Vodafone Idea gains most in three years after govt agrees to convert interest dues into equity

Summary

Shares of Vodafone Idea are gaining the most in over three years.

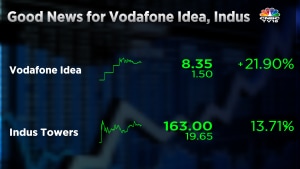

Shares of debt-ridden telecom operator Vodafone Idea have gained nearly 22 percent on Monday – their biggest single-day jump since November 2019. The surge comes after the government cleared a proposal to convert its interest dues of Rs 16,133 crore into equity.

Vodafone Idea on Friday informed the bourses that post the conversion of interest dues into equity, the government will become the single-largest shareholder in the company with a 35.8 percent stake.

The company has been directed to issue equity shares of the face value of Rs 10 each. Vodafone and Birla Group will have a stake of 28.5 percent and 17.8 percent respectively.

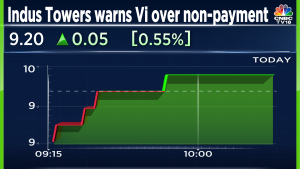

Along with shares of Vodafone Idea, those of Indus Towers are also witnessing double-digit gains on Monday as the former is the tower company’s major customer.

Indus Tower reported a net loss of Rs 708 crore for the December quarter, citing a persistent shortfall in collections from a “major customer,” which was Vodafone Idea.

The telecom infra company last month made a provision of doubtful debt worth Rs 2,298.1 on account of troubled balance sheet of Vodafone Idea. It had earlier made a provision of Rs 1,770 crore in the September quarter, adding to the Rs 1,232 crore it had already provided in the June quarter, taking the total provisions past Rs 5,000 crore.

Indus Towers has earlier warned Vodafone Idea of swifter repayment of dues, failing which it will discontinue their services. The current receivables from Vodafone Idea for Indus Towers are close to Rs 7,000 crore.

Shares of Vodafone Idea are trading 21.1 percent higher at Rs 8.3, while those of Indus Towers are also trading 13.5 percent higher at Rs 163.05.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter