Four companies set to go public next week; seeks to raise over Rs 4,500 crore via IPO

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

Together, these four companies are expected to fetch over Rs 4,500 crore through the IPOs, according to merchant banking sources. Apart from these, Uniparts India and Five Star Business Finance are expected to come out with their respective IPO in November, they added.

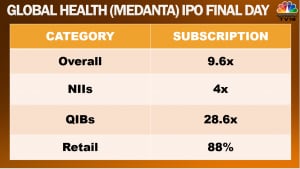

The primary market is heading for a busy time, with four firms, including Global Health Ltd, which operates hospitals under the Medanta brand, and micro-finance lender Fusion Micro Finance Ltd, lining up their IPOs next week.

The other two companies whose IPOs are ready to open are DCX Systems, a manufacturer of cables and wire harness assemblies, and Bikaji Foods International.

Together, these four companies are expected to fetch over Rs 4,500 crore through the IPOs, according to merchant banking sources. Apart from these, Uniparts India and Five Star Business Finance are expected to come out with their respective IPO in November, they added.

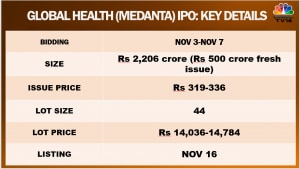

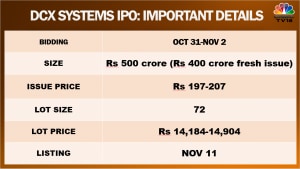

The initial share sale of DCX Systems will open for public subscription on October 31 and conclude on November 2, while that of Fusion Micro Finance will be open during November 2-4. The IPOs of Global Health and Bikaji Foods will open for subscription on November 3 and close on November 7.

Also Read: Nervous November up ahead for new-age companies

In 2022 so far, as many as 22 companies have floated their IPOs to raise over Rs 44,000 crore. In 2021, 63 IPOs raised more than Rs 1.19 lakh crore, according to data from the exchanges.

“Volatility of the secondary market has led to a weak IPOs market in 2022 and it is expected to remain subdued going ahead,” Vinod Nair, head of research at Geojit Financial Services, said.

However, the response of investors to the offered IPOs was decent because of the opportunity to invest in new companies at attractive prices. This was also in the context of high liquidity available from HNI’s and retail investors looking for listing gain, he said.

In the majority, IPOs were also attractive for institutional investors to invest in high-quality new businesses bringing diversification to schemes, he added.

DCX Systems’ IPO comprises a fresh issue of equity shares worth Rs 400 crore and an offer for sale (OFS) of equity shares up to Rs 100 crore by promoters NCBG Holdings Inc and VNG Technology.

Also Read: Indian Oil reports net loss of Rs 272.3 crore in September quarter

The Bengaluru-based company has already raised Rs 225 crore from anchor investors. It has fixed a price band of Rs 197-207 per share for its issue.

Proceeds from the fresh issue will be used towards debt payment, funding working capital requirements, investment in its wholly-owned subsidiary Raneal Advanced Systems to fund its capital expenditure expenses and general corporate purposes.

Fusion Micro Finance is looking to raise Rs 1,104 crore from its IPO which comprises fresh issuance of equity shares worth Rs 600 crore and an offer of sale of 13,695,466 equity shares by promoters and existing shareholders.

Those selling shares in the OFS are — Devesh Sachdev, Mini Sachdev, Honey Rose Investment Ltd, Creation Investments Fusion, LLC, Oikocredit Ecumenical Development Co-operative Society U.A and Global Financial Inclusion Fund.

Also Read: Havas Media expects India to be the third largest market by 2030

Net proceeds from the fresh issue will be used to augment the capital base of the microfinance firm. The company has set a price band of Rs 350-368 a share.

Global Health’s IPO consists of a fresh issue of equity shares aggregating to Rs 500 crore, and an OFS of up to 5.08 crore equity shares by Anant Investments, an affiliate of private equity major Carlyle Group, and Sunil Sachdeva (jointly with Suman Sachdeva).

The IPO price band has been fixed at Rs 319-336 per share and at the upper end of the price band, the company is expected to fetch Rs 2,206 crore through the issue. Proceeds from the fresh issue will be used to pay debt and general corporate purposes.

Bikaji is aiming to mop up an estimated Rs 1,000 crore, through its initial share sale, merchant banking sources said. Certain shareholders of the Rajasthan-based company as well as its promoters — Shiv Ratan Agarwal and Deepak Agarwal– will offload around 2.94 crore shares through the OFS route.

The equity shares of the four companies will be listed on the BSE and NSE.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter