Inflation may worsen to surpass 8% within 6 months: Nomura

Summary

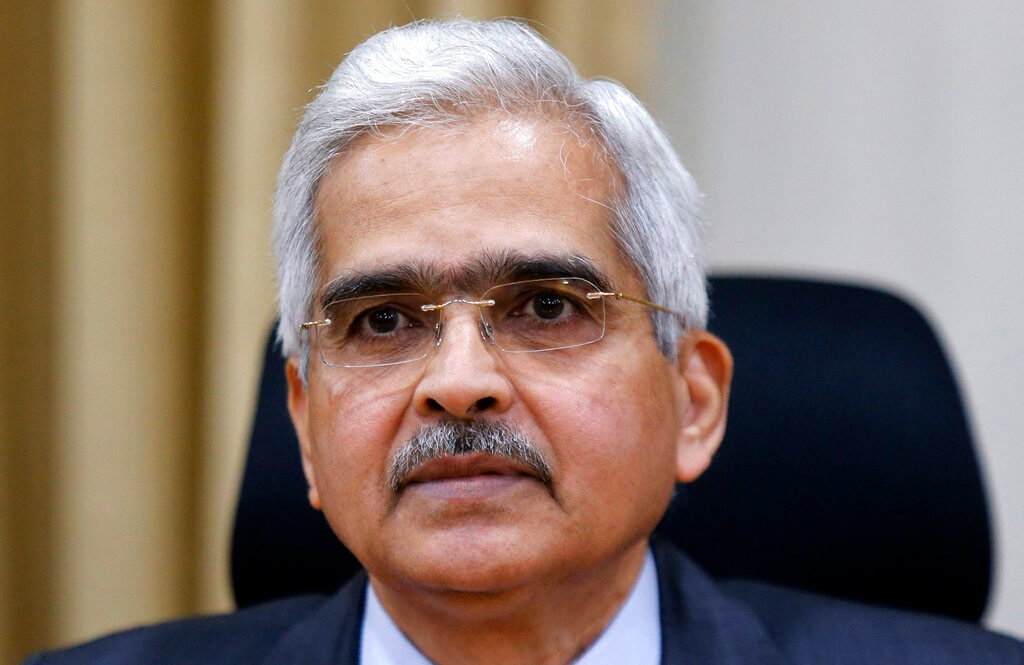

In an interview with CNBC-TV18, Sonal Varma, Managing Director and Chief Economist-India and Asia ex-Japan, Nomura Financial Advisory & Securities, and Suyash Choudhary, Head-Fixed Income, IDFC MF shed light on what to expect on inflation and rate hikes from the RBI.

Central banks around the globe are focused on removing the pandemic era low rates and excess liquidity. The Monetary Policy Committee’s minutes of the meetings that came yesterday also focused on getting rid of the accommodative stance of the RBI and taming inflation.

To understand what to expect on rate hikes and inflation, CNBC-TV18 caught up with Sonal Varma, Managing Director and Chief Economist-India and Asia ex-Japan, Nomura Financial Advisory & Securities, and Suyash Choudhary, Head-Fixed Income, IDFC MF.

Varma is of the view that inflation has not yet peaked and can go above 8 percent within the next six months. For FY23, she expects the headline inflation to be at 7.23 percent. She stressed the need for policymakers to focus on underlying inflation, which is running above 6 percent.

Also Read: RBI opted for off-cycle rate hike to avoid tougher action in June MPC meeting: Shaktikanta Das

“The demand and supply-side pressures are still rising. So we do not think inflation has peaked. It potentially goes close to 8 percent, even perhaps slightly above 8 percent within the next six months. On average, though, which is more important than a particular monthly print, for FY23 we are looking at about 7.2 percent on the headline, inflation. So momentum is still rising and risks to inflation are still to the upside,” she said.

Varma doesn’t believe that RBI wants a repo rate at pre-Covid levels. She said, “The minutes clearly emphasize the need to frontload the rate action and get back to the pre-pandemic level, which is 5.15. So we are building in 50 basis point hike in June, followed by a 35 in August.”

Meanwhile, Choudhary begs to differ with Varma on this. He feels the RBI intends to bring back the repo rate to pre-pandemic levels. He explained that the repo rate cycle will peak off at 5.5 percent. He pointed out that while the repo rate is rising, 5-year G-Sec is stuck.

“They (RBI) want to get to a certain level of neutral policy rates fairly quickly. It looks like they are broadly placing that at the pre-pandemic repo rate of 5.15 percent. So probably over June and August with a small chance that entirely June they want to get there,” Choudhary said.

He expects government bond yields to stabilise in the coming months. “We do expect over the next one year, maybe not in the next six months government bond yields may probably stabilise, corporate bond spreads could somewhat widen,” said Choudhary.

For the entire discussion, watch the accompanying video

Catch the latest stock market updates with CNBCTV18.com’s blog

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter