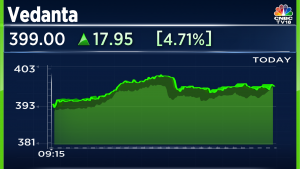

Vedanta Dividend: Board meet on May 16 to consider first payout for FY25, fund raising plans

Summary

The mining conglomerate had paid total dividends worth ₹37,573 crore in financial year 2023.

Anil Agarwal-led mining conglomerate Vedanta Ltd. on Monday (May 13) said it will convene a board meeting on May 16 to consider the first interim dividend for financial year 2025.

Additionally, the board will also deliberate on various fundraising strategies, including the issuance of equity shares or other convertible securities, according to a stock exchange filing.

The fund raising proposals will not be limited to public offers, rights issues, ADRs, GDRs, QIPs, preferential issue or any other method permissible.

Record date for the first interim dividend, if any, has been fixed as May 25, 2024.

Also Read: Cochin Shipyard clinches order worth ₹500-1,000 crore from European client

However, any decision in this regard will be subject to regulatory and statutory approvals, including the consent of the shareholders obtained through a general meeting.

The mining conglomerate had paid total dividends worth ₹37,573 crore in financial year 2023. The previous two instances has seen the company pay dividends worth ₹11 per share and ₹18.5 per share.

Recently, Vedanta’s subsidiary Hindustan Zinc had announced its first interim dividend of ₹10 per share for financial year 2025. Vedanta, with its 64.92% stake in the company received a total payout of ₹2,743 crore.

In an analyst meet held in February this year, Vedanta had guided for reducing debt by $3 billion by financial year 2027. The management had said that this will be done without adding any further incremental debt to the books of the Indian listed entity.

The street has raised concerns over Vedanta’s possibilities to fund its debt repayments due this year and the next. Earlier this year, Vedanta Resources, the parent entity, had received consent from bondholders to restructure four series of bonds, two of which were due in 2024 itself.

Shares of Vedanta Ltd ended at ₹413.95, up by ₹3.20, or 0.78% on the BSE.

Also Read: Hero MotoCorp becomes first Indian automaker to join ONDC network

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter