Trade Setup for April 29: Nifty sets its eyes on the Fed for further direction as earnings remain mixed

Summary

The Nifty crossed 22,600 on both Thursday and Friday, but failed to sustain above that level. In fact, it even closed below 22,500 after Friday’s decline.

Yet another truncated week beckons us. But that doesn’t mean it is any devoid of action. The swift recovery witnessed by the Nifty through all of last week took a pause on Friday as the resistance at higher levels translated into selling pressure for the index. The Nifty snapped a five-day winning streak on Friday.

For the better part of last week, the Nifty found hurdles near the 22,500 mark. When it did cross that level on Thursday, it found a barrier at the 22,600 mark for the remaining two days of the week. The Nifty crossed 22,600 on both Thursday and Friday, but failed to sustain above that level. In fact, it even closed below 22,500 after Friday’s decline.

Global cues remain edgy. After the sell-off on Thursday, the benchmark indices recovered on Friday led by a rally in tech stocks. However, all eyes will be on the US Fed meet later this week on April 30 and May 1. While a rate cut is all but ruled out in this policy, the street will be keenly awaiting clarity from Fed Chair Jerome Powell as to whether the Fed will cut rates this year and if so than how many times and if not, then when does the rate cutting cycle begin? Plenty of questions to answer.

Back home, the market is making one thing pretty clear; Good earnings, positive management commentary are getting disproportionately rewarded as was witnessed in the case of Tech Mahindra on Friday. On the flip side, stocks with the slightest error are getting hammered, regardless of their market capitalisation. Bajaj Finance turned out to be a case in point on Friday, shedding nearly 8% on Friday post results.

Saturday saw a slew of banking stocks report results such as ICICI Bank, Yes Bank, RBL Bank and all of them will react to these results on Monday. Also reacting to results will be stocks like L&T Finance, Sanghi Industries, and IDFC First Bank. Other Nifty components like HCLTech will also react to results on Monday.

UltraTech Cement will be the only Nifty constituent reporting earnings on Monday, while Can Fin Homes, PNB Housing, Poonawalla Fincorp, Tata Chemicals among the broader market names will also be reporting results on Monday.

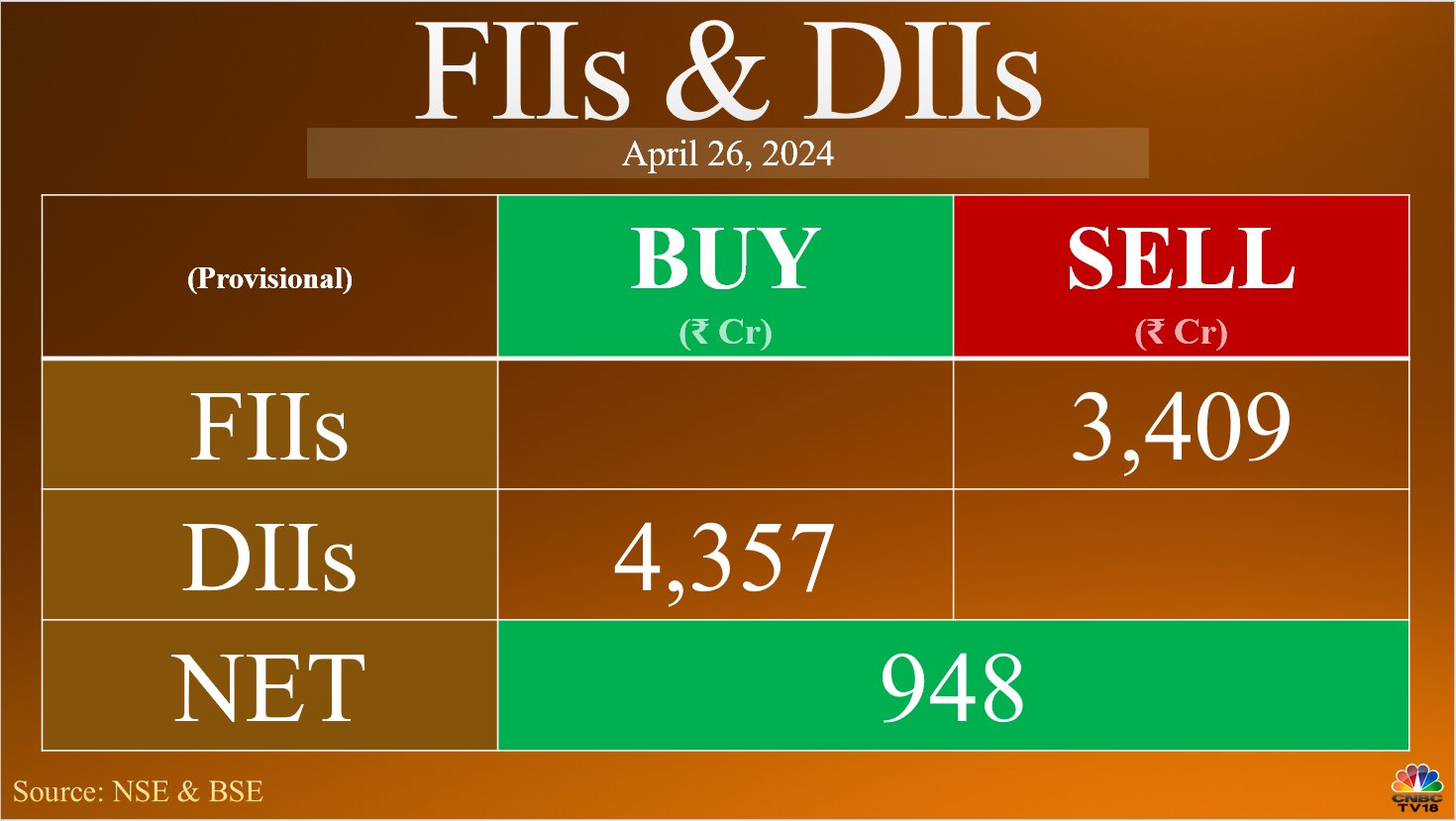

For Friday’s trading session, yet another heavy sell figure emerged from the foreign investors’ desk, while domestic institutions tried offsetting the selling, as has been the case for most of the April series.

Amol Athawale of Kotak Securities expects the correction formation on the Nifty to continue as long as the index trades below the 22,620 mark. Below that, he expects the market to fall back to its 50-Day Moving Average of 22,235 and if that level breaks too, then even 22,100 can be seen on the index. He only sees a fresh uptrend after the index sustains above the 22,620 mark, which can take it higher to levels of 22,900.

The Nifty is trading in a rising channel formation and the index has formed a support base around its 89-Day Exponential Moving Average of 21,800, said 5paisa.com’s Ruchit Jain. Immediate support is at the 40-DEMA mark of 22,240, followed by 22,000. Above levels of 22,600, the index can rally towards 22,800 or even 23,000.

Angel One’s Rajesh Bhosale is of the belief that the Nifty can see potential hurdles at higher levels due to the ‘dar cloud cover’ pattern on the daily chart. He sees resistance for the index between 22,600 – 22,800, while Thursday’s low of 22,300 will act as a key support. He advises traders to buy the dips but book profits at higher levels.

The Nifty Bank also snapped a five-day winning streak on Friday but managed to end the week higher. It also managed to sustain above the 48,000 mark. Reaction from ICICI Bank to its quarterly results, along with a long list of banking names will be a key determining factor as to where the index heads going forward.

Hrishikesh Yedve of Asit C Mehta Investment Intermediates said that it is important for the Nifty Bank to close above the mark of 48,500 for a move towards levels of 49,000 – 49,500. Short-term support for the index is at 47,000 and 46,600, while resistance is seen at 48,500.

What Are The F&O Cues Indicating?

Nifty 50’s May futures shed 9.2% or 10.48 lakh shares in Open Interest on Friday. They are now trading at a premium of 136.05 points from 83.6 points earlier. On the other hand, Nifty Bank’s Mayu futures shed 6.1% or 1.13 lakh shares in Open Interest on Friday. Nifty 50’s Put-Call Ratio is at 0.96 from 1.3 earlier.

Vodafone Idea is the only stock that remains in the F&O ban.

Nifty 50 on the Call side for May 2 expiry:

For this week’s weekly expiry, the Nifty 50 Call strikes between 22,500 and 22,700 have seen Open Interest addition.

| Strike | OI Change | Premium |

| 22,500 | 24.13 Lakh Added | 125.75 |

| 22,700 | 21.98 Lakh Added | 47.75 |

| 22,600 | 20.29 Lakh Added | 80.85 |

Nifty 50 on the Put side for May 2 expiry:

On the Put side, while the 22,200 and 22,350 strike saw Open Interest addition, the 22,600 strike has seen shedding in Open Interest for this Thursday’s expiry.

| Strike | OI Change | Premium |

| 22,200 | 13.14 Lakh Added | 39.5 |

| 22,350 | 5.1 Lakh Added | 74.8 |

| 22,600 | 5.82 Lakh Shed | 186.45 |

These stocks saw addition of fresh long positions on Friday, meaning an increase in price and Open Interest:

| Stock | Price Change | OI Change |

| Hindustan Copper | 2.81% | 53.11% |

| Sun TV | 4.61% | 23.59% |

| Biocon | 5.58% | 17.61% |

| Ashok Leyland | 4.36% | 12.63% |

| Dixon Technologies | 6.21% | 12.15% |

These stocks saw addition of fresh short positions on Friday, meaning a decline in price but increase in Open Interest:

| Stock | Price Change | OI Change |

| L&T Technology Services | -9.96% | 105.77% |

| Bajaj Finance | -7.85% | 27.15% |

| Kotak Mahindra Bank | -1.67% | 8.20% |

| Bajaj Finserv | -3.93% | 7.21% |

| SBI Life Insurance | -2.12% | 5.91% |

Short covering was witnessed in these names during Friday’s trading session, meaning an increase in price but decline in Open Interest:

| Stock | Price Change | OI Change |

| Coromandel International | 7.52% | -14.50% |

| Havells India | 5.20% | -8.60% |

| Divi’s Laboratories | 4.96% | -8.10% |

| LTIMindtree | 3.03% | -6.58% |

| Tech Mahindra | 7.55% | -6.34% |

These are the stocks to watch out for ahead of Monday’s trading session:

- ICICI Bank: Net profit at ₹10,757.5 crore compared to a CNBC-TV18 poll of ₹10,323.3 crore. Net Interest Income of ₹19,092.8 crore is also higher than the poll estimate of ₹18,982.3 crore. Gross NPA at 2.16% from 2.3% in December. Net NPA at 0.42% from 0.44% last year. Slippages at ₹5,139 crore from ₹5,714 crore sequentially. Net Interest Margin flat quarter-on-quarter but down 50 basis points year-on-year. Management said that there are ongoing discussions with the RBI with regards to IT infra and they get feedback from time-to-time. The management also expects NIMs to remain rangebound till there is a change in repo rates.

- ICICI Bank: The bank has said that it has received an email from the NCLT that certain shareholders have e-filed an application before court with regards to the ICICI Securities delisting. The bank will make an appropriate representation.

- Maruti Suzuki: Net profit at ₹3,877.8 crore, lower than the poll of ₹4,104 crore. Margin misses estimates by 120 basis points to 12.2%. Year-on-year, margin improved by 170 basis points. Also declared a dividend of ₹125 per share. Profit growth of 47.8% from last year but kept in check due to higher tax expenses.

- HCLTech: FY25 revenue growth guidance seen at 3-5% year-on-year, lower than CNBC-TV18’s poll of 5% – 7% growth. Constant currency revenue growth of 0.3% versus 6% in December and lower than poll of 0.4%. EBIT margin of 17.6% also lower than estimate of 18.3%. Management said that the growth guidance issued by the company is back-ended. Subdued guidance due to one large project moving offshore which will impact Q1 performance and an additional headwind of 80 basis points in Q2 due to statestreet BPO JV exit.

- IDFC First Bank: Aiming for 1.4% to 1.5% RoA in the next 2-3 years. Q1 profit to be flat sequentially, will improve post that. Q4 should be the best profitable quarter of FY25, according to the management. FY25 loan growth seen between 22% and 23%, while deposit growth seen between 28% and 30%. Credit costs will be upfronted in H1FY25. Net profit and Net Interest Income in the fourth quarter were slightly lower than the CNBC-TV18 poll. Gross NPA at 1.88% from 2.04% last quarter, Net NPA at 0.6% from 0.68% in December.

- Yes Bank: Tax write-back of ₹20.3 crore, first in three years. Lower overall provisions despite sequential rise in slippages. Write-offs at a 12-quarter high. Annualised credit cost is also at a four-quarter high. NIMs at 2.4% is a nine-quarter low. Gross NPA at 1.7% from 2% in December. Net NPA at 0.6% from 0.9% in December.

- RBL Bank: Operating profit growth year-on-year is the highest in 21 quarters. Gross NPA and Net NPA is the lowest in 13 quarters. Credit-deposit ratio is the lowest in six quarters. RoA and RoE are the highest in 19 quarters. Net Interest Income met expectations, while net profit was marginally higher. Slippages at ₹680 crore from ₹666 crore. Write-offs at ₹721 crore from ₹356 crore.

- L&T Finance: Net Interest Income of ₹1,909 crore below Equirus estimates of ₹1,955.2 crore. Net profit of ₹554 crore also below estimates of ₹661.6 crore. Disbursements up 24.8% year-on-year and 3.4% sequentially to ₹15,366 crore. AUM growth of 5.7% from last year to ₹85,564 crore. Gross NPA at 2.84% from 2.95%, Net NPA at 0.62% from 0.64%.

- Aditya Birla Sun Life AMC: Quarterly Average AUM up 6.5% sequentially to ₹3.32 lakh crore. Revenue up 7% sequentially to ₹366 crore. Net profit flat but was above expectations.

- SBI Life Insurance: Net profit up 4.4% to ₹811 crore. Annual Premium Equivalent up 17.1% to ₹5,330 crore. Value of New Business up 4.9% to ₹1,510 crore. VNB margin at 28.3% from 31.7%.

- VST Industries: Net profit up 28.4% to ₹88.2 crore. Revenue up 22.4% at ₹375.1 crore. EBITDA up 17.8% to ₹96.6 crore. EBITDA margin at 25.6% from 27.2%. Dividend of ₹150 per share.

- Apollo Hospitals: Apollo HealthCo to raise ₹2,475 crore or $300 million from Private Equity Firm Advent. To also merge Keimed, promoter-owned pharma wholesale distribution business over the next 24-30 months. The merger will be EPS accretive from year 1. Deal will involve Keimed buying out multiple JV partners. Growth capital for Apollo HealthCo worth ₹860 crore. Debt worth ₹890 crore out of ₹1,290 crore will also be retired. Aspire to have ₹25,000 crore in revenue and 7-8% margin in three years.

- SBI Card & Payment Services: Revolver rate improves for the first time in two years. Credit card business momentum has been weak with corporate spends declining 55% sequentially. Net Interest Margin at the lowest in four years. Annualised credit cost remains elevated at a nine-quarter high of 7.6%. Cards receivables at ₹50,846 crore, up 25% year-on-year. Gross NPA at 2.76% from 2.64%, while Net NPA at 0.99% from 0.96%.

- Sanghi Industries: Net loss of ₹19 crore from loss of ₹105 crore last year. Revenue up 26% to ₹285 crore from ₹226 crore last year. EBITDA of ₹58.6 crore from EBITDA loss of ₹13 crore. EBITDA margin at 21%.

- IRCON International: Gets order worth ₹1,198.09 crore from East Coast Railway.

- Ajanta Pharma: To consider buyback of equity shares at its board meet on May 2.

- Patanjali Foods: Gets a proposal to buy the non-food operations from Patanjali Ayurved.

- IREDA: Gets “Navratna” status from the Department of Public Enterprises.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter