Storyboard18 | Summer advertising heats up as temperatures soar

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

Summer category brands have already mounted big-scale campaigns across media platforms and properties such as the Indian Premier League (IPL).

After a tepid 2021 and 2020 owing to covid-19 led disruption, summer category brand campaigns are back with a bang this year. From colas, coolers/air conditioners to travel companies, brands are leaving no stones unturned to lure customers to buy their products.

In a conversation with Storyboard18, Navin Khemka, CEO South Asia at MediaCom says that it is the first time in the last three years that we are having a normal Q2, a normal summer quarter.

“The last two quarters were badly affected by covid-19 which also impacted media spends in a big way across categories. Therefore, a lot of the growth of media spends this year will be dependent on this quarter and if it continues to go the way it is going right now then the real growth in the adex will return in 2022,” he adds.

Big spends

As per the GroupM TYNY 2022 report, ad spends are estimated to reach Rs 107,987 crore in 2022 in India registering an estimated growth of 22 percent for the calendar year 2022.

“Quarter two will account for 26-27 percent of overall adex. The big change we have seen in the last two years is that we are seeing all summer category brands are back with a huge activity be it soft drinks, hospitality, travel and consumer durables. Of course, the new age brands continue to aid this category further,” Khemka adds.

Summer category brands have already mounted big-scale campaigns across media platforms and flagship properties such as the Indian Premier League (IPL).

Campaign galore

Parle Agro said that it’s the first time we have four high-octane campaigns being rolled out which also taps into IPL media property and premiere of movies. The company’s fruit-based beverage brands Frooti, Appy Fizz and B Fizz and flavoured milk brand, Smoodh will be spearheading our summer campaigns this season.

“Capitalising on the high reach and visibility of big-ticket events, our brand communication will also be promoted across mass pillars like entertainment and sports. Out-of-home mobility resuming to pre-covid levels has given a massive boost to out-of-home consumption. We have implemented a high impact and innovative OOH strategy with eye-catchy hoardings at places of commute and points of purchase,” tells Nadia Chauhan, joint managing director and CMO, Parle Agro.

When compared to last year, this season comes with much-awaited optimism with markets opening up to nearly 100 percent and brands are geared up to capitalize on this opportunity that this season offers.

Travel and tourism ads are also gaining visibility. Online booking platform RedBus, for instance, brought Pushpa famed actor Allu Arjun to spearhead its summer campaign across TV, cinema, digital, social media and OOH platforms.

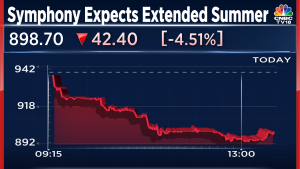

Symphony Ltd has launched a new campaign to promote its newest air cooler offerings. Electronics firm Voltas Ltd, for instance, has already rolled out its summer campaign in March which will be promoted through June. The company has invested in omnichannel platforms such as digital, electronic, and print to communicate and engage with consumers.

“Additionally, our association with IPL for the past decade has consistently given us incremental gains, as it reaches out to multiple consumer segments and provides wide reach and scale. And this year we will continue to leverage this opportunity,” says Deba Ghoshal, Vice President and Head of Marketing, Voltas Ltd.

Ice-creams, another key summer category, is also back as more ad campaigns by brands gain momentum with soaring temperatures. Havmor Ice Cream is advertising during the IPL with Disney + Hotstar as the lead on OTT in addition to the other OTT platforms. The company has introduced bite-sized ice creams called Shotties and a premium range of TUBS in various flavours.

“Our TV spending has gone up by 2X ensuring we have a prolonged presence during the summer months. In addition, we continue to build on our IP, The Coolest Summer job which will be in its 5th edition and will start accepting entries from 22 April,” notes Vincent Noronha, vice-president, marketing, Havmor Ice Cream.

IMD’s prognosis of a hot summer, high vaccination coverage and low caseload might turn out to be the right mix for brands to redeem themselves this summer season.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter