Analysts see upside in BoB, Firstsource, Sun TV and RVNL

Summary

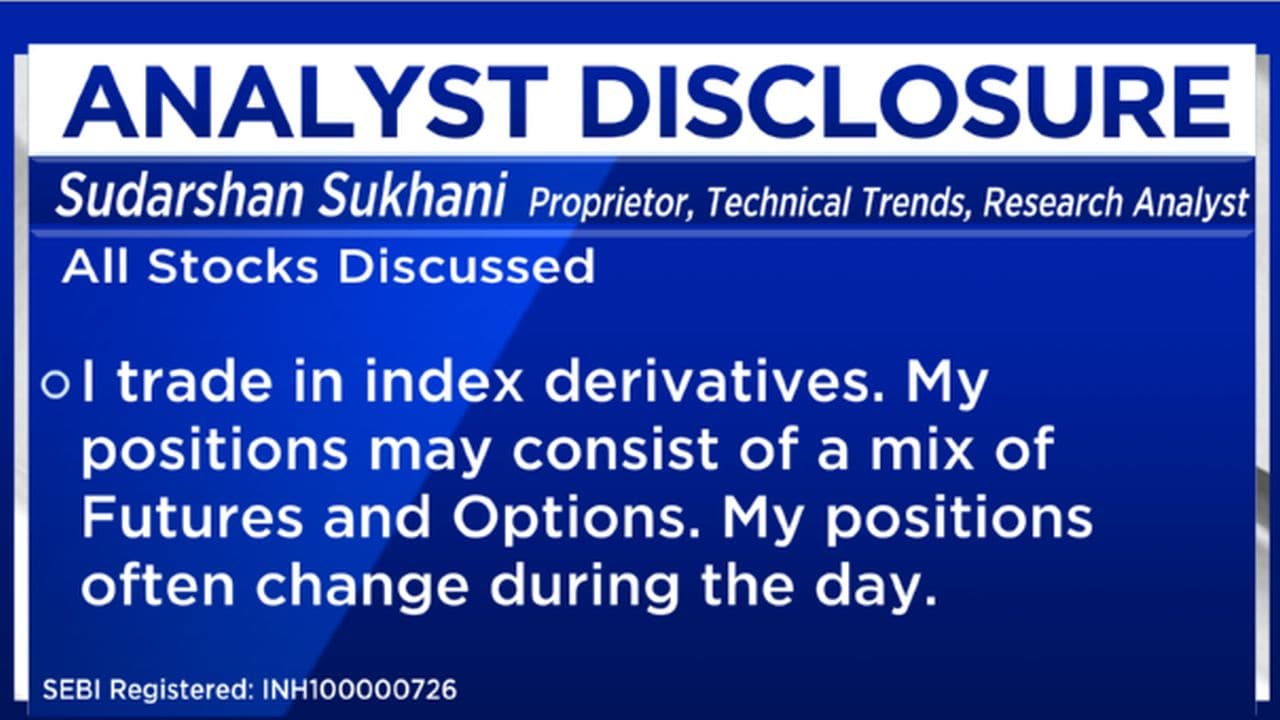

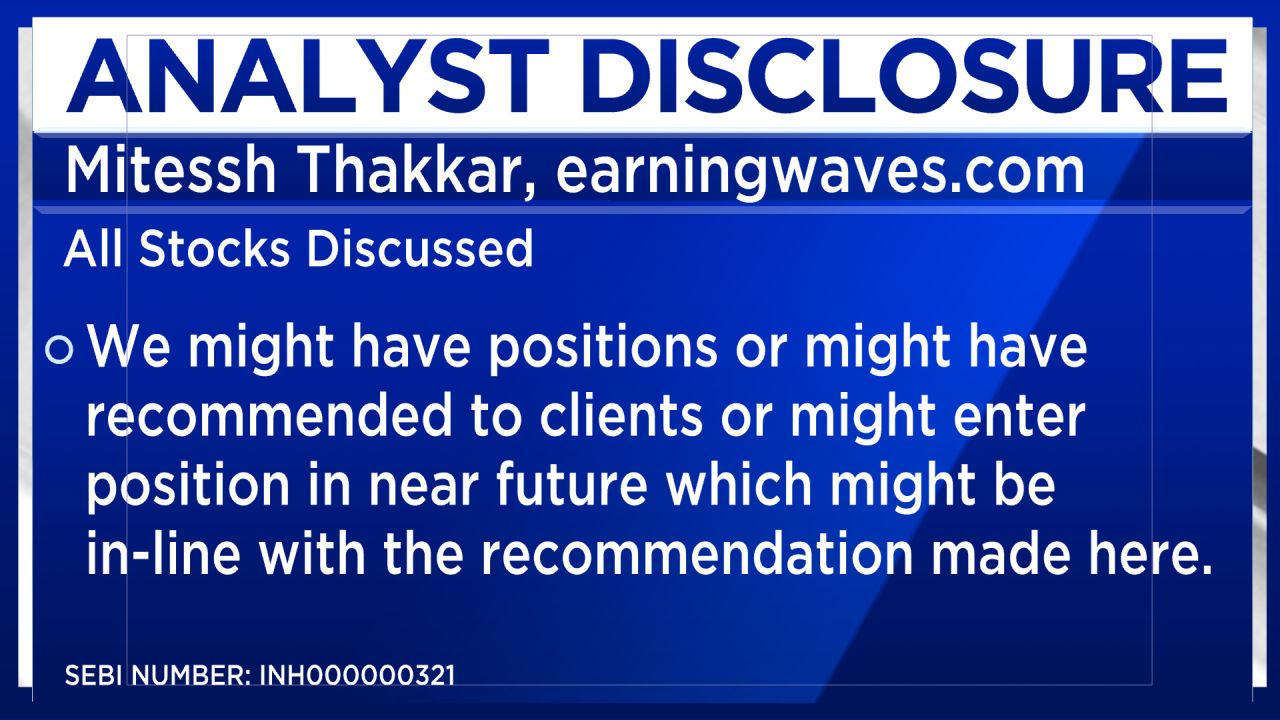

Market tech analysts, Mitessh Thakkar and F&O analyst Sneha Seth have these recommendations for Friday’s trading session.

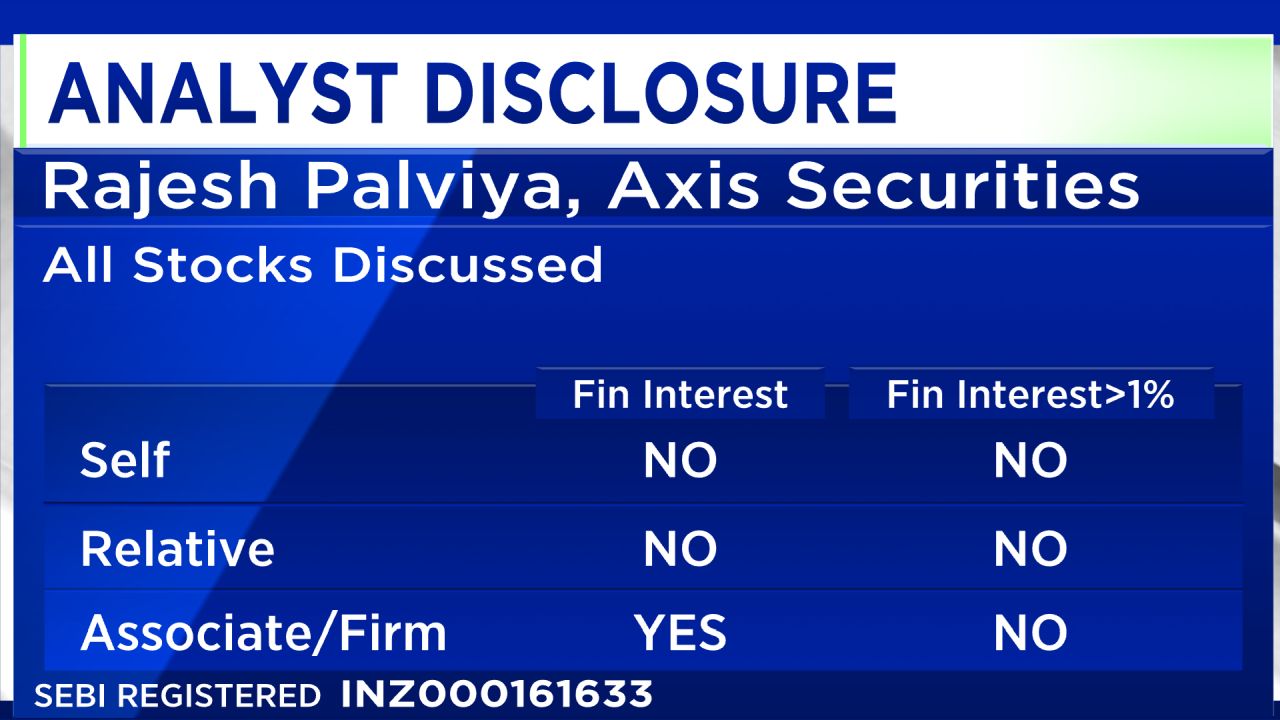

Technical analysts Mitessh Thakkar of earningwaves.com, along with Sneha Seth, Derivatives Research Analyst, Angel One share their top stock picks for the day.

From Mitessh Thakkar

Mitessh Thakkar’s first buy call of the day is on Bank of Baroda (BoB). He recommends this with a stop loss of ₹262 for an upside target of ₹284. Shares have gained more than 3% in the last month.

He recommends a buy call on Firstsource Solutions with a stop loss of ₹207 for an upside target ₹233. The stock is up more than 10% over the last month.

Sun TV is another buy call from Mitessh Thakkar. His recommendation comes with a target of ₹655 and a stop loss of ₹622. The stock has gained more than 8% in the last month.

Among the sell recommendations, Thakkar has one on Indian Hotels with a stop loss of ₹590 for a downside target of ₹540. Shares have gained more than 2% over the last month.

From Sneha Seth

Sneha Seth has a buy call on RVNL with a stop loss of ₹279 and a price target of ₹304 on the upside. The stock was up more than 10% in the past month.

Disclaimer: The views and investment tips expressed by investment experts on CNBCTV18.com are their own and not that of the website or its management. CNBCTV18.com advises users to check with certified experts before taking any investment decisions.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter