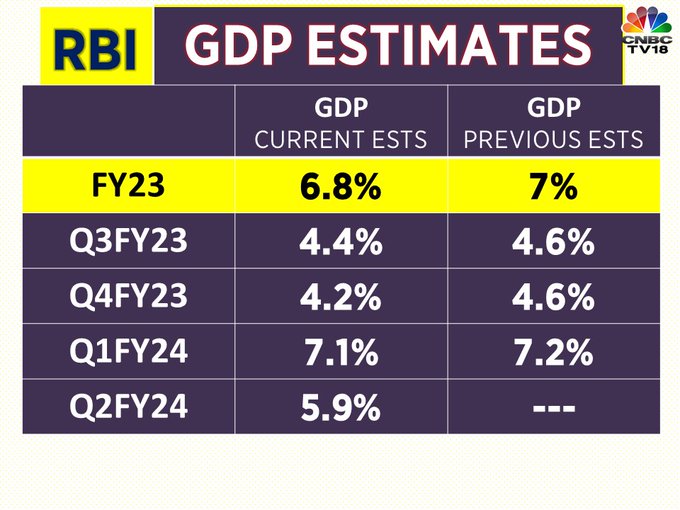

The RBI has maintained India’s fiscal year 2025 GDP growth target at 7%. The governor mentioned that the impact of above-normal temperatures warrants monitoring.

| RBI GDP Projections | ||

| Period | Previous | Revised |

| FY25 | 7% | 7% |

| Q1 FY25 | 7.2% | 7.1% |

| Q2 FY25 | 6.8% | 6.9% |

| Q3 FY25 | 7% | 7% |

| Q4 FY25 | 6.9% | 7% |

The governor during his speech highlighted that while inflation is moving closer to target, the last mile of inflation is turning out to be challenging. As a result, the central bank has left the Consumer Price Inflation (CPI) forecast unchanged at 4.5%.

“Two years ago around this time, when CPI inflation peaked at 7.8% in April 2022, the Elephant in the room was inflation, the elephant has gone out for a walk and appears to be returning to the forest. We would like the elephant to return to the forest and remain there on a durable basis,” the central bank Governor said.

| RBI Inflation Projections | ||

| Period | Previous | Revised |

| FY25 | 4.5% | 4.5% |

| Q1 FY25 | 5% | 4.9% |

| Q2 FY25 | 4% | 3.8% |

| Q3 FY25 | 4.6% | 4.6% |

| Q4 FY25 | 4.7% | 4.5% |

“The policy is broadly on expected lines. Things I would like to borrow from the governor’s speech is that liquidity management is nimble and flexible. I think we could witness in the last few weeks that the liquidity is not constrained in the system. Whenever liquidity is excess, absorption was done and when the shortfall was noticed, injection was done. What the governor has assured us in terms of being nimble and flexible is reassuring,” SBI Managing Director CS Setty said.

The RBI governor also warned that the government risks in advanced economies could erupt abruptly and that emerging economies with rising debt could be vulnerable.

Catch the live updates on RBI MPC here.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter

“

“