Gujarat Gas shares drop after Jefferies cuts volume estimates, price target

Summary

Jefferies expects Gujarat Gas to post a 5 percent CAGR (compounded annual growth rate) in earnings per share (EPS) over the financial year 2022-2025.

[wealthdesk shortname=”Gujarat Gas” isinid=”INE844O01030″ bseid=”539336″ nseid=”GUJGASLTD” sector=”Oil Drilling And Exploration” exchange=”nse”]

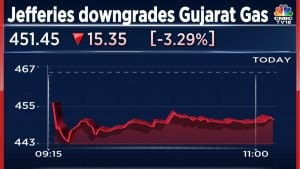

Global investment banking and capital markets firm Jefferies on Thursday downgraded Gujarat Gas Ltd., one of India’s largest city gas distribution companies, to ‘underperform’.

The firm also cut the target price on the Gujarat Gas stock to Rs 400 from Rs 570 earlier, indicating a downside of more than 14 percent from its closing level on Thursday.

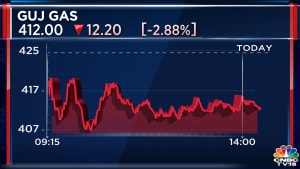

Reacting to the development, shares of Gujarat Gas fell as much as 5.3 percent in opening trade on Friday.

Jefferies said that the downgrade was due to the firm outlook on spot LNG prices. It sees a structural drag on Gujarat Gas’s pricing power, margin outlook, and volume growth in the medium term due to rising LNG prices.

Jefferies has cut the company’s volume estimates to 17/15 percent For the financial year 2025. It has also lowered the company’s financial year 2024-2025 estimated EBITDA by 15 percent due to lower volumes and compression in margins.

Also, Jefferies expects Gujarat Gas to post a 5 percent CAGR (compounded annual growth rate) in earnings per share (EPS) over the financial year 2022-2025.

Notably, Gujarat Gas reported a consolidated total income of Rs 4,468 crore during the September quarter, down 19.6 percent from the preceding quarter’s Rs 5,558.32 crore and up 6.8 percent in total Income of Rs 4,182 crore in the year-ago quarter. The company also reported a net profit after tax (PAT) of Rs 621.82 crore.

Shares of Gujarat Gas are trading 3.25 percent lower at Rs 451.65.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter