China beats India again as the world’s biggest gold buyer

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

China and India have typically vied over the title of world’s biggest buyer. But that shifted last year as Chinese consumption of jewelry, bars and coins swelled to record levels. China’s gold jewelry demand rose 10% while India’s fell 6%. Chinese bar and coin investments, meanwhile, surged 28%.

Gold’s rise to all-time highs above $2,400 an ounce this year has captivated global markets. China, the world’s biggest producer and consumer of the precious metal, is front and center of the extraordinary ascent.

Worsening geopolitical tensions, including war in the Middle East and Ukraine, and the prospect of lower US interest rates all burnish gold’s billing as an investment. But juicing the rally is unrelenting Chinese demand, as retail shoppers, fund investors, futures traders and even the central bank look to bullion as a store of value in uncertain times.

Biggest Buyer

China and India have typically vied over the title of world’s biggest buyer. But that shifted last year as Chinese consumption of jewelry, bars and coins swelled to record levels. China’s gold jewelry demand rose 10% while India’s fell 6%. Chinese bar and coin investments, meanwhile, surged 28%.

And there’s still room for demand to grow, said Philip Klapwijk, managing director of Hong Kong-based consultant Precious Metals Insights Ltd. Amid limited investment options in China, the protracted crisis in its property sector, volatile stock markets and a weakening yuan are all driving money to assets that are perceived to be safer.

“The weight of money available under these circumstances for an asset like gold – and actually for new buyers to come in – is pretty considerable,” he said. “There isn’t much alternative in China. With exchange controls and capital controls, you can’t just look at other markets to put your money into.”

Imports Jump

Although China mines more gold than any other country, it still needs to import a lot and the quantities are getting larger. In the last two years, overseas purchases totaled over 2,800 tons — more than all of the metal that backs exchange-traded funds around the world, or about a third of the stockpiles held by the US Federal Reserve.

Even so, the pace of shipments has accelerated lately. Imports surged in the run-up to China’s Lunar New Year, a peak season for gifts, and over the first three months of the year are 34% higher than they were in 2023.

Central Bank

The People’s Bank of China has been on a buying spree for 17 straight months, its longest-ever run of purchases, as it looks to diversify its reserves away from the dollar and hedge against currency depreciation.

It’s the keenest buyer among a number central banks that are favoring gold. The official sector snapped up near-record levels of the precious metal last year and is expected to keep purchases elevated in 2024.

Shanghai Premium

It’s indicative of gold’s allure that Chinese demand remains so buoyant, despite record prices and a weaker yuan that robs buyers of purchasing power.

As a major importer, gold buyers in China often have to pay a premium over international prices. That jumped to $89 an ounce at the start of the month. The average over the past year is $35 versus a historical average of just $7.

For sure, sky-high prices are likely to temper some enthusiasm for bullion, but the market’s proving to be unusually resilient. Chinese consumers have typically snapped up gold when prices drop, which has helped establish a floor for the market during times of weakness. Not so this time, as China’s appetite is helping to prop up prices at much higher levels.

That suggests the rally is sustainable and gold buyers everywhere should be comforted by China’s booming demand, said Nikos Kavalis, managing director at consultancy Metals Focus Ltd.

China’s authorities, which can be quite hostile to market speculation, are less sanguine. State media have warned investors to be cautious in chasing the rally, while both the Shanghai Gold Exchange and Shanghai Futures Exchange have raised margin requirements on some contracts to snuff out excessive risk-taking. SHFE’s move followed a surge in daily trading volumes to a five-year high.

ETF Flows

A less frenetic way to invest in gold is via exchange-traded funds. Money has flowed into gold ETFs in mainland China during almost every month since June, according to Bloomberg Intelligence. That compares with chunky outflows in gold funds in the rest of the world.

The influx of money has totaled $1.3 billion so far this year, compared with $4 billion in outflows from funds overseas. Restrictions on investing in China are again a factor here, given the fewer options for Chinese beyond domestic property and stocks.

Chinese demand could continue to rise as investors look to diversify their holdings with commodities, BI analyst Rebecca Sin said in a note.

On the Wire

Chile imposed temporary anti-dumping tariffs on Chinese steel products used in the country’s mining industry in a bid to support faltering local producers. The move pushed Cap SA to reverse a decision to wind down its steel mills.

China’s most-promising industries are facing a growing threat of trade restrictions from Western governments, blurring the outlook for stocks that have the potential to fuel the nation’s market growth.

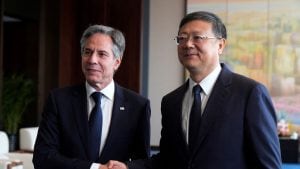

With Beijing already becoming a top target in the US election campaign, President Xi Jinping’s government is resisting any move that could backfire on the world’s second-largest economy.

When you introduce a raft of tariffs and restrictions to protect domestic industries, you’d better make sure there are some around to protect. That’s a major problem with the US decision to treat China’s clean technology leadership as grounds for a trade fight.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter