How to choose the right mutual fund for a given goal

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

Mutual funds can be a good investment tool for both short and long-term financial goals, depending on the individual’s investment objective, risk profile, and investment horizon.

Mutual funds can be a good investment tool for both short and long-term financial goals, depending on the individual’s investment objective, risk profile, and investment horizon. There has been a growing awareness among Indians about the benefits of mutual funds as an investment option, and a significant number of investors have started investing in mutual funds to achieve their financial goals.

For short-term goals, debt mutual funds can be suitable as they offer relatively lower risk than equity mutual funds. For long-term goals, equity mutual funds are generally considered suitable as they have the potential to generate higher returns over an extended period, although they do carry a higher degree of risk.

Mutual funds can be a good investment tool as they offer diversification, professional management, convenience, liquidity, cost-effectiveness, and flexibility.

The choice of mutual funds for short, medium, and long-term goals may vary depending on the individual’s investment objectives, risk profile, and investment horizon. However, here are some general recommendations:

For short-term goals (less than three years), debt mutual funds are generally considered suitable as they offer relatively lower risk than equity mutual funds. Examples of debt mutual funds include liquid funds, ultra-short-term funds, and short-term funds.

But we need to understand what these funds are all about.

Liquid funds: Liquid funds invest in securities with short residual maturities, making them an ideal choice for short-term goals such as keeping idle money, emergency planning, and more. Since they primarily invest in low-maturity instruments, they come with a minimal duration risk.

Treasury bills, commercial paper, certificates of deposit, and other money market securities with a maturity of up to 91 days to name a few.

Ultra-short-term funds: Ultra-short-duration mutual funds primarily invest in fixed-income instruments, with short-term maturities that are higher in comparison to liquid funds. These funds come with low-interest rate risks and aim to provide better returns than liquid funds.

Short-term funds: These funds are recognised for investing in short-duration fixed-income instruments, maintaining a portfolio with a Macaulay duration of one to three years. They can be a suitable option for individuals planning to save for a foreign vacation, park a pre-retirement corpus, or purchase consumer durables.

For medium-term goals (three to five years), balanced mutual funds or hybrid mutual funds can be considered as they invest in a mix of equity and debt instruments. Examples of balanced mutual funds include aggressive hybrid funds and conservative hybrid funds.

Aggressive hybrid funds: Aggressive conservative hybrid funds allocate 65-80 percent of total investments to both equity and debt instruments, which leads to equity taxation. These funds may be suitable for individuals who are willing to take moderate risks while aiming for the returns of equity and the stability of debt.

Conservative hybrid funds: The majority of the corpus in debt instruments is invested by this type of mutual fund, with a smaller proportion allocated to equities to earn capital gains. Typically, these funds invest 75-90 percent of the corpus in fixed-income securities and the rest in equities. Due to the high allocation of debt instruments, the risk in these schemes is lower than that of equity funds. Conservative investors who prioritise stability in debt and seek the benefits of upside potential in equities may find these funds ideal.

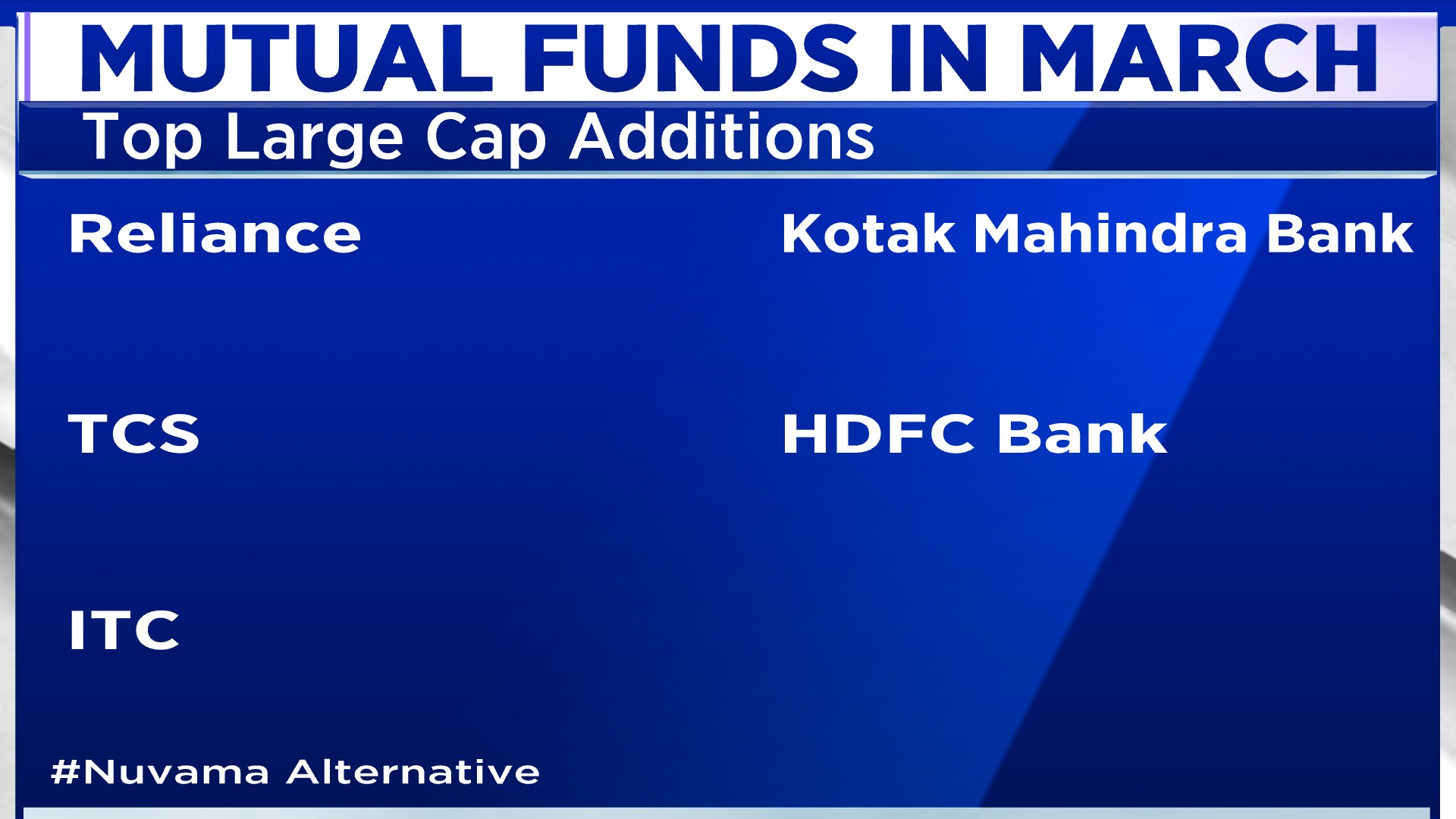

For long-term goals (more than five years), equity mutual funds are generally considered suitable as they have the potential to generate higher returns over an extended period, although they do carry a higher degree of risk. Examples of equity mutual funds include large-cap funds, mid-cap funds, and small-cap funds.

Large-cap funds: Large Cap Funds allocate a minimum of 80 percent of their total assets to equity and equity-related instruments of large-cap companies, specifically the top 100 companies based on market capitalisation. These funds are generally more stable compared to mid-cap or small-cap funds, providing investors with added assurance.

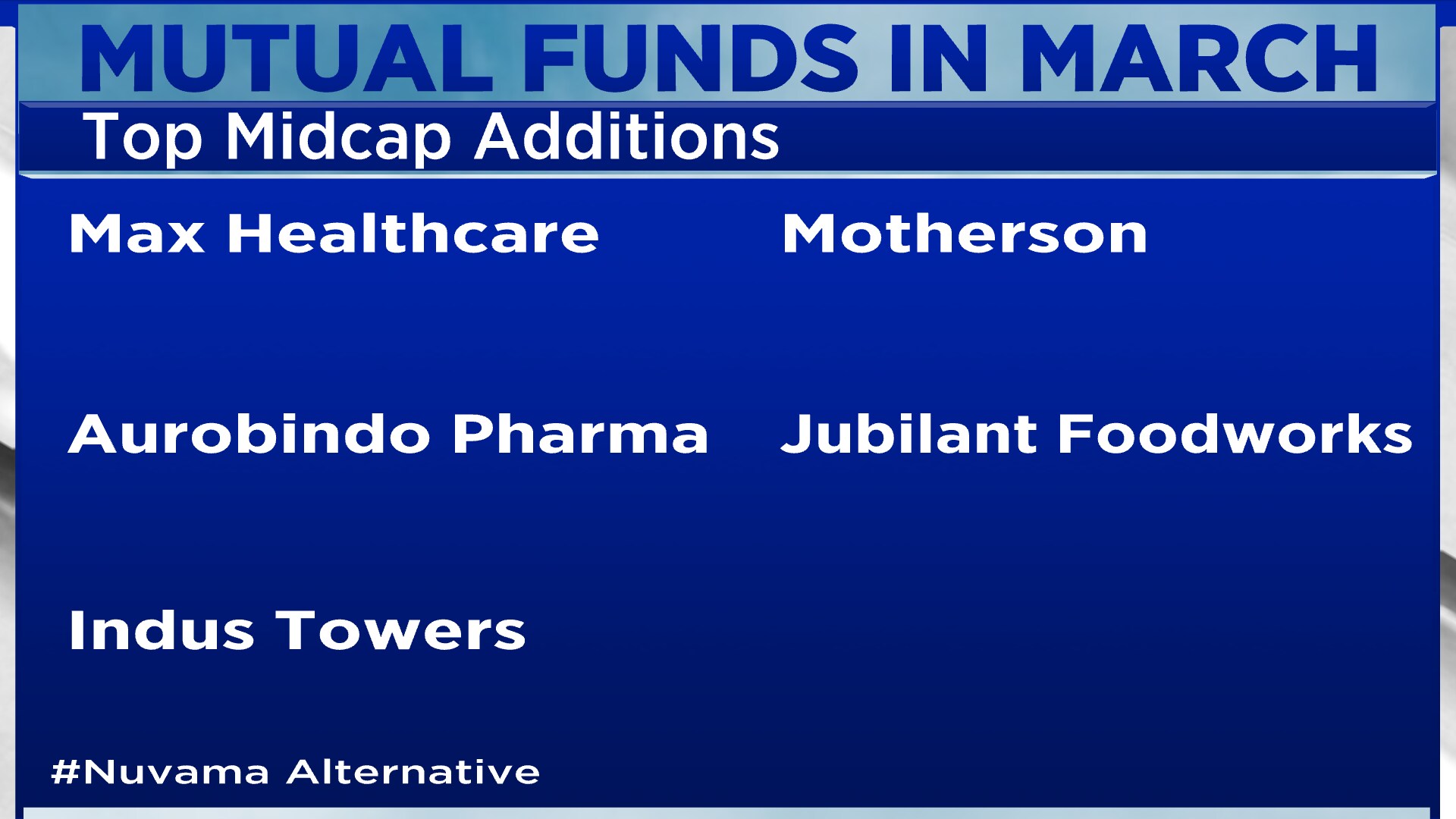

Mid-cap funds: Mid Cap Funds allocate a minimum of 65 percent of their total assets to equity and equity-related instruments of mid-cap companies. Although these funds come with a volatile nature, they may provide better returns than large-cap schemes.

Small Cap funds: Small Cap Funds allocate a minimum of 65 percent of their total assets to equity and equity-related instruments of small-cap companies. These funds are known for their high volatility but also have great potential for returns. If you are seeking highly volatile funds with the potential for high returns, consider small-cap funds.

In conclusion, aligning your mutual fund investments with your financial goals requires careful planning and execution. By identifying your financial goals, selecting the right mutual fund category, allocating your investments wisely, rebalancing your portfolio periodically, and monitoring your investments regularly, you can ensure that your mutual fund investments are aligned with your financial goals and help you achieve them.

Note: This is a partnered post

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter