RBI’s action against Kotak Mahindra Bank: Here’s your FAQ answered

Summary

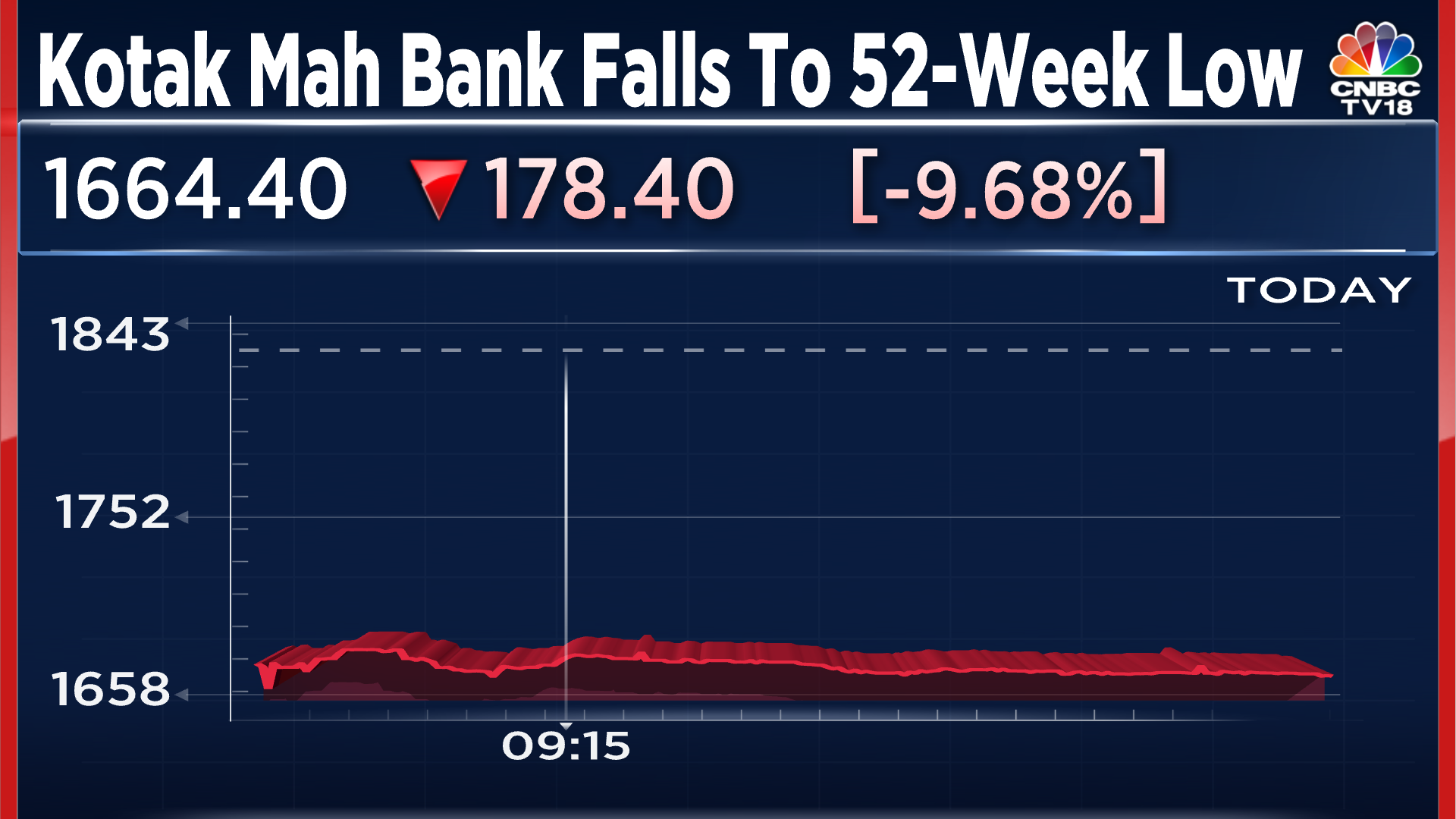

The Reserve Bank of India has barred Kotak Mahindra Bank from onboarding any new customers through its online and mobile banking channels and also prohibited it from issuing fresh credit cards. Here’s what happens to customers now

The Reserve Bank of India (RBI) has recently taken measures against Kotak Mahindra Bank due to repeated non-compliance with IT norms. As a result, the bank has been prohibited from onboarding new customers through its online and mobile banking channels and issuing fresh credit cards.

Here are some frequently asked questions to address concerns users may have:

[faq][ques]Will the current action affect existing customers and their use of Kotak Mahindra Bank’s digital services?[/ques][ans]There is no problem with the bank’s digital services if users have any existing savings account, salary account, loan account, or credit card. The bank has assured uninterrupted services, including credit card, mobile, and net banking, for existing customers.[/ans][/faq]

[faq][ques]If a user had applied for a Kotak Mahindra Bank credit card online. What will happen to the application now?[/ques][ans]If the bank processed and approved the card application before the RBI’s embargo, the user will still receive the card. However, no new credit card applications are being accepted at the moment.[/ans][/faq]

[faq][ques]If a user had applied for a personal loan online before the RBI’s supervisory action. What will happen to the sanction of that loan now?[/ques][ans] If the personal loan hasn’t been sanctioned yet, it might not be processed further due to the current restrictions.[/ans][/faq]

[faq][ques]Can users get a new credit card from Kotak Mahindra Bank?[/ques][ans]As RBI has banned Kotak Mahindra Bank from issuing new credit cards, users cannot obtain a new credit card from the bank at the moment.[/ans][/faq]

[faq][ques]Can Kotak Mahindra Bank customers apply for a new personal loan online?[/ques][ans]No, users cannot apply for a personal loan online despite having an account with the bank.[/ans][/faq]

[faq][ques]Can users open a savings bank account at any branch of Kotak Mahindra Bank?[/ques][ans] Yes, users can open a savings account at any branch of Kotak Mahindra Bank, as the bank is not restricted from onboarding new customers offline.[/ans][/faq]

[faq][ques]How long will RBI’s restrictions on Kotak Mahindra Bank remain in place?[/ques][ans]The restrictions will be reviewed upon completion of a comprehensive external audit and remediation of deficiencies, which experts say may take six to twelve months.[/ans][/faq]

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter