Tech Mahindra shares rally 12% to become top Nifty 50 gainer after Q4 results

Summary

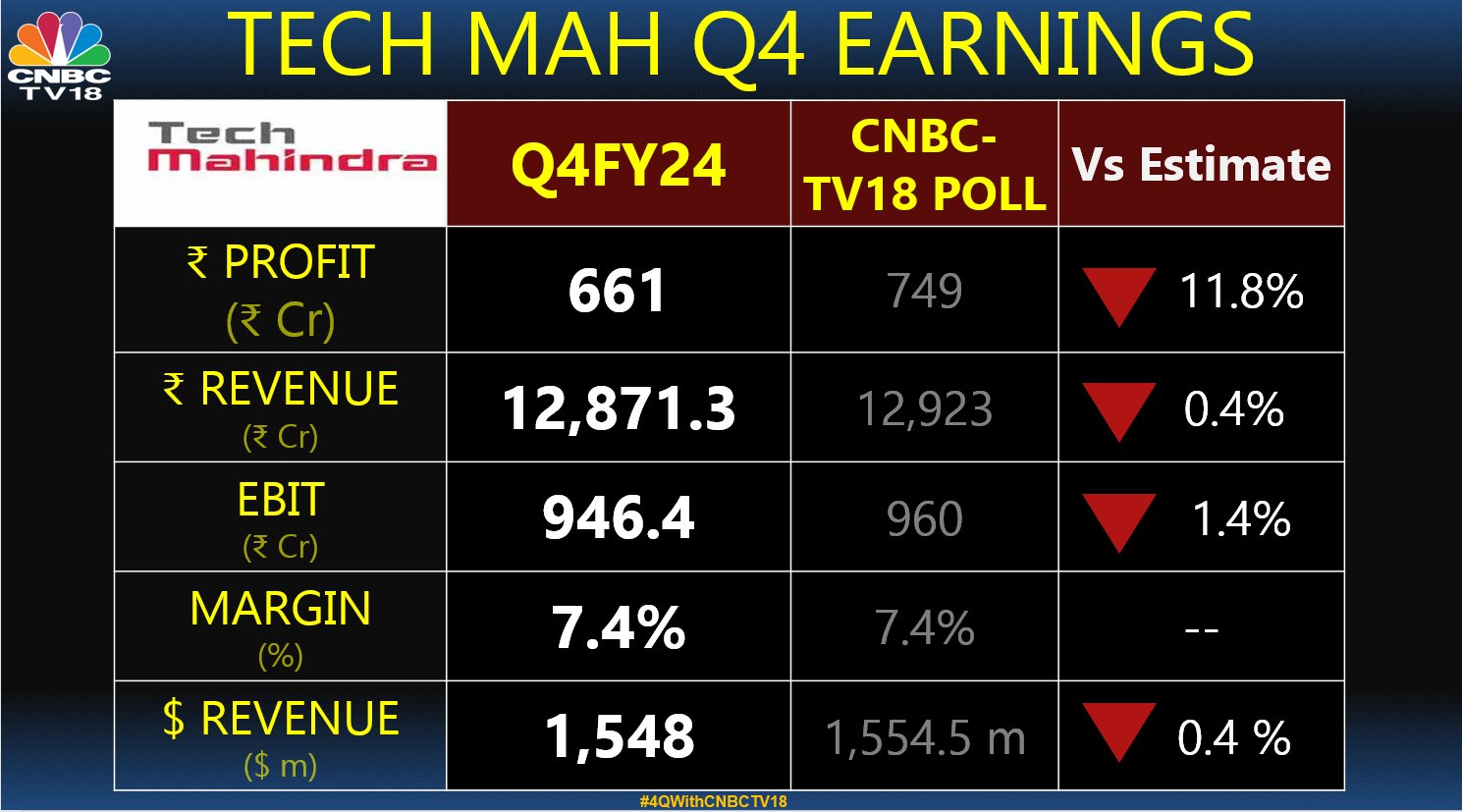

Tech Mahindra stock became the top Nifty 50 gainer even as brokerages had a mixed stance on its fourth quarter results, which were largely in line with CNBC-TV18 poll estimates, except the profit which came in almost 12% lower.

Tech Mahindra shares rallied as much as 12% in early trade on April 26, a day after the IT services company reported its earnings for the January to March 2024 quarter.

The IT stock became the top Nifty 50 gainer even as brokerage firms had a mixed stance on the company following its fourth quarter results for 2023-24.

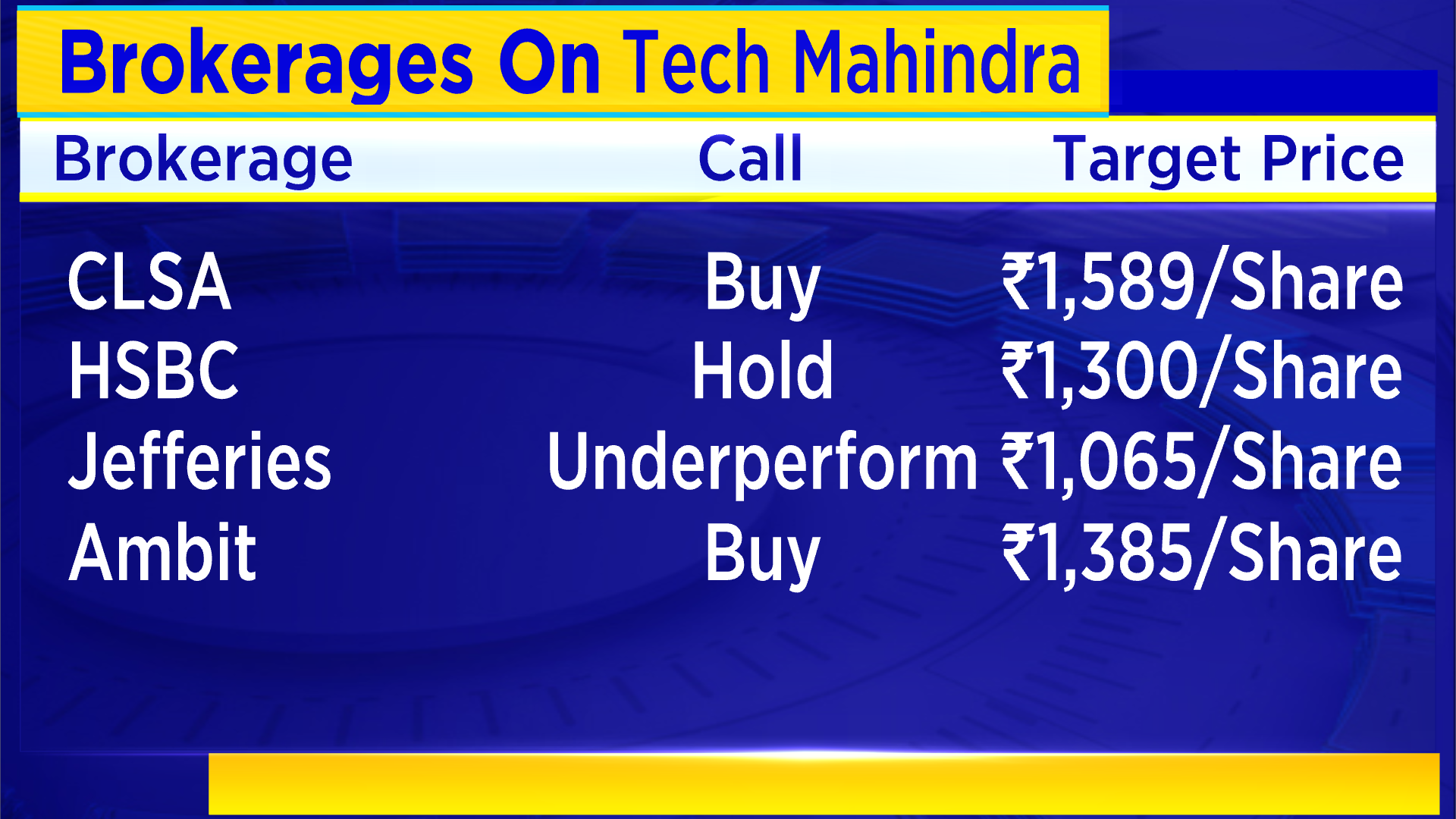

While CLSA has a buy call on the stock, HSBC recommends holding it whereas Jefferies has given it an ‘underperform’ rating and cut its target price.

The earnings report was largely in line with CNBC-TV18 poll estimates, except the profit which came in almost 12% lower.

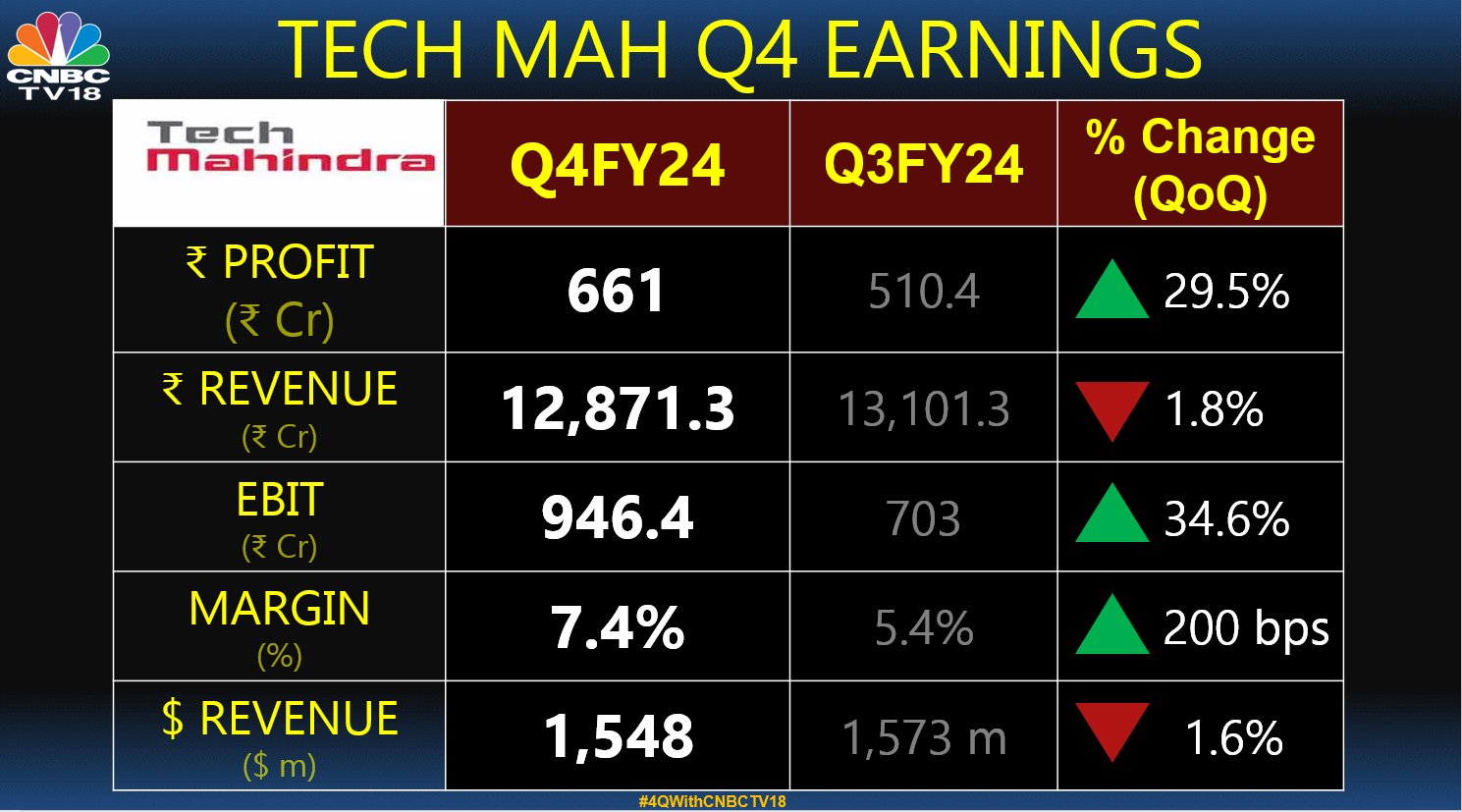

However, Tech Mahindra’s new CEO Mohit Joshi in a post-earnings address said that he expects the financial year 2025 to be a better year than the financial year 2024. The company has guided for industry-leading growth in three years and an EBIT margin of 15% from the current 7% by FY27.

Joshi said that at this stage, the work will be to integrate front-end portfolio companies, focus on turbocharge programme for key account growth and start Project Fortius for cost optimisation. The firm is targeting $250 million a year in savings from Project Fortius.

Here’s what brokerages make of Tech Mahindra’s Q4 results

CLSA: It has set the target price for Tech Mahindra shares at ₹1,589, implying a potential upside of more than 33% from the previous close on April 25.

The brokerage said the FY27 targets are cast in stone for the company to deliver. It said there were multiple positives from Q4 that give a glimpse of what lies ahead whereas the negatives reflect on the current chinks in the armour.

CLSA has cut its earnings before interest and taxes or EBIT margin and earnings per share (EPS) estimate by 13% and 12%, respectively, for FY25/26.

HSBC: The brokerage recommends holding the stock and has set the target price at ₹1,300, an upside of 9% from the previous close. The IT stock has already crossed this level in trade today.

According to the brokerage, the new turnaround plan looks sensible for the firm while execution remains challenging, especially in the current environment.

It noted that margin expansion is highly contingent on pyramid improvement while maintaining average pricing considering a lacklustre sector outlook. In fact, some investors may see the firm as an alpha, HSBC said.

Jefferies: The analyst has cut its target price ₹1,065 following the Q4 results. It believes that weak order booking and headcount declines point to a weak growth outlook. It has cut estimates by 4-9% to push back the improvement in growth/margins to FY26/27.

It noted that the management aims to boost growth to above the industry average and margins to 15% by FY27 with most improvements being back-ended.

Nirmal Bang: The brokerage has pointed out that the FY27 EBIT margin guidance of 15% is higher than the consensus of 13.9%. It expects EPS upgrades for FY27.

The firm plans returning 85% of free cash flow (FCF) to shareholders, and this provides downside support. It is of the view that valuations are not expensive at 20X FY26e PE.

Tech Mahindra shares surged 9.68% to ₹1,305.50 on NSE at 10:22 am.

Track latest stock market updates on CNBCTV18.com’s blog here

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter