Cabinet clears Rs 6,062 crore World Bank-assisted programme for MSMEs

Summary

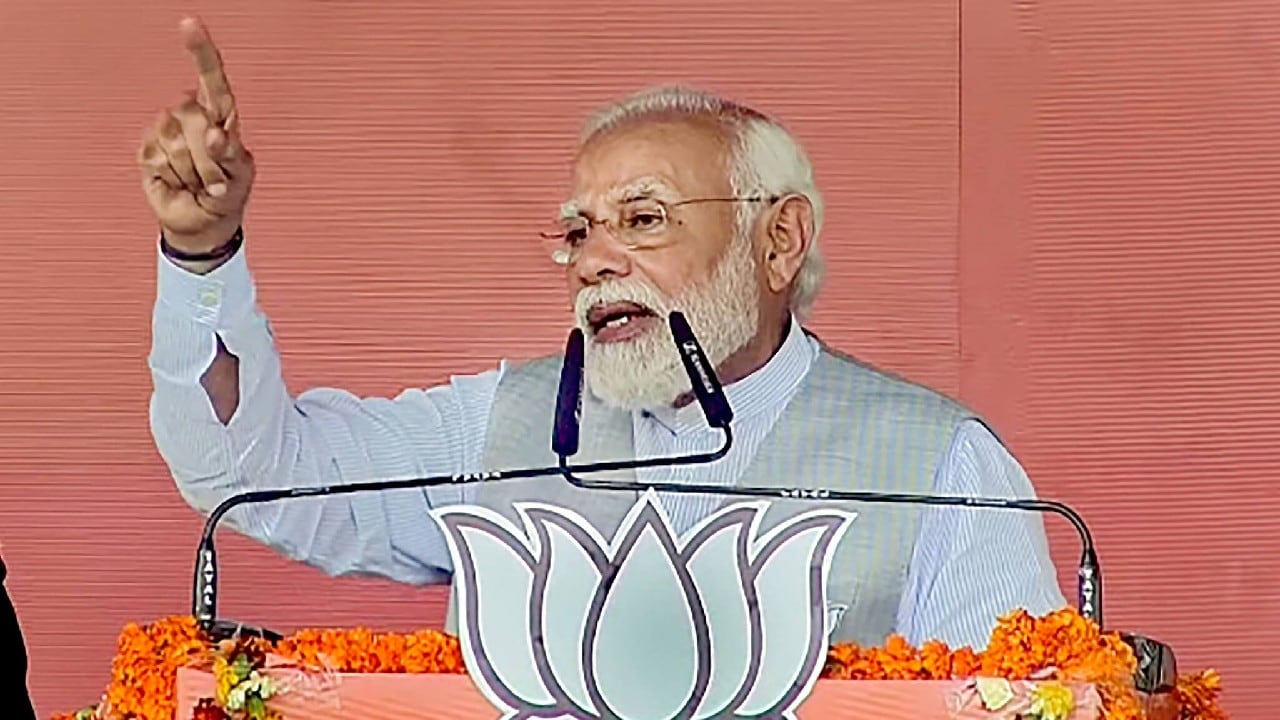

The Cabinet Committee on Economic Affairs (CCEA), chaired by Prime Minister Narendra Modi, approved the Rs 6,062.45 crore or USD 808 million ‘Raising and Accelerating MSM Performance’ (RAMP) for the micro, small and medium enterprises (MSMEs), an official release said.

The Union Cabinet on Wednesday approved a World Bank-assisted Rs 6,062 crore funding programme for the small and medium businesses to help improve their access to market and credit.

The Cabinet Committee on Economic Affairs (CCEA), chaired by Prime Minister Narendra Modi, approved the Rs 6,062.45 crore or USD 808 million ‘Raising and Accelerating MSM Performance’ (RAMP) for the micro, small and medium enterprises (MSMEs), an official release said.

RAMP will commence in FY23, it said. Of the total outlay under the programme, Rs 3,750 crore (USD 500 million) will come from World Bank loan, and the remaining Rs 2,312.45 crore will be funded by the central government.

RAMP will work under the Ministry of MSME (MoMSME) towards resilience and recovery interventions after the coronavirus disease. “The programme aims at improving access to market and credit, strengthening institutions and governance at the Centre and state, improving Centre-state linkages and partnerships, addressing issues of delayed payments and greening of MSMEs. In addition to building the MoMSME’s capacity at the national level, the RAMP programme will seek to scale up implementation capacity and MSME coverage in states,” the release said.

The government formulated and proposed RAMP for strengthening MSMEs in line with the recommendations of the UK Sinha committee, KV Kamath committee and the Economic Advisory Council of the Prime Minister (EAC-PM). RAMP programme with impacts across the country will directly or indirectly benefit all 6.3 crore enterprises under the MSME category.

Also Read: Women-owned ‘very small businesses’ offer $11.4 bn investment opportunity: IFC Report

A total of 5,55,000 MSMEs are specifically targeted for enhanced performance. In addition, expansion of target market to include service sectors and increase of about 70,500 women MSMEs is envisaged, the release said. RAMP has identified two result areas after preliminary missions and studies, first is to strengthen institutions and governance of the MSME programme and second is to support market access, firm capabilities and access to finance.

“Funds would flow through RAMP into the ministry’s budget against Disbursement Linked Indicators (DLIs) to support ongoing MoMSME programmes, focusing on improving market access and competitiveness.” The disbursement of funds from the World Bank towards RAMP would be made on fulfilling DLIs such as implementing the national MSME reform agenda, accelerating MSME sector Centre-state collaboration, enhancing effectiveness of Technology Upgradation Scheme (CLCS-TUS). The government said the programme will prepare Strategic Investment Plans (SIPs) in which all the states and Union Territories will be invited.

The SIPs would include an outreach plan for identification and mobilization of MSMEs under RAMP, identify key constraints and gaps, set milestones and project the required budgets for interventions in priority sectors, including renewable energy, rural and non-farm business, wholesale and retail trade, village and cottage industries, women enterprises, among others. The apex national MSME council headed by the minister for MSME will monitor and look after the policy overview of RAMP.

An RAMP programme committee headed by the Secretary of MoMSME will monitor specific deliverables, the government said. For day-to-day implementation, there would be programme management units at the national level and in states, comprising professionals and experts competitively selected from the industry to support MoMSME and states, to implement, monitor and evaluate RAMP programme, the release said.

Also Read: Cabinet nod to extension of NIP-2012 for Hindustan Urvarak and Rasayan

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter