Reliance’s oil to chemical biz revenue slips 18% in Q1 on recession fears, slower demand

Summary

The demand was impacted by destocking on recessionary fears and high interest rates, as well as slower than expected ramp-up in China markets. Year-on-Year comparisons are skewed due to historic high fuel cracks in 1Q FY23, with dislocation in energy markets, RIL said in a regulatory filing.

Reliance Industries’ (RIL) oil-to-chemicals (O2C) business saw a 18 percent year-on-year (YoY) dip in revenue to Rs 1.33 lakh crore, primarily due to a sharp fall in fuel cracks from exceptionally high levels in corresponding quarter of last year. The same was Rs 1.61 lakh crore reported in the year-ago quarter. The company with the second-biggest weightage on the Nifty 50 index reported its April to June quarter results on Friday, June 21.

For the O2C segment, the revenue was up 3 percent on a sequential basis.

The demand was impacted by destocking on recessionary fears and high interest rates, as well as slower than expected ramp-up in China markets. Year-on-Year comparisons are skewed due to historic high fuel cracks in 1Q FY23, with dislocation in energy markets, RIL said in a regulatory filing.

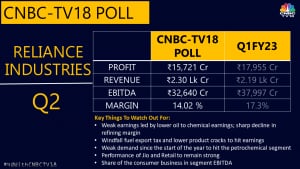

During the quarter, consolidated EBITDA or Earnings Before Interest, Taxes, Depreciation, and Amortization came in at Rs 15,271 crore, down 23 percent YoY, and down 6 percent QoQ, in the O2C segment.

‘O2C biz resilient despite global macro headwinds’

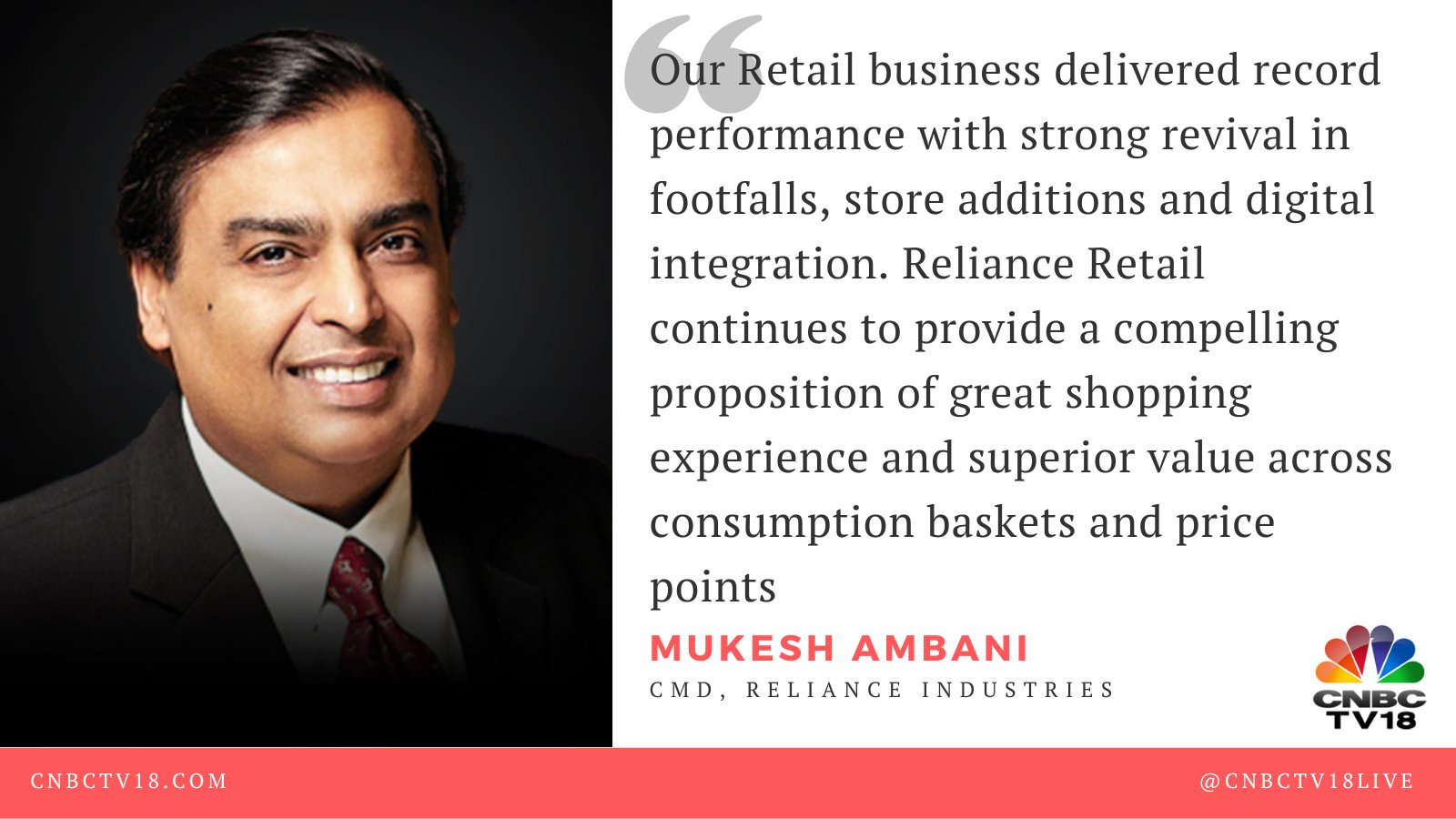

“O2C business delivered a resilient performance despite continuing global macro headwinds. Commencement of MJ field operations during the quarter will enhance India’s energy security, with total production from KGD6 block rising to 30 MMSCMD in the coming months,” said Mukesh Ambani, Chairman and Managing Director, Reliance Industries.

Sequentially, throughput marginally came lower at 19.7 MMT. Fuel cracks corrected qaurter-on-quarter and year-on-year, but remain above mid-cycle level with a strong global demand.

Diesel crack average stood at $15.6 per bbl versus $28.6 per bbl in the previous March quarter and 51.6 per bbl in the year-ago period.

Gasoline cracks average at $12.1 per bbl as against $15 per bbl in Q4 of FY23 and 29.8 per bbl in Q1 of FY23. ATF cracks average was at $14 per bbl versus $26.5 per bbl in Q4 of FY23 and 39.2 per bbl in Q1 of FY23.

“It is far better than what expectations were, while we knew that some of the old businesses would be struggling a bit in terms of growth and margins, those margins also aren’t something you would complain about. Singapore GRMs were anyways really down almost 50-55 percent on a quarter-on-quarter basis So that was pencilled in. But in spite of that, the O2C business overall also, if you see thins to petchem, which has been soft traditionally for this quarter, that’s also done pretty well,” said market expert Prakash Diwan.

Meanwhile, the conglomerate’s net profit came in at Rs 16,011 crore, down 11 percent YoY for the three-month period, owing to pressure in its O2C segment. Consolidated revenue declined 5.3 percent YoY to Rs 2.11 lakh crore.

The board has recommended dividend payout of Rs 9 a share, subject to approval of the shareholders.

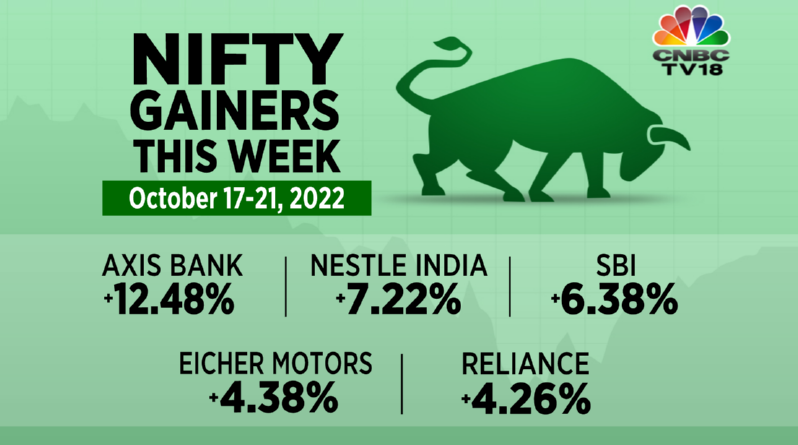

Reliance Industries shares finished lower by 2.48 percent at Rs 2,555 apiece on NSE, ahead of the Q1 earnings announcement. The stock is trading close to its all-time high and has recovered nearly 30 percent from its March 2023 lows.

Dalal Street investors are now eyeing the company’s upcoming annual general meeting (AGM) scheduled to be held in August.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter