Google has a new site for tracking your investments

Summary

The new version replaces an aging portal that looked outdated but still provided valuable information.

Google Finance got a complete redesign on Tuesday.

The new version replaces an aging portal that looked outdated but still provided valuable information. The new Google Finance is smarter and takes advantage of your search history. For example, since Google knows what you’re looking up, it automatically pulls in ticker symbols for companies you’ve read about and can recommend others to follow.

It’s rolling out to users now, so some people will have to wait a day or two for the new version hits their browsers.

Here’s a look at the new Google Finance.

The new homepage

This is the new Google Finance homepage. It shows information on stocks or companies that you’ve recently searched. In this case, we looked up Nvidia and Netflix. At the bottom, Google recommends stocks. The right of the screen gives a snapshot of U.S. and global markets.

Your Stocks

This is your stocks page, where you can follow specific companies. Think of this as the portfolio section from the old Google Finance. You’ll get a snapshot of stocks you own or want to track. However, you can’t create different portfolios, which was a unique feature in the old version.

Local Markets

This is your stocks page, where you can follow specific companies. Think of this as the portfolio section from the old Google Finance. You’ll get a snapshot of stocks you own or want to track. However, you can’t create different portfolios, which was a unique feature in the old version.

Local Markets

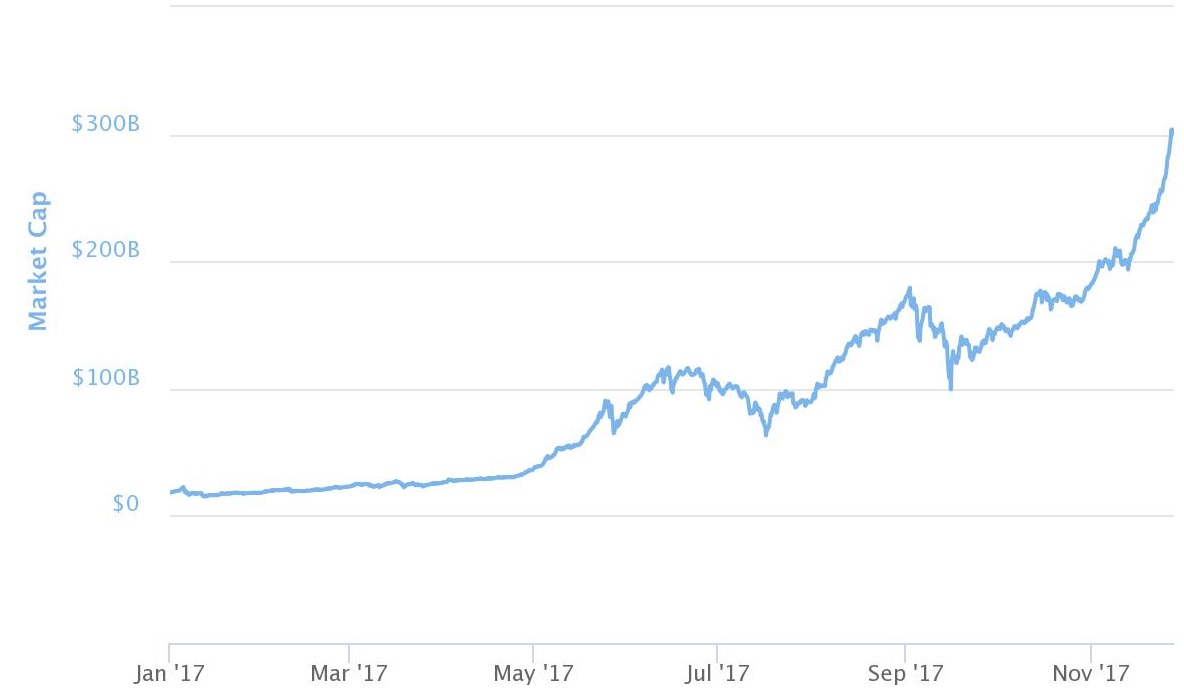

This is the new local markets page. It shows the Dow Jones Industrial Average, the S&P 500 Index and the Nasdaq Composite in the U.S., with charts and performance for each market. The chart can be updated to reflect changes over the past month, three months, one year, five years or from the beginning of trading. The bottom of the page shows local market news.

World Markets

This is the world markets tab. It looks just like global markets. Here we see a snapshot of the Dow, the German DAX Performance Index and a look at the performance of the finance. There are also news feeds if you scroll down.

News

Here’s a look at the news feeds. The topics consist of information relevant to the tab you’ve selected. Here you will see the top stories on the homepage that are related to what you have searched. Also note that since the news is further down the page, there’s additional information on global exchanges and currency exchange rates.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter