Revenue growth of Indian telecom companies slows to a two-year low

Summary

Bharti Airtel and Reliance Jio have been steadily gaining market share, with each experiencing remarkable growth of around 2 percent over the last two years. However, the question arises whether this trend will continue.

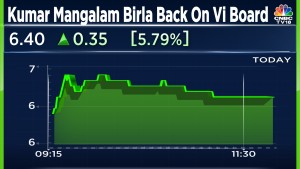

In the past quarter, the performance of telecom companies has been a cause for concern. The top three players in the Indian telecom market, namely Bharti Airtel, Reliance Jio, and Vodafone Idea, experienced a significant decline in revenue, reaching a near two-year low.

On a quarter-on-quarter basis, the revenue growth was a modest 1 percent, marking the slowest growth seen in the past seven quarters. Compared to the previous year, the growth was only 10 percent. The main reason behind this sluggish growth is barely any uptick in the Average Revenue per User (ARPU).

The last significant price increase in the prepaid category occurred in November and December of 2021, over a year and a half ago. Consequently, the full benefit of the 20 percent price increase has already been realised, resulting in stagnant average revenue per user figures for all these telecom companies in the current quarter on a sequential basis.

To revive revenue growth, it is essential to consider a price increase in prepaid 4G tariffs. If telecom companies want to see a positive turnaround, a tariff increase is necessary.

Among the three major players, Reliance Jio experienced slightly better growth, with a 1.7 percent increase on a quarter-on-quarter basis. However, when comparing year-on-year figures, both Reliance Jio and Bharti Airtel show similar numbers.

Another significant aspect to note is the capital expenditure (capex) spend by Vodafone Idea, which has dwindled to Rs 3,360 crore. This marks the lowest capex spend for Vodafone Idea since its merger in 2018-2019. Moreover, Vodafone Idea’s capex spend is only about 7-12 percent of its peers. In comparison, it accounts for about 7 percent of Reliance Jio’s capex and approximately 12 percent of Bharti Airtel’s capex in India. This significant divergence in capex raises concerns about potential market share losses for Vodafone Idea.

Over the past several quarters, Bharti Airtel and Reliance Jio have been steadily gaining market share, with each experiencing remarkable growth of around 2 percent over the last two years. However, the question arises whether this trend will continue.

To summarize, two key takeaways from the telecom sector are the slowdown in revenue growth in the March quarter, marking the lowest figures in the past two years for the Indian mobile wireless space, and the significantly reduced capex spend by Vodafone Idea, which raises concerns about further market share losses compared to its peers, Bharti Airtel and Reliance Jio.

Disclosure: RIL, the promoter of Reliance Jio, also controls Network18, the parent company of CNBCTV18.com.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter