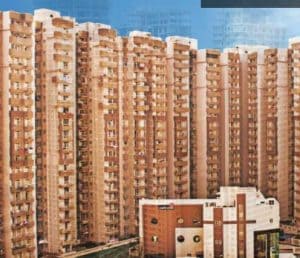

Supertech to raise Rs 1,600 crore by July to complete ongoing housing projects in NCR

Summary

The company has signed a term sheet with investors to raise this interim funding for 18 ongoing housing projects comprising around 50,000 apartments.

Realty firm Supertech Ltd plans to raise around Rs 1,600 crore from institutional investors by July to complete its 18 ongoing housing projects across Delhi-NCR, its Chairman RK Arora said.

The company has signed a term sheet with investors to raise this interim funding, and due diligence is currently undergoing, Arora said, but did not share the name of the investors.

“We recently got a nod from the Supreme Court to arrange for interim funding to complete ongoing projects and hand over the flats to existing customers.

“We plan to raise around Rs 1,600 crore fund. Hopefully, we will be able to raise this amount by the end of July,” he told PTI.

Arora said there are 18 ongoing housing projects under Supertech Ltd, comprising around 50,000 apartments.

“We need to give possession of 17,000 flats to our existing customers. We intend to hand over these flats over the next two years,” he said.

Further, he said that the company needs Rs 3,000 crore to complete the pending work in these ongoing 18 projects.

”We have receivables of around Rs 2,500 crore from customers against the sold units. Moreover, we have unsold units worth Rs 10,000 crore in these projects,” he said.

Asked about bank loans and dues of development authorities, Arora said it would be around Rs 3,000 crore.

”This proposed interim funding will be utilised for construction. The collections from sold units and units to be sold will be used to clear outstanding amounts of existing banks and NBFCs, new investors, and authorities,” he noted.

Arora said these projects are net worth positive and therefore the company would be able to complete them with the help of fresh funding and receivables from customers.

In March last year, the Delhi bench of the National Company Law Tribunal (NCLT) had ordered to initiate the insolvency proceedings against Supertech Ltd over a petition filed by the Union Bank of India for non-payment of dues of around Rs 432 crore.

However, this was challenged by Supertech promoter Arora before the NCLAT.

In June last year, the National Company Law Appellate Tribunal (NCLAT), however, ordered starting of insolvency proceedings in only one of the housing projects of Supertech Ltd and not the entire company.

The NCLAT had directed the constitution of the Committee of Creditors for the Eco Village II project located in Greater Noida (West).

”We, however, make it clear that other projects apart from the Eco Village II project shall proceed as ongoing project basis under the overall supervision of the IRP (Interim Resolution Professional),” the NCLAT bench had said.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter