Interview | The secret behind the tripling of profit for this Mumbai drug maker

Summary

The company, which went public with a ₹700 crore initial offer (IPO) in 2021, is now looking at custom-development and manufacturing (CDM) business for APIs and dosage forms in a big way and exploring exclusive partnerships with global branded drugmakers.

Pharmaceutical companies are always under pressure as they are in a sector that is highly regulated and at the same time, highly competitive. This has been more intense in the active pharma ingredient (API) space as the business of generic drugs is getting increasingly commoditised, and the market prices are highly volatile. Sustaining growth, therefore, has become a big challenge even for large companies.

Some small and medium players with a niche market approach, however, could beat the trend.

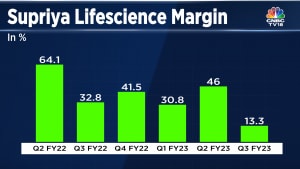

Mumbai-based Supriya Lifescience (SLL) raked three times the profit in the latest December quarter compared to a year earlier. CNBC-TV18 spoke to Dr Saloni Wagh, Wholetime Director, SLL, to ask how the tide turned for the company.

The ₹500 crore company makes active pharmaceutical ingredients, the primary input for making drug formulations, a business where the margins are highly volatile. The net profit margin of the company ranged between 12% to 22% in the last five years (2019 to 2024), while the industry margin swinged between 0.1% and 19% during this period.

Wagh highlighted three strategic changes: focus on niche therapeutic areas and strong entry-barrier products with predictable business, reduce reliance on volatile markets like China and add most potential regulated markets for sales, and a new management team of professionals.

“We want to beat the trend by pursuing our niche market approach with additional capabilities in product innovation and manufacturing and (are) also following a complete backward integration model,” the 29-year-old Wagh, daughter of the company’s founder Satish Wagh, said.

Listed in December 2021 after a ₹700 crore initial offer (IPO), SLL is today valued at ₹28.21 billion. The company, which is now entering the custom-development and manufacturing (CDM) of dosage forms, is setting up a dedicated research and development facility in Ambernath near Mumbai.

In the latest December quarter, the company clocked a 33.2% growth in revenue at ₹140 crore, at a time when the industry average was less than 8%. The net profit almost tripled to reach ₹41.49 crore, with a net profit margin of 21.27%, as opposed to 20.81% in the year-ago quarter.

Here’s a look at the performance of peers

| Company | Revenue growth | Profit growth | Margin |

|---|---|---|---|

| Divi’s Lab | 8.63% | 1.6% | 7.4% |

| Granules India | 11.26% | 16.69% | 0.18% |

| Aarti Drugs | -8% | -0.03% | 9.6% |

SLL Chairman & Managing Director Satish Wagh, who founded the company in 1987, believes this is a sign that the strategic changes have started to yield results.

Dr Saloni Wagh, who steered the fresh growth momentum in the company along with a new team of senior industry professionals, said that SLL, as part of the CDM business, is also exploring exclusive partnerships with global branded drugmakers, and significantly adding production capacities at its manufacturing site at Lote Parshuram industrial area in Maharashtra looking at this new growth opportunity.

Reducing dependence on volatile markets

Since 80% of its revenue comes from exports to 86 countries, Supriya Lifescience decided to focus on developed markets where the business is more predictable and the margins are high.

Traditionally, one of Supriya’s key markets (sales) has been China. But as part of the geographical shift, this dependence is being reduced. Earlier (till 2022-23), more than 50% of SLL’s revenue was from Asian markets, predominantly China. But the geographical shift has resulted in changing this proportion to 40:60 (60% revenue from Europe, Latin America and the US.)

Currently, the largest contributor to SLL’s revenue is Europe, where Saloni’s younger sister Shivani, who is also on the Board now, leads the market development efforts.

Niche products with predictable margin

In the last five years, SLL has been aggressive on product and process innovation. While the product innovation — in the form of efficacy enhancements, added bioavailability or new delivery systems (NDDS) by identifying patient needs— helps boosting niche market play with less competition and better margin, prcess innovation helps the company to keep the production cost lower to compete in the generic market. The new business opportunity with custom-development and manufacturing of dosage forms will support its plans to partner with large branded drug makers with high margin products and even market exclusivity.

Currently, there are about 8-10 products in various stages of research and development. These span from anaesthetics and antidepressants to analgesics, anti-obesity, and drugs for attention-deficit/hyperactivity disorder (ADHD).

“Most of the new products, which are either in the registration process or research pipeline of SSL are in the category of high revenue potential,” says Dr Wagh.

All these products, which are expected to be on the market in the next three years, have a combined revenue potential of about ₹500 crore for the company.

The company expects to get exclusive marketing rights for at least six months in the US for one of these products. Now, the company is increasing the production capacity at Lote Parshuram industrial area in Maharashtra by multifold to 550 KL.

A new team of professionals

Supriya Lifescience brought in senior industry professionals like Rajeev Kumar Jain, Dr Shekhar Bhirud and Sreekant Shreedharan, among others—each of them with an average industry experience of at least 25 years, as part of steadily moving from the promoter driven management to a professional driven one. The daughters who joined the Board of late work closely with these professional leaders.

| Name | Earlier | Role at Supriya Lifescience |

| Rajeev Kumar Jain | Max India, DSM | Chief Executive Officer |

| Dr Shekhar Bhirud | Glaxo, Cipla, Glenmark | Director, Business Development and Strategy |

| Sreekant Shreedharan | Ranbaxy, Morepen Labs, Jubilant Generics | GM, Global Sales & Marketing |

What does the street make of SLL’s pivots?

SLL stock has moved up more than two times in the last one year from ₹170.95 a unit in March 2023 to ₹348.45 in March 2024.

“Supriya is well placed with its leadership position in niche products, comprising 38 APIs across diverse therapeutic segments,” says HDFC Securities’ Kushal Rughani in his recent report. While the Chinese market continues to remain a concern for the company, the management is now de-risking the current product basket, minimising geographical reliance, added Rughani.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter