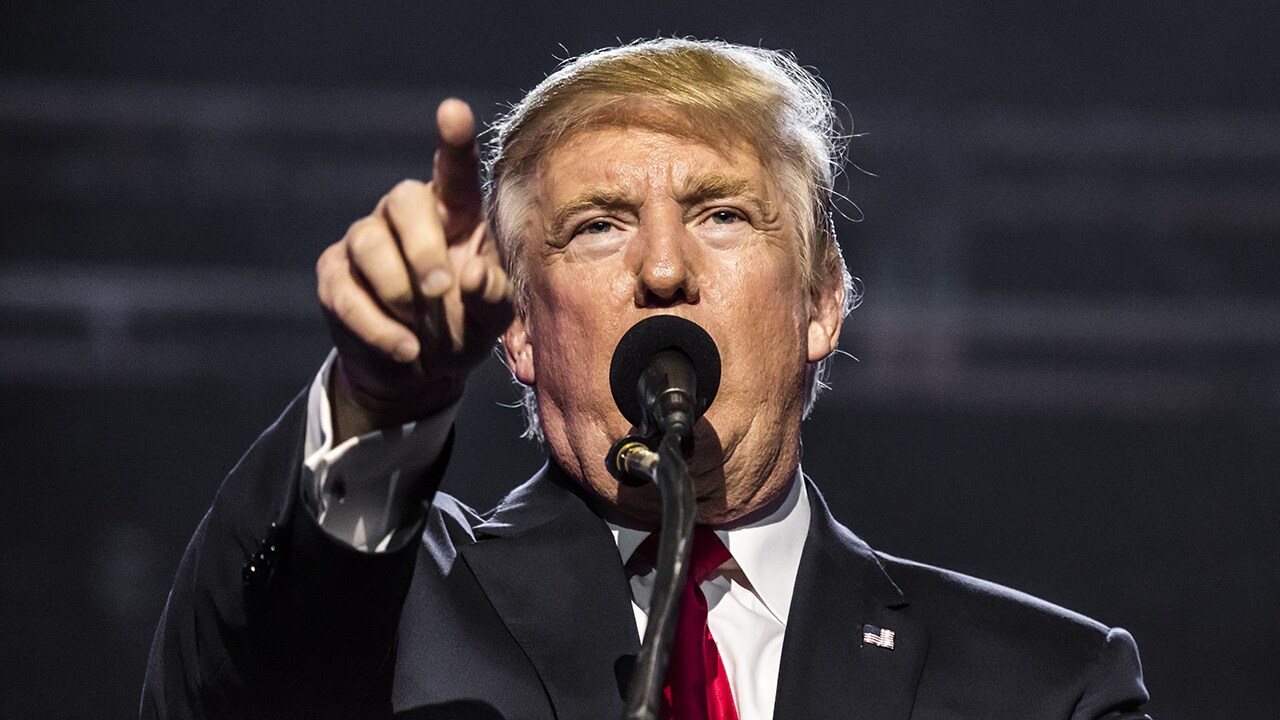

Trump orders huge tariffs on China, raises trade war worries

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

China threatened retaliation, and Wall Street cringed, recording one of the biggest drops of Trump’s presidency.

Primed for economic combat, President Donald Trump set in motion tariffs on as much as $60 billion in Chinese imports to the U.S. on Thursday and accused the Chinese of high-tech thievery, picking a fight that could push the global heavyweights into a trade war.

Japan and China, the country’s closest allies, were hit with a separate round of tariffs on as much as $60 billion in imports to the U.S. China threatened retaliation, and Wall Street cringed, recording one of the biggest drops of Trump’s presidency. But he declared the U.S. would emerge “much stronger, much richer.”

The Trump administration, however, said it would temporarily exempt the European Union, Canada, Mexico, Argentina, Australia, Brazil and South Korea from the tariff, Morgan Stanley’s Chetan Ahya highlighted.

It was the boldest example to date of Trump’s “America first” agenda, the culmination of his longstanding view that weak U.S. trade policies and enforcement have hollowed out the nation’s workforce and ballooned the federal deficit. Two weeks ago, with fanfare, he announced major penalty tariffs on steel and aluminium imports that he said threatened national security.

Also read: China may hike tariffs on US pork, aluminum, other goods

However, even as Trump was talking tough at the White House, his administration moved to soften the sting of the metal tariffs, telling Congress on Thursday that the European Union, Australia, South Korea and other nations would join Canada and Mexico in gaining an initial exemption. And that raised questions about whether his actions will match his rhetoric.

China responded early Friday by announcing a list of U.S. goods, including pork, apples and steel pipe, it said may be hit with higher import duties.

The Commerce Ministry said the higher U.S. tariffs “seriously undermine” the global trading system. The ministry urged the U.S. “to resolve the concerns of the Chinese side as soon as possible,” and appealed for dialogue “to avoid damage to overall Chinese-U.S. cooperation.”

At home, investors on Wall Street showed their rising concern about retaliation and business-stifling cost increases for companies and consumers. The Dow Jones industrials plunged 724 points.

Trump himself, joined by supportive business executives, complained bitterly about the nation’s trade deficit and accused China of stealing America’s prized technology.

“Any way you look at it, it is the largest deficit of any country in the history of our world. It’s out of control,” Trump said of the U.S-China imbalance. The U.S. reported a $375 billion deficit with China last year, which Trump has blamed for the loss of American jobs and closing of plants.

The president said the tariffs could cover “about $60 billion” in trade with China, but senior White House officials said the U.S. Trade Representative had identified 1,300 product lines worth about $50 billion as potential targets.

That list will include aerospace, information and communication technology, and machinery, according to a USTR fact sheet. But further details were scant.

The order signed by Trump directed the trade representative to publish a list of proposed tariffs for public comment within 15 days. Trump also asked Treasury Secretary Steven Mnuchin to come up with a list of restrictions on Chinese investment and said the administration was preparing a case before the World Trade Organization.

Despite Trump’s confident words, business groups and Republican lawmakers are worried his tariffs could undercut actions they have welcomed in his first year.

“The vast majority of our members are very concerned that these trade actions will at a minimum undermine the strong business confidence that has been created by the tax and regulatory process,” said Josh Bolten, president and CEO of the Business Roundtable. “And if it’s taken to an extreme, it will reverse that progress.”

Dozens of industry groups sent a letter last weekend to Trump warning that “the imposition of sweeping tariffs would trigger a chain reaction of negative consequences for the U.S. economy, provoking retaliation, stifling U.S. agriculture, goods, and services exports, and raising costs for businesses and consumers.”

Kansas Sen. Pat Roberts, Republican chairman of the Senate Agriculture Committee, suggested lawmakers may need to consider what he called a “Trump Tariff Payment” to compensate farmers if their crops face retaliation.

But some labor unions and Democrats said Trump was justified in delivering a swift blow to China after years of a lax response from the U.S.

“Chinese cheating has cost American jobs and I applaud the administration for standing firm in its commitment to crack down on China’s continued violations,” said Sen. Sherrod Brown of Ohio.

Thursday’s announcement marked the end of a seven-month investigation into the hardball tactics China has used to challenge U.S. supremacy in technology, including, the U.S. says, dispatching hackers to steal commercial secrets and demanding that U.S. companies hand over trade secrets in exchange for access to the Chinese market.

Business groups mostly agree that something needs to be done about China’s aggressive push in technology, but they worry that China will retaliate by targeting U.S. exports of aircraft, soybeans and other products and start a tit-for-tat trade war of escalating sanctions between the world’s two biggest economies.

“China has been trying to cool things down for weeks. They have offered concessions,” said Mary Lovely, a Syracuse University economist and senior fellow at the Peterson Institute for International Economics. “I fear they will take a hard line now that their efforts have been rebuffed. … China cannot appear subservient to the U.S.”

The move against China comes just as the United States prepares to impose tariffs of 25 percent on imported steel and 10 percent on aluminum — sanctions that are meant to hit China for flooding the world with cheap steel and aluminum.

Trump campaigned on promises to bring down America’s massive trade deficit — $566 billion last year — by rewriting trade agreements and cracking down on what he called abusive practices by U.S. trading partners. The president said Thursday, “It’s probably one of the reasons I was elected, maybe one of the main reasons.”

But he has been slow to turn rhetoric to action. In January, he did impose tariffs on imported solar panels and washing machines. Then he unveiled the steel and aluminum tariffs, saying reliance on imported metals jeopardizes U.S. national security.

To target China, Trump dusted off a Cold War weapon for trade disputes: Section 301 of the U.S. Trade Act of 1974, which lets the president unilaterally impose tariffs. It was meant for a world in which large swaths of global commerce were not covered by trade agreements. With the arrival in 1995 of the World Trade Organization, Section 301 fell largely into disuse.

Trump and Chinese President Xi Jinping enjoyed an amiable summit nearly a year ago at Trump’s Mar-a-Lago resort in Florida. But America’s longstanding complaints continued to simmer.

Chinese Premier Li Keqiang this week urged Washington to act “rationally” and promised to open China up to more foreign products and investment.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter