Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Everything that we are doing in life is centred around money.

What a way to exist!

For most of us, practically the whole day all we are thinking is about money and more specifically how to have more money!

As if money was the only thing in life. Unfortunately for most of us, circumstances just do not permit any other thought!

We are running behind money most of the time which is almost akin to have become obsessed with money. Everything that we are doing in life is centred around money.

Unfortunately, this is because we need money for anything and everything that we do. There’s nothing wrong and what are you doing, however the problem is that over time, it becomes a compulsive habit to keep earning more.

That’s where the danger is. The problem is that there is a point where from we chase money as an addiction, we chase money because we like to do so. If we did not chase money we would not know what to chase now because we get out identity from money and the amount of money we have.

Another thing is that right from childhood we are always taught and our minds are conditioned that everything that we are doing is going to be for the sake of earning money.

There is no one who told you that money is just a means, and then there is something greater in life to achieve. Some examples are legacy; building something, charity; to giving something / helping someone, passion; pursuing something and living; simply to enjoy life and your money

We have got addicted to this and how!

There are three reasons for this:

First, we are what we do. It is the human behaviour. I know I should exercise and I don’t. I know I should eat healthy and I don’t. I know I should spend time with my kids and I don’t. I know that, yes, money isn’t going to make me happy and I still keep trying to make money.

We live by the laws of inertia, in a pattern which is hard to break. But we have to break it. For ourselves and for the sake of people and reasons for which we are chasing money.

Secondly, we need signals of progress. Money is a measure of how far you have progressed in life. The more the money you have the more you can make sure your progress. It’s simply the logic of evolution. People need validation of their success. Bigger house, bigger car, branded goods and list goes on.

Thirdly, it’s the easy way out. It’s only human to avoid difficult things. Important things are very difficult to measure. Have I been a good father or husband? Have I groomed my child well? Such things take years to measure and we still don’t have answers.

So, should we not be focused on creating money for ourselves?

I’m not saying that. Definitely create. Take care of yourself for sure!! Use it to the maximum to make yourself happy!!! You need a certain amount and beyond that is extra.

The definition of their certain amount is naturally different from one person to another. If that extra is going to happen easily, without stress and without your involvement, then its fine. Basically don’t kill yourself for that extra. Be Smart.

Kartik Jhaveri is an expert at planning money, life and aspirations. He is a certified financial planner, wealth manager and financial freedom coach.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Most of us in Mumbai, see this huge structure called the Reserve Bank of India and wonder what it really does. It’s also a tourist attraction!! It has so many other offices and again one wonders why they need to have so many offices. I’m going to try and highlight a very interesting part of …

Most of us in Mumbai, see this huge structure called the Reserve Bank of India and wonder what it really does. It’s also a tourist attraction!! It has so many other offices and again one wonders why they need to have so many offices. I’m going to try and highlight a very interesting part of RBI’s work and how it helps us directly on a day-to-day basis.

The RBI does a review of the monetary policy of the country at frequent intervals during the year. So how does the monetary policy help us investors to take smart decisions?

Monetary policy is a tool by which the RBI decides to raise interest rates or reduce interest rates or keep them steady.

In our country, as we’re an oil importing nation, this decision is very closely linked to Oil. Oil to a large extent contributes to inflation. We all know what happens when inflation keeps rising. We in India unfortunately do not see too much of inflation falling and things becoming cheaper.

Oil is Not Well

So when oil prices rise i.e. we see a rise in crude oil prices almost instantly we can expect rising food prices. This is because there is going to be a rising cost pressure for manufacturing & services. This rise obviously gets passed onto the retail consumers.

When this happens RBI adopts a hawkish stance, tries to pull money out of the system by raising interest rates. Now when interest rates rise no one seems to be interested in borrowing. This immediately puts a brakes on money circulation. Less money chasing goods decreases the demand for money. This way it controls inflation.

There is yet another tool that the RBI has and that is known as the CRR or the cash reserve ratio. This ratio in simple words means the amount of cash that the bank must maintain with the RBI as the percentage of the total assets. So when this increases banks are forced to park more with the RBI and this is also a way to control inflation.

On the other hand when things look dull, when there is a recession of sorts, the RBI comes to the rescue and gets into action to kickstart growth in the country. It does this by lowering the interest rates. This we all will understand quite easily because we see a direct benefit of this happening. We see a fall of interest outgo in our EMI’s for the home loan that we are carrying. New loans become cheaper.

Individuals are motivated to go out and make purchases, whether it is for a washing machine or a piece of real estate. Businesses are motivated to go out and borrow to buy more machinery, to expand capacity, to hire more staff and manpower and basically do everything that will add to the growth of business.

Economic growth results as a result of all this. It is also during this time that stock market rises, we see a rally in stock prices and mutual fund NAV’s jumping higher and higher each day. There is prosperity all around.

Critical Role

As you can see that the central bank of the country has a very very important role to play. If it makes a mistake, things can go really wrong. Imagine like the USA or Japan if our interest rates were very low; everyone would run to borrow, they would borrow more than they require because it would be cheap and easy to borrow. And that is very individuals would run into what is known as the debt trap, because someday you’ll have to pay back.

Each day the central bank attempts to make sure that everything in our country remains stable and financially there’s nothing that goes wrong dramatically.

Kartik Jhaveri is an expert at planning money, life and aspirations. He is a Certified Financial Planner, Wealth Manager & Financial Freedom Coach.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Whenever we see discontent among depositors of fixed deposits, the bond markets come to the rescue.

We are not talking of James Bond, we are talking of investment bonds.

We are in a situation where the fixed deposit rates are at a general low and there is a lot of discontent among depositors of fixed deposits.

Whenever we see a situation like this, one way or the other, the bond markets come to the rescue. It comes to the rescue of smart depositors, who are agile to move their money from fixed deposits to bond funds.

Let’s understand what is happening and why.

What Exactly is Happening in the Bond Markets?

It is likely that in this year, investors of bond funds will make handsome gains. Bond prices may rise and there may be capital gains. Investors of bond funds not only earn the rate of interest, but also earn capital gains. So that way, they make more than the return they would make on fixed deposits. The returns could be a high single digit or sometimes as high as double digits.

Over three years, this will become practically tax free or the tax would be a very small amount. So, basically, I am thinking that a rally will happen in the bond market. There are three main reasons for this — reduction in government borrowing (which is favourable), recovery of trading losses (which is favourable) and no change in monetary policy (which is neutral).

A word of caution, however, that such bond market investments are also subject to bond-market volatility and should be considered ideally with the help of a financial expert.

Before proceeding further, let us, therefore, quickly explain a bond, bond fund and bond market. We need to do this because few people understand the bond markets and even fewer invest in the bond markets.

Bond is nothing, but a commercial transaction where the borrower is issuing a bond to the lender and the lender will earn a certain rate of interest. When interest rates fall, everyone becomes interested in owning that bond.

As a result, the demand for the bond increases, the price of the bond increases and the bondholder makes capital gains.

A bond fund is a fund where ordinary investors pool in their money and a fund manager buys them a portfolio of bonds.

Moving onto the Reasons For a Rally in Bond Funds…

Now, the fundamental reason for a rally is reduction in interest rates as it stimulates economy and growth.

Firstly, the government is a massive borrower of funds. So a reduction in government borrowing reduces the demand for money in the economy. As a result, prices of bonds rise and this contributes to capital gains for bond holders.

Secondly, the Reserve Bank of India (RBI) recently announced that the commercial banks and RBI, which are the largest lenders to the government, will have another year to offset losses they have incurred on account of buying government bonds in the past. This action will lead to a rise in the price of bonds and this contributes to capital gains for bond holders.

Lastly, on one side due to the rise in oil prices, there is more inflation and thus more money is needed for circulation in the economy. On the other side, many government bonds are maturing, which will provide money supply. So, it is likely that we see a neutralising effect and thus RBI will take no action. This inaction here will support capital gains as explained above. Hence, this year might be a year of good gains for the bond investors.

Kartik Jhaveri is an expert at planning money, life and aspirations. He is a Certified Financial Planner, Wealth Manager & Financial Freedom Coach.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

April and May are great months to get a lot of things started, financially speaking. Here is a guide.

I am going to try and explain to you why the summer holidays of April and May are great months to get a lot of things started, financially speaking.

This time period in a way resets the financial clock. You also have the option to hit the reset button on everything you have done so far; financially speaking of course and hope to do better things better than you did last year.

Let’s look at some of the new and unusual things to do in April.

Learn something about money or anything you like. The best way to make money is to learn something about money. Just like if you wanted to learn cooking you will get into the cooking class. If you wanted to learn swimming you would enrol in the swimming class. If you find learning about money is too daunting task than learn something which is close at to your heart or related to your work. If you learn something new, there’s a possibility that you will use your new ideas to generate new income and in turn that will generate new wealth for you. So make a budget, enrol somewhere and spend that budget. How about a % of your annual income? Spend it for sure!

When you’re by yourself and without your mobile phone you will have the opportunity to think! When you have time to think, suddenly good ideas will come to your mind. You may think this is silly but you can be sure that you will be amazed if your drivers experiment just once. So it might be a good idea to go for a holiday just by yourself. If you find that too intimidating, join a group of strangers. You can combine that with the adventures experience if you like. Be extra careful if you’re going with your special buddies. Do this only if they are going to be in a position to help you discuss your idea and make it bigger. They must play the role of complimenting your thoughts. So make a schedule to do this holiday and obviously make a budget to make it happen. Think & create new ways of making wealth.

Be brave. Let’s aim to grow and multiply net worth by 50% by the time you come to the end of this financial year. This is not a joke and it is easier than you can imagine. I’m speaking about NETWORTH and I’m not talking about return on investment. If your networth is Rs. 100 today, all I’m saying is that let’s aim to make this a 150 by the end of this year. This networth comprises of all your savings till date. This can be achieved by simply saving aggressively every month for the next twelve months. Just put this into a recurring deposit or liquid fund so you don’t spend it. We just have to prove to ourselves that this is possible. Where and how we will invest this money will think about that later.

I want to give you an exercise here. Write down all your negative beliefs you have about money and wealth. Most people are not able to achieve the desired level of wealth because they think about wealth negatively. So even if you are earning a good amount of income you will never see yourself becoming wealthy. Examples are money causes problems, money causes a fight, managing money is complicated etc. Then for each negative thought, you have written down the positives i.e. the opposite for a few months. Soon negatively biased feelings will evaporate.

Again here you do not have to be a financial expert. The idea is to learn something new. There are hundreds of investment options. Our objective here is to learn something new. Talk to your advisor and seek his or her guidance. Just a word of caution here; don’t do anything which is speculative or is something that you just can’t understand. Do what do find easy you understand and do that then.

Kartik Jhaveri is an expert at planning money, life and aspirations. He is a Certified Financial Planner, Wealth Manager & Financial Freedom Coach.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

The important thing to understand is that your money needs action.

John Lewis famously remarked, “If not now, then when? If not us, then who?” This is so appropriate in the current financial world that we live in.

That statement will leave to rest every other argument that is conservative and against the idea of wealth creation. We are often faced with the situation where there is no option but to create wealth. Read on to know why!

Interest rates are painfully low. For all those diehard fans of guaranteed investment returns, there’s hardly any place to go to. Thinking of fixed deposits? Feeling happy with 7%? And fully taxable? That period is over. Period.

That doctrine of investing into pure fixed deposits and similar instruments is unfortunately standing challenged. There is no option but to sprinkle it with a combination of a little something that will add to the returns earned from fixed income type of securities. In fact this category of investors are in a way, best placed in terms of the current tax laws.

They can earn about 9-10% with minimal or near zero tax over about five years and more. Starting to generate rate of return above the inflation level of 7% is starting to create wealth. So there it is; there is no option but to move in the direction of creating wealth.

For more evolved investors, who invest in equities and who and still sitting on the sidelines tend to run out of patience every now and then. They are sometimes waiting for the right time, sometimes waiting for correction, sometimes waiting for valuation and sometimes waiting for just nothing. Sometimes, just too busy to take action!

I totally understand not wanting to lose hard-earned money. But if the money does not move it will stagnate. That’s the problem with money.

Hit the Ground Running

Inaction and inactivity kills it. Makes it costly to hold. Makes us lose opportunities, sometimes small and sometimes significant. I know of many people including my dad, who just kept investing into equities and holding forever. No doubt they were hugely (big HUGELY) better off then the people in the same time zone. I think they could have done far better with some smart lessons on asset allocation. This is because if they compare the growth rate of their holding over a period of 20 or maybe 30 years the compounded rate of return earned is often not impressive.

It is just marginally better or a few percentage points above the fixed deposit rate. Hence the need for asset allocation, which simply put is not to have all eggs in one basket at any given point in time. These sections of investors anyways create wealth, and, asset allocation is the tool that ensures that the process of wealth creation continues uninterrupted. So again there it is; even for this section there is not option but to start enhancing their wealth creation activities, else returns will continue to remain forever mediocre.

Then there are skeptics and there is nothing much for skeptics of everything, except that they need a serious dose of financial education. Perhaps what if needed is a proof of concept and for that, which better country to live in other than India where financial transparency in investments is so high that I sometimes feel, it comes from another planet.

Your Money Needs Action

Today, there is a whole lot of variety to choose from and we have never been more spoilt for choice. But the most important thing in all this is to understand that your money needs action. It needs activity and for that the time is now!

And furthermore, if you asked me this question 10 years ago; I would have said that, the Time is NOW. If you ask this question 10 years hence, I will still say the Time is NOW. Any time is the right time to start the process of creating wealth. All that is important is that you take your first step; then continue it all the way with zeal and determination… till you have the level of wealth that you desire. And if you accumulate more than you need, still do it and share it with the world.

If you want your financial freedom; then the Time is NOW!

Kartik Jhaveri is an expert at planning money, life and aspirations. He is a Certified Financial Planner, Wealth Manager and Financial Freedom Coach.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Venture fund Aspada was co-founded by Kartik Srivatsa and Thomas Hyland in 2012 and has made 17 investments so far across Fin-tech, agriculture, health and edu-tech startups. Young Turks takes a look at their investment thesis, their differentiated VC model and meet three of their portfolio companies – Capital Float that underwrites unsecured loans to …

Continue reading “Young Turks: Here’s the success story of venture fund Aspada”

Venture fund Aspada was co-founded by Kartik Srivatsa and Thomas Hyland in 2012 and has made 17 investments so far across Fin-tech, agriculture, health and edu-tech startups.

Young Turks takes a look at their investment thesis, their differentiated VC model and meet three of their portfolio companies – Capital Float that underwrites unsecured loans to startups and SMEs; Dunzo, a hyper local concierge and delivery player that is also Google’s first direct startup investment in India; WayCool, a Chennai-based agriculture-tech startup.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Sai Sudarshan caught the attention of the IPL fraternity when he played a breath-taking knock of 96 runs in the final of the 2023 edition of the tournament. He tore apart the Chennai Super Kings (CSK) bowling unit with the help of eight boundaries and six maximums to bat at a strike rate of 205 and get GT to 214 in the first innings of the grand finale.

Gujarat Titans (GT) batter Sai Sudarshan scored 89* off 49 deliveries with the help of seven boundaries and four maximums to take his team to 200 batting first against the Royal Challengers Bengaluru (RCB) at the Narendra Modi Stadium in Ahmedabad on Monday.

In the absence of Hardik Pandya, Sudarshan has become an integral member of the GT batting unit whom the management banks upon. The 22-year-old batter plays domestic cricket for Tamil Nadu and has featured in 22 IPL matches so far. He averages 42 with the bat at a strike rate of 133.7, and has smashed five half-centuries in the tournament, with the help of 82 boundaries and 20 maximums.

Also Read: Glenn Maxwell ends indefinite break from IPL, returns to RCB playing XI against GT

He debuted for India during the national team’s tour of South Africa late last year. Sudarshan played all three One Day Internationals (ODIs), scoring 127 runs at an average of 63.5, striking at 89.4. He brought up a couple of half-centuries and showed incredible adaptability to the hostile batting conditions in the home of the Proteas.

Sudharshan has even played in 17 first-class matches for Tamil Nadu. He has scored 1118 runs at an average of 38.55, with a strike rate of 54.36. Impressively, the southpaw has notched four half-centuries and three tons. In 28 List A games, Sudarshan aggregates 1396 runs with an average oif 60.69 and strike rate touching 96.

Sudarshan caught the attention of the IPL fraternity when he played a breath-taking knock of 96 runs in the final of the 2023 edition of the tournament. He tore apart the Chennai Super Kings (CSK) bowling unit with the help of eight boundaries and six maximums to bat at a strike rate of 205 and get GT to 214 in the first innings of the grand finale.

Interestingly, the left-handed batter even underwent a county stint for Surrey last year, and is hovering around the Indian international team setup after strong outings in domestic cricket lately.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

The Nifty crossed 22,600 on both Thursday and Friday, but failed to sustain above that level. In fact, it even closed below 22,500 after Friday’s decline.

Yet another truncated week beckons us. But that doesn’t mean it is any devoid of action. The swift recovery witnessed by the Nifty through all of last week took a pause on Friday as the resistance at higher levels translated into selling pressure for the index. The Nifty snapped a five-day winning streak on Friday.

For the better part of last week, the Nifty found hurdles near the 22,500 mark. When it did cross that level on Thursday, it found a barrier at the 22,600 mark for the remaining two days of the week. The Nifty crossed 22,600 on both Thursday and Friday, but failed to sustain above that level. In fact, it even closed below 22,500 after Friday’s decline.

Global cues remain edgy. After the sell-off on Thursday, the benchmark indices recovered on Friday led by a rally in tech stocks. However, all eyes will be on the US Fed meet later this week on April 30 and May 1. While a rate cut is all but ruled out in this policy, the street will be keenly awaiting clarity from Fed Chair Jerome Powell as to whether the Fed will cut rates this year and if so than how many times and if not, then when does the rate cutting cycle begin? Plenty of questions to answer.

Back home, the market is making one thing pretty clear; Good earnings, positive management commentary are getting disproportionately rewarded as was witnessed in the case of Tech Mahindra on Friday. On the flip side, stocks with the slightest error are getting hammered, regardless of their market capitalisation. Bajaj Finance turned out to be a case in point on Friday, shedding nearly 8% on Friday post results.

Saturday saw a slew of banking stocks report results such as ICICI Bank, Yes Bank, RBL Bank and all of them will react to these results on Monday. Also reacting to results will be stocks like L&T Finance, Sanghi Industries, and IDFC First Bank. Other Nifty components like HCLTech will also react to results on Monday.

UltraTech Cement will be the only Nifty constituent reporting earnings on Monday, while Can Fin Homes, PNB Housing, Poonawalla Fincorp, Tata Chemicals among the broader market names will also be reporting results on Monday.

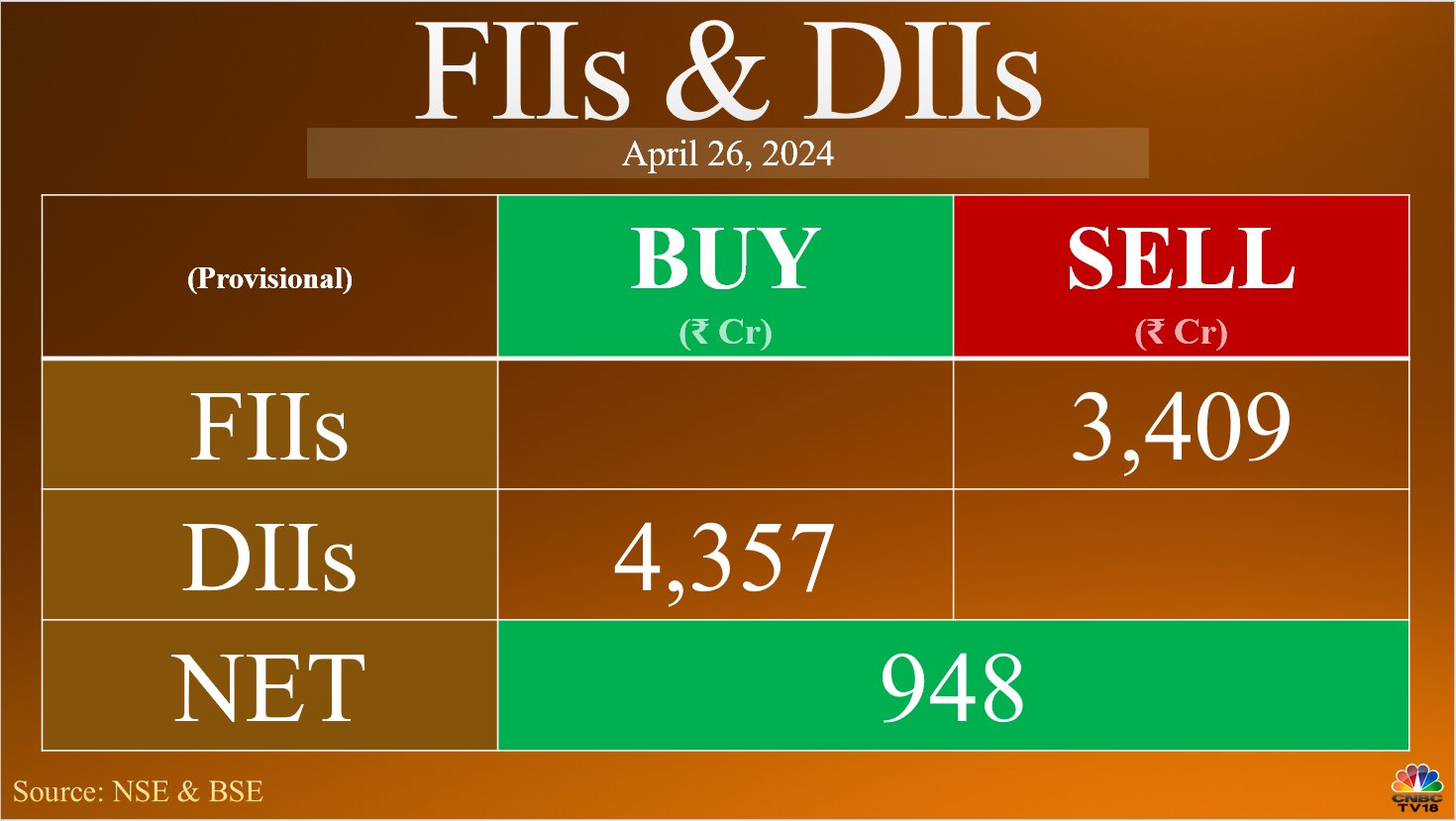

For Friday’s trading session, yet another heavy sell figure emerged from the foreign investors’ desk, while domestic institutions tried offsetting the selling, as has been the case for most of the April series.

Amol Athawale of Kotak Securities expects the correction formation on the Nifty to continue as long as the index trades below the 22,620 mark. Below that, he expects the market to fall back to its 50-Day Moving Average of 22,235 and if that level breaks too, then even 22,100 can be seen on the index. He only sees a fresh uptrend after the index sustains above the 22,620 mark, which can take it higher to levels of 22,900.

The Nifty is trading in a rising channel formation and the index has formed a support base around its 89-Day Exponential Moving Average of 21,800, said 5paisa.com’s Ruchit Jain. Immediate support is at the 40-DEMA mark of 22,240, followed by 22,000. Above levels of 22,600, the index can rally towards 22,800 or even 23,000.

Angel One’s Rajesh Bhosale is of the belief that the Nifty can see potential hurdles at higher levels due to the ‘dar cloud cover’ pattern on the daily chart. He sees resistance for the index between 22,600 – 22,800, while Thursday’s low of 22,300 will act as a key support. He advises traders to buy the dips but book profits at higher levels.

The Nifty Bank also snapped a five-day winning streak on Friday but managed to end the week higher. It also managed to sustain above the 48,000 mark. Reaction from ICICI Bank to its quarterly results, along with a long list of banking names will be a key determining factor as to where the index heads going forward.

Hrishikesh Yedve of Asit C Mehta Investment Intermediates said that it is important for the Nifty Bank to close above the mark of 48,500 for a move towards levels of 49,000 – 49,500. Short-term support for the index is at 47,000 and 46,600, while resistance is seen at 48,500.

These stocks saw addition of fresh long positions on Friday, meaning an increase in price and Open Interest:

| Stock | Price Change | OI Change |

| Hindustan Copper | 2.81% | 53.11% |

| Sun TV | 4.61% | 23.59% |

| Biocon | 5.58% | 17.61% |

| Ashok Leyland | 4.36% | 12.63% |

| Dixon Technologies | 6.21% | 12.15% |

These stocks saw addition of fresh short positions on Friday, meaning a decline in price but increase in Open Interest:

| Stock | Price Change | OI Change |

| L&T Technology Services | -9.96% | 105.77% |

| Bajaj Finance | -7.85% | 27.15% |

| Kotak Mahindra Bank | -1.67% | 8.20% |

| Bajaj Finserv | -3.93% | 7.21% |

| SBI Life Insurance | -2.12% | 5.91% |

Short covering was witnessed in these names during Friday’s trading session, meaning an increase in price but decline in Open Interest:

| Stock | Price Change | OI Change |

| Coromandel International | 7.52% | -14.50% |

| Havells India | 5.20% | -8.60% |

| Divi’s Laboratories | 4.96% | -8.10% |

| LTIMindtree | 3.03% | -6.58% |

| Tech Mahindra | 7.55% | -6.34% |

These are the stocks to watch out for ahead of Monday’s trading session:

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

The Lok Sabha elections is being conducted in seven phases. The voting for the first two phases is over. The voting percentage has been low vis-a-vis 2019 General Elections.

The Congress on Sunday, April 28, appealed to the Election Commission (EC) to increase the duration of voting due to heatwave in the ongoing Lok Sabha elections, a media report said.

News24 reported that the Telangana unit of the Congress has appealed to the EC to conduct voting from 7 am to 6 pm. This comes after the India Meteorological Department (IMD) asked people not to step out from 12 noon to 4 pm as it has issued a warning in many states.

The Lok Sabha elections are being conducted in seven phases. The voting for the first two phases is over. The voting percentage has been low vis-a-vis the 2019 General Elections. The voter turnout in the second phase was 66.7%, which was less than the figures of the 2019 parliamentary polls. In the first phase, the turnout was 65.5% as compared to 69.43% in the phase one of the 2019 parliamentary polls

The heatwave is believed to have contributed to several voters not turning up at polling stations in both phases. The polling time was extended till 6 pm in many polling stations in Banka, Madhepura, Khagaria and Munger constituencies in Bihar to give some succour to voters against the hot weather.

Special arrangements were made to combat the heat, including a provision of ‘shamiana’, drinking water, medical kits and fans for the convenience of the voters. The usual polling time is 7 am to 6 pm but it varies depending on factors such as terrain, time of sunset, and security situation.

The EC issued a heat wave advisory after the IMD said the country will likely witness a severe heatwave this summer. The IMD had appealed to people to drink and carry enough water, and wear lightweight, light-coloured, loose, porous cotton clothes. It asked people to use a damp cloth to cool down and avoid strenuous activities when temperatures are high.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

The bill granting 10% reservation for Marathas in government employment and educational institutions was unanimously approved by the Maharashtra Assembly during a special one-day session on February 20

In the heart of Maharashtra, the echoes of the Maratha reservation debate reverberate loudly, with Marathwada emerging as a focal point of agitation.

In 2023, the houses of legislators were burnt and vandalized by angry Maratha protesters. Even though the Maharashtra government says that it has given reservation to the Marathas, the issue of Maratha reservation is still resounding.

Also Read | Lok Sabha Elections 2024: Maratha reservation to farmer suicides, key political issues in Maharashtra

The bill granting 10% reservation for Marathas in government employment and educational institutions was unanimously approved by the Maharashtra Assembly during a special one-day session on February 20. Subsequently, the Maharashtra Legislative Council also endorsed the bill.

However, some of the Maratha organisations later claimed that this might not stand judicial scrutiny as the overall quota in the state now exceeds the 50% limit.

According to reports, OBCs constitute 34% of the total population of Maharashtra, while the Marathas account for 28%.

Marathas are 28% of the voters in the state. In the 2019 Lok Sabha elections, the Bharatiya Janata Party (BJP) emerged victorious in 23 out of the 48 seats in Maharashtra, with its erstwhile ally Shiv Sena securing victories in 18 constituencies. The Nationalist Congress Party (NCP), led by Sharad Pawar, secured four seats, while the Congress and AIMIM each claimed one seat. An Independent candidate clinched the remaining seat.

Also Read | Explained: PM Modi’s ‘wealth distribution’ remarks–Part of Congress Manifesto? Or an election manifestation

Earlier, activist Manoj Jarange Patil demanded that an entire Maratha community be provided a quota under the OBC category by identifying them as ‘Kunbi’ — which is an agrarian community that falls in the OBC category. However, Chhagan Bhujbal, a prominent OBC leader, has opposed the demand.

Also Read | BJP spent more than ₹103 crore on ads since May 2018, maximum expenditure on videos

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

The Met office had said 10-20 days of heatwave are expected against a normal of four to eight in the entire April-June period.

The India Meteorological Department (IMD) on Sunday, April 28, said heat wave to severe heat wave conditions are likely to continue over East and south Peninsular India for the next five days.

The IMD said rainfall and thunderstorms are likely over Western Himalayan Region and adjoining plains of Northwest India till April 29. Heavy rainfall very likely over Northeast India till April 30 and it is likely to intensify thereafter.

Amid the prevailing but weakening El Nino conditions, the IMD had earlier warned of extreme heat during the April-June period when around a billion people are expected to exercise their franchise during the seven-phase Lok Sabha elections, heightening concerns about vulnerability to heat waves. The voting for the first two phases is over.

The Met office had said 10-20 days of heatwave are expected against a normal of four to eight in the entire April-June period.

The areas and regions predicted to witness a higher number of heatwave days are Madhya Pradesh, Gujarat, Odisha, Andhra Pradesh, Madhya Maharashtra, Vidarbha, Marathwada, Bihar and Jharkhand. Some places may record more than 20 heatwave days. The intense heat could strain power grids and result in water shortages in parts of India.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Maxwell had earlier opted out of the RCB playing XI amidst a poor run of form for the team and also to focus on his mental health.

Glenn Maxwell has returned from his indefinite break from the Indian Premier League (IPL) as the Australian all-rounder is back into the Royal Challengers Bengaluru (RCB) playing XI for their fixture against the Gujarat Titans (GT) at the Narendra Modi Stadium in Ahmedabad. Maxwell had earlier opted out of the RCB playing XI amidst a poor run of form for the team and also to focus on his mental health.

“The wicket will be better later, so we will like to chase. With so many high scores the nature of this game has changed, our bowlers have been exceptional in the last two games. We have scored big with the bat, those are the changes. Maxwell comes back in, we have some firepower in the middle-order,” RCB captain Glenn Maxwell said at the toss, as the visitors chose to bowl first in this afternoon game.

Maxwell has returned with disappointing figures for the franchise in IPL 2024. He played six matches this season for RCB, aggregating merely 34 runs, out of which 28 came ina single game. He averaged merely 5.33 with a strike rate of 94.12 and could hit only three fours and a solitary six. His performances were slightly better with the ball though, securing four dismissals at an economy of 8.44 and a bowling strike rate touching 13.

RCB managed to bag only their second win of the competition when they beat Sunrisers Hyderabad (SRH) at the Rajiv Gandhi International Stadium earlier this week. They are looking to further boost their prospects by roping in experience and dynamism into their batting unit, getting Maxwell back into the scheme of things, hoping that the batter delivers when needed with a recharged mental framework.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

As a coach Gary Kirsten guided India to win the ICC Men’s ODI World Cup in 2011. Kirsten also has experience of coaching in India’s T20 league, the IPL.

The Pakistan Cricket Board (PCB) on Sunday appointed World Cup-winning Gary Kirsten as their head coach for ODIs and T20Is, while former Australian pacer Jason Gillespie will take over that role in Test cricket.

Along with them, former Pakistan all-rounder Azhar Mahmood was appointed as the assistant coach of the team across the formats.

“The appointment of (Gary) Kirsten and (Jason) Gillispie who are high-profile coaches shows how much value is given to the Pakistan cricket team and how much potential foreign coaches see in our players,” PCB chief Mohsin Naqvi said during a media conference.

“We want to give the team the best facilities and that is why we have gone for Kirsten and Gillispie,” he added.

Kirsten is expected to take over from Pakistan’s tour of England from May 22 which will feature four T20Is and from there the team will travel for the T20 World Cup in June.

Pakistan have been on the search for a full-time head coach since the end of the 50-over World Cup last year where they failed to enter the knockout stages.

After their shambolic effort in the marquee event held in India, Pakistan had sacked the entire set of coaching staff – head coach Grant Bradburn, team director Mickey Arthur, bowling coach Morne Morkel and batting coach Andrew Puttick.

Premier batter Babar Azam was also removed from captaincy post the ICC showpiece with Pakistan opting to appoint pacer Shaheen Shah Afridi as their white-ball leader and Shan Masood doing that duty in Tests.

Along with that, Pakistan had also turned to former cricket Muhammad Hafeez for the guiding role during their tour to Australia.

But Hafeez lost the job after Pakistan lost 0-3 in the Test series and 1-4 in the T20Is.

While Masood was retained as captain, Afridi was relieved from leadership and Babar was reinstated in the last week of March.

However, Pakistan could not find a full-time head coach despite them approaching some top names such Matthew Hayden and Shane Watson.

Eventually, they have been zeroed in on Kirsten, who had led India to World Cup triumph in 2011, and Gillespie, who comes with bagful of coaching experience with English county side Sussex.

Naqvi explained the rationale behind choosing foreign names for coaching role.

“We have maintained a balance for this. There’s a lot of talent in our country. But we’re not that far ahead in medical sciences which is why there are some fitness issues in our team.

“So, closing our options to get the best options from outside our country may not get us the best results for us,” said Naqvi. PTI Corr UNG AT AT

.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

With a promising start in 2024, the Sikkim Tourism Department is projecting a potential milestone of 1.2 million tourist arrivals by the year-end if the current growth rate persists.

Parts of Northeast India have been embroiled in violence for a while now, with the situation escalating in May 2023 following ethnic violence in the state of Manipur. Despite instability in the scenic region, the state of Sikkim has witnessed record footfalls, thanks to the culture, weather and scenic locales of the hilly areas. In the first quarter of 2024, Sikkim experienced an unprecedented surge in tourist arrivals, according to official data from the Tourism and Civil Aviation Department.

Until March 31, 2024, Sikkim welcomed a staggering 2,90,401 tourists, including 2,56,537 domestic visitors and 30,864 foreigners. This surge in arrivals has been attributed to the recovery made in Sikkim’s hospitality sector, which suffered greatly due to the devastating flash floods in October 2023.

The calamity claimed dozens of 40 lives, leading to a significant decline in tourist arrivals. However, early trends emerging in 2024 suggest that Sikkim would regain its status as a premier tourist destination, reports suggest.

Also read: 12 destinations you must visit in Northeast India for a cool summer vacation

However, the economic impact of tourism on the state is significant, with the industry estimated to have generated over Rs 500 crore in revenue prior to the COVID-19 pandemic, the Sikkim Tourism Department website. As tourist numbers continue to rise, this figure is expected to witness a sizeable increase, providing a much-needed boost to the local economy.

There are 1,725 travel agencies catering to tourists looking to visit the state, with a total of 38,208 beds to accommodate the influx of travellers.

Also read: Planning a monsoon holiday in Kullu, Kedarnath, Sikkim or Mumbai? Read this first

According to Tourism Sikkim data, ther has been a consistent upward trend in tourist arrivals over the past decade. Starting from 576,749 visitors in 2013, the numbers surged to a peak of 1,625,573 in 2023. With a promising start in 2024, projections indicate a potential milestone of 1.2 million tourists by year-end if the current growth rate persists.

(With inputs from agencies)

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

RCB vs GT LIVE Score: Follow the live scores and updates from IPL 2024 match between RCB and GT being played at the Narendra Modi Stadium, Ahmedabad.

Gujarat Titans posted 200 for 3 in their Indian Premier League match against Royal Challengers Bengaluru at the Narendra Modi Stadium today.

Sai Sudharsan (84 not out) and M Shahrukh Khan (58) struck fifties to take GT to the 200-run mark after being invited to bat.

For RCB, Swapnil Singh, Mohammed Siraj and Glenn Maxwell took a wicket apiece.

Brief Scores: Gujarat Titans: 200 for 3 in 20 overs (Sai Sudharsan 84 not out, M Shahrukh Khan 58; Swapnil Singh 1/23).

Earlier, Royal Challengers Bengaluru captain Faf du Plessis won the toss and elected to bowl.

RCB brought Glenn Maxwell back to their eleven.

Two weeks ago, the Australian all-rounder had decided to take a “mental and physical” break from the IPL after going through a modest run in the tournament.

GT retained their eleven from the last match.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Indian tech brand BOULT aims to hit ₹1,000 crore revenue before going public, focusing on offline expansion, new categories, and international markets while prioritizing its “Make in India” approach.

Indian consumer tech brand BOULT plans to go public next year, with a revenue benchmark of ₹1,000 crore this fiscal, as it expands into international markets and new categories, according to its co-founder Varun Gupta. Gupta spoke in detail about his vision to make the Indian company global, listing out the homegrown brand, and his ambitious targets for this fiscal year.

”We are not focusing on IPO this year, our primary focus is to foray into offline markets, international geographies, and new categories, but possibly in the next year,” he said. The young entrepreneur said the company has set an internal touchstone for itself before it goes public.

”… We have an internal benchmark, when we hit a ₹1,000 crore revenue, that’s when we want to go for an IPO. Technically, we’re eligible to go for an IPO today because we’re profitable and comfortably over ₹500 crore. But we have an internal milestone of ₹1,000 crore, and that is when we will consider ourselves eligible for that (IPO),” Gupta said. He further said the bootstrapped brand expects to close the financial year 2023-24 at a touchdown of ₹650-700 crore.

”In FY25, we’re looking at a ₹1,000 crore target, a very reasonable target because of our foray into new categories, because of our growing presence in our TWS (True Wireless Stereo), which is the biggest category for us. And thirdly, getting offline as a channel and thereby international channels,” he said. The homegrown company, which has peers like boAt and Noise, expanded its reach to offline retail stores around October last year.

Also read: BOULT forays into smart home audio with the launch of new BassBox SoundBars

The idea is to be accessible and available at 20,000 points of sale within the country for the customers to get access, availability, and credibility, Gupta said, because when a customer sees the product in an offline store he gets a lot of credibility. ”We’re proud of the fact that we have penetrated every state in India, we are live at over 4,000 points of sale.” Marking its debut globally, Boult tapped into the US and UK markets in May 2023, and in January 2024, it set foot in Nepal. It received great responses from all the geographies, the young entrepreneur said.

”Right from the beginning, our vision was to make in India, for the world. We wanted to make a global brand out of India, to change the worldwide narrative of India by creating a top technology brand, and to make the nation proud. The plan forward is to foray into Europe, Australia, and thereafter Africa as well,” he said. The company plans to launch in Europe by July 2024, in Australia post-Diwali, and Africa within the first half of 2025.

Emphasising the brand’s focus on Make in India, Gupta said ”99% of the products that we sell in India are manufactured and assembled in India.” He said Boult is unlike other Indian players, who pick up products from OEMs (original equipment manufacturers), label them, and sell them in India. ”That’s not what we believe in. That’s not in our DNA … We are the only firm that does 100 per cent in-house product designing. I am an artist myself, and so I work with the design team. I work on the colour, material, finish, overall presentation of the product, and ergonomics, everything is done in-house. That’s why when you look at our products, you’ll see a huge amount of differentiation and uniqueness,” he said. Boult currently has a manufacturing facility in Delhi and is setting up another in Gurgaon.

The company has roped in actor Saif Ali Khan and cricketer Suryakumar Yadav as brand ambassadors, however, it doesn’t believe in spending a fortune on marketing. ”We don’t have heavy pockets or deep investment money to splurge money into marketing because we’re a bootstrapped firm. For us, the product is the hero. The product is something that creates an impact. ”We’ve maintained a certain price point and immensely greater product quality than our competition. That is our core, and the reason why we have over 2 million ratings, and the highest repeat purchases in the category,” Gupta said.

Talking about Boult’s biggest competitors, Gupta said they are more of a mass brand. ”We have positioned ourselves as a mass tech or a mass premium brand. Our price points are on average about 10 per cent higher. We don’t want to get into a race for market share and thereby keep on dropping prices and cutting corners in terms of the product and customer experience.

The founder acknowledged boAt as Boult’s biggest competitor. In the smartwatch segment, he named Noise, Firebolt, and boAt. ”International competitors are not really a phenomenon. In 2024, along with my competition, I’m proud of the fact that we’ve together taken about 80 per cent of the market,” he said.

Also read: BOULT Z40 Ultra Review: Good sound quality, better price

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Daily Newsletter

Daily Newsletter

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -72.15 |

| sensex | ₹1,882.60 | +28.30 |

| nifty IT | ₹2,206.80 | +30.85 |

| nifty bank | ₹1,318.95 | -14.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| index | Price | Change |

|---|---|---|

| nifty 50 | ₹16,986.00 | -7.15 |

| sensex | ₹1,882.60 | +8.30 |

| nifty IT | ₹2,206.80 | +3.85 |

| nifty bank | ₹1,318.95 | -1.95 |

| Company | Price | Chng | %Chng |

|---|---|---|---|

| Dollar-Rupee | 73.3500 | 0.0000 | 0.00 |

| Euro-Rupee | 89.0980 | 0.0100 | 0.01 |

| Pound-Rupee | 103.6360 | -0.0750 | -0.07 |

| Rupee-100 Yen | 0.6734 | -0.0003 | -0.05 |

Answer Anonymously