Startup Digest: Zomato posts ₹138 crore Q3 profit, SoftBank posts first profit in five quarters and more

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

Here are the top headlines from the startup space.

RBI on Paytm crackdown: Supervisory action, restrictions proportionate to gravity of situation

The Reserve Bank has said the action against Paytm was taken due to the fintech firm’s ‘persisted non-compliance’ with regulatory norms.

When CNBC-TV18 asked if the central bank would consider extending the February 29 deadline when Paytm Payments Bank will not be able to accept deposits or top-ups in any customer account, prepaid instruments, wallets, and FASTags, RBI deputy governor Swaminathan J said, the action on the fintech is a supervisory one on a regulated entity over persistent non-compliance.

Swaminathan J clarified that such actions are preceded by months or years of bilateral engagement and that regulated entities (in this case Paytm Payments Bank) are provided adequate time to take corrective action so as to protect consumers and financial stability of the system.

Zomato Q3 Results: Third straight quarterly profit

Food delivery aggregator Zomato has reported a net profit for the third straight quarter. Zomato reported a consolidated net profit of ₹138 crore for the October to December period. During the same quarter last year, the company had reported a net loss of ₹347 crore.

Revenue for the quarter on a consolidated basis grew by 79% year-on-year to ₹3,288 crore, compared to ₹1,948 crore.

The company also said that it is on track to meet its guidance of adjusted EBITDA break-even for Blinkit on or before the June quarter of financial year 2025. Blinkit’s Gross Order Value doubled from last year, rising 103% to ₹664 crore. Even on a sequential basis, GOV increased by 28%. Losses for the business also declined.

Attentive raises $7 million from Vertex Ventures Southeast Asia and India

Attentive, an AI-based SaaS startup, has bagged $7 million in its Series A funding round led by Vertex Ventures Southeast Asia and India, with participation from existing investors Peak XV Partners and InfoEdge Ventures.

Tenacity Ventures will also come onboard the cap table through a secondary investment, the firm said.

The startup intends to use the fresh capital to enhance product development, sales, marketing, and customer success initiatives, focusing on its recently launched products, Accelerate and Beam AI.

Upekkha invests $ 4.3 million across 37 startups in 2023, plans to fund 70 startups in 2024

Upekkha, an early-stage SaaS fund and accelerator, has announced today that it funded 37 companies in 2023, deploying a total of $4.3 million. The firm is looking to invest in 70 startups in 2024.

Some of the firm’s portfolio companies include Enthu AI, Medpiper, Toothlens, Kommunicate, InsightGig among others.

“We are witnessing a remarkable surge in the Indian SaaS landscape, driven by advancements in AI. The investment is of $125k in each startup under SAFE guidelines,” added Prasanna Krishnamoorthy, Managing Partner at Upekkha.

Upliance AI raises ₹34 crore in funding from Khosla Ventures

upliance.ai, an AI-powered home appliance company has raised a seed funding round at ₹34 crores at a valuation of ₹143 crores from Khosla Ventures.

With the fresh funds, upliance.ai said it aims to grow its revenue to ₹150 crores in 2024 and to scale production to 20,000 units per annum in the next 6 months.

The funds will also be used to accelerate product expansion by investing in tooling and advanced manufacturing techniques, building the team, and collaborating with content creators for marketing.

Algorithmic Biologics secures $2.5 million in Pre-Series A Funding

Deeptech startup Algorithmic Biologics has secured $2.5 million in Pre-Series A funding round led by Bharat innovation Fund with participation from existing investor Axilor Ventures.

According to the startup, proceeds of the fundraise will be used to support the product pipeline, building the sales organization and furthering their international expansion.

“Tapestry is providing affordable genomics sequencing for all, in collaboration with leading genomics labs,” said Dr Manoj Gopalkrishnan, founder and CEO of Algorithmic Biologics.

Neodocs raises $2 million in seed round for smartphone-based diagnostics

Affordable smartphone-based test kits Neodocs has raised $2 million in a funding round led by Omidyar Network India.

Other investors include YCombinator, 9Unicorns, Gemba Capital, Titan Capital, and angels such as Prashant Tandon and Gaurav Agarwal (1Mg), Rohit MA (Cloudnine), Kunal Shah (Cred), Varun Alagh (Mamaearth), Viren Shetty (Narayana Healthcare), Harshad Reddy (Apollo Hospitals) and Vivek Gambhir (Boat).

Neodocs plans to expand its footprint in international markets, including Europe, Australia, the Middle East, and the Americas. The company is also working on rolling out ‘instant’ finger-prick blood tests that will give results on the phone by just clicking a picture, a statement said.

Ivory gets $500,000 from Capital A

Ivory, an age-tech startup specializing in brain health, has raised $500,000 in a funding round led by early-stage VC fund – Capital A.

TDV Partners (Ujwal Sutaria) and several notable angel investors including Abhishek Kabra (MD, Samara Capital), Tushar Vashisht (Co-Founder and CEO, HealthifyMe), Abhishek Ganguly (Co-Founder and CEO, Agilitas Sports) and Rajeev Singh (VP, SAP India) also participated in the round.

The startup caters to individuals aged 55 and above, including retirees, with a focus on maintaining and enhancing mental and cognitive abilities. The firm will use funds to expand its reach to over 15 million elderly Indians at risk of dementia.

redBus joins ONDC as an independent mobility app

redBus, an online bus ticketing platform, has joined Open Network for Digital Commerce (ONDC) and is offering multi-modal transport booking services on its platform in various cities.

By integrating with ONDC Network, redBus said it now offering metro ticket booking facilities in Kochi and Chennai. The firm has also unveiled auto rickshaw booking in Bengaluru, Delhi, Chennai, and Hyderabad.

The firm plans to expand this service to other cities in the future in collaboration with local apps.

GLOBAL TECHNOLOGY AND STARTUP NEWS

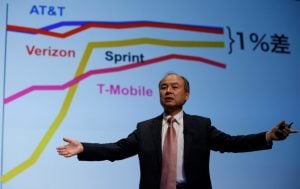

SoftBank posts first profit in five quarters with $6.6 billion net income

Japan’s SoftBank Group, has returned to profit for the first time in five quarters, as the Japanese tech investment firm was buoyed by an upturn in portfolio companies, sparking hope it was emerging from a period of retrenchment.

Net profit totalled 985.5 billion yen ($6.6 billion) in the three months to December, versus a 744.7 billion yen loss in the same period a year earlier.

Founded by Chief Executive Masayoshi Son, SoftBank and its Vision Fund investment arm have gone through a difficult period of slashing investment activity and selling assets. Stakes in high-growth startups were particularly hit as risk appetite waned during the pandemic and its aftermath.

Disney to take $1.5 billion stake in Epic Games

Walt Disney CEO Bob Iger announced Disney would acquire a $1.5 billion minority equity stake in Fortnite’s publisher Epic Games in an interview with CNBC.

The investment is aimed at letting consumers interact with stories and characters from Disney, Marvel, Pixar and Star Wars, on Epic’s Fortnite, where 100 million players gather each month.

“In terms of their total media screen time on video games, it was stunning to me – equal to what they spend on TV and movies,” Iger said during a call with analysts and investors after reporting quarterly results. “And the conclusion I reached was we have to be there. And we have to be there as soon as we possibly can in a very compelling way.”

AI startup founded by ex-OpenAI engineer raises $21 million

Daedalus, an artificial intelligence (AI) startup founded by a former OpenAI engineer Jonas Schneider said it had raised $21 million from investors including NGP Capital, Addition and Khosla Ventures as it looks to expand its production in Germany.

Its software, based on AI models such as OpenAI’s ChatGPT, helps in the manufacturing of any bespoke precision part used by companies in sectors ranging from semiconductors to defence with minimal human intervention.

Daedalus is using an AI platform to automate its entire manufacturing process, from quoting to delivery, for high-precision and high-mix parts.

Nvidia’s stock market value on verge of overtaking Amazon

Wall Street’s enthusiasm about artificial intelligence has Nvidia on the verge of becoming more valuable than Amazon for the first time in two decades, and the AI chipmaker is not far behind Google-owner Alphabet.

A 40% surge in Nvidia so far in 2024 has elevated its market capitalization to $1.715 trillion as of mid-day trading on Wednesday, only about 3% below Amazon’s $1.767 trillion value, and less than 6% below Alphabet’s $1.812 trillion value, according to LSEG data.

After Nvidia’s stock more than tripled in 2023, it has already become the US stock market’s fifth most valuable company.

Apple defeats lawsuit claiming it overpaid CEO Tim Cook, others

A federal judge has dismissed a lawsuit accusing Apple of overpaying Chief Executive Tim Cook and other top executives by tens of millions of dollars by miscalculating the value of performance-based stock awards.

US District Judge Jennifer Rochon in Manhattan said the iPhone maker described its pay methods in detailed compensation tables in its 2023 proxy statement, “precisely” as securities laws and US Securities and Exchange Commission rules require.

Rochon also found no proof that Apple’s board of directors acted improperly in awarding pay, and said the plaintiff, a pension fund affiliated with the International Brotherhood of Teamsters, did not give the board enough time to consider its objections before suing.

Spain’s high court suspends $209 million fines on Apple, Amazon amid appeal

Spain’s high court suspended 194 million euros ($209 million) in fines imposed on Amazon and Apple by the local antitrust watchdog in July, pending an appeal by the tech giants, an Amazon spokesperson told Reuters.

CNMC, as the watchdog is known, fined Amazon and Apple for colluding to prevent dealers other than Amazon from selling Apple wares on Amazon’s websites in Spain.

Apple was fined 143.6 million euros and Amazon 50.5 million euros and both companies at the time said they would appeal.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter