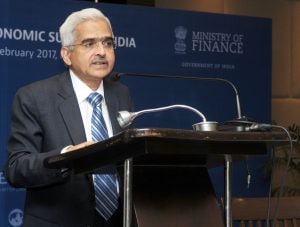

RBI governor Shaktikanta Das vows to uphold central bank’s autonomy: Here is what experts have to say

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

The government on Tuesday appointed former finance secretary and current member of the finance commission Shaktikanta Das as the 25th governor of the Reserve Bank of India (RBI). Das was named the new governor of RBI after Urjit Patel abruptly resigned amid a face-off with the government over issues related to governance and autonomy of the central bank. …

Continue reading “RBI governor Shaktikanta Das vows to uphold central bank’s autonomy: Here is what experts have to say”

The government on Tuesday appointed former finance secretary and current member of the finance commission Shaktikanta Das as the 25th governor of the Reserve Bank of India (RBI).

Das was named the new governor of RBI after Urjit Patel abruptly resigned amid a face-off with the government over issues related to governance and autonomy of the central bank.

In his first remarks after taking charge as the RBI governor, Shaktikanta Das on Wednesday promised to uphold central bank’s autonomy, credibility, and values of the “great institution” and take every stakeholder, including the government, along in a consultative manner.

Addressing media hours after assuming the charge, Das said, “I will work as a team with other officials in RBI in the best interest of the economy and try and take measures in a timely manner on issues, on aspects which the economy requires or which are in the best interest of the Indian economy.”

CNBC-TV18 caught up with Ashima goyal, member, PMEAC; R Gandhi, former deputy governor RBI; Pratip Chaudhuri, former CMD, SBI; Arvind Virmani former CEA; Ananth Narayan professor, SPJIMR; Jayesh Mehta of Bank of America; Lakshmi Iyer of Kotak Mahindra Asset Management Company and Janmejaya Sinha, chairman, Boston Consulting group, India, to understand the challenges that the new governor faces.

What is your expectation from hereon as far as the new governor is concerned?

Chaudhuri: He has to give some signals and most importantly he has to convey a message that he is open to listening. He is sensitive to the feelings and the situation in the market. Right now, the difficulty is that RBI is perceived as absolutely sphinx like. What is more important is he gives out a desire that we are here to listen and which is not such a bad thing. The details should follow later

Do you believe that there needs to be some discretion as far as the prompt corrective action (PCA) framework is concerned? While that may not necessarily mean that lending by these banks will start from tomorrow but do you believe that this is a point that requires some redressal by the RBI?

Chaudhuri: Yes, RBI has to be less dogmatic. Why must they keep the benchmark so high, they can keep the benchmark at a level equivalent to Basel. They have kept an additional 1 percent capital requirement which, of course, at this time is not very useful.

Of course, RBI is right in pursuing and pressurising the government to release the capital because the centre is also committed to releasing the capital. Now if you have to release it in December, why do it on 31st, why don’t you do it on 15th itself? So, the capital release should also be accelerated. If more banks come out of PCA by whatever way, by additional capital or by relaxing the norms, then it will lead to greater supply in the market.

I was just in a meeting with one of the NBFCs and they were saying that we do not have difficulty but the banks are charging 3 percent more and they are not releasing even the sanctioned limits. The limit is something which is always said that it goes with the market condition, so if the banks think that there is not enough liquidity they can always find a reason not to release the money. So, it is more of psychological and that has to be alleviated by RBI itself.

On the liquidity issue, what is it that you would like the RBI to do? As you said this is perhaps much more of a psychological problem that is causing this kind of a liquidity constraint in the market than perhaps a real problem. So, how would you like the RBI to address it?

Chaudhuri: It is very simple, cut the CRR (cash reserve ratio) by 2 percent and that releases about Rs 2 lakh crore into the economy. CRR in terms of economic value is zero. How does it help the GDP? Today, with oil prices being so benign and inflation I do not think is a problem because 2.5 or 3 percent is the retail inflation and it is much below even the 4.5 percent RBI mark.

You won’t release the CRR when the inflation is high and when the inflation is low then also you will not release, then how is the CRR a flexible instrument? Secondly, we have had 12 percent CRR and 37 percent SLR, what did it led the country to? In 1992, when CRR was relaxed the country had taken off. So, accelerate the process.

What would be your expectation in this first meeting with public sector banks, what should be high on the priority list?

Chaudhuri: We are making this distinction which is not necessary. Why do you meet public sector separately and private sector separately. The role for a bank or the expectation for a bank is the same. So why do you make a distinction like this. Secondly, if you lower the threshold or if you lower the shareholding from 51 to 26 or wherever, I think there would be a flight of deposits.

In fact, today, the problem public sector banks are facing that they don’t have deposits. Even if you see Kotak Mahindra Bank and the Yes Bank are paying 6 percent in saving bank deposits, whereas no public sector banks pays more than 3.5 or 4. So that advantage will go and not only capital they would also be constrained of this deposits, resources.

The RBI governor starting off saying that he intends to follow a much more consultative approach when it comes to policy making, what is the first reaction on the back of what you have heard?

Mehta: Overall bond market has reacted already. So, people not really waiting for the speech today. We have seen that the bonds have reacted almost by 10 basis points between yesterday (Tuesday) and today (Wednesday). I think this will enhance the bond market conviction that the yield is going down. People may just wait for December 14 board meeting outcome and it would consolidate. Of course, at every level you will have profit booking coming in.

What would be the expectation now from the board meeting on December 14? Ahead of that there is a meeting with public sector bankers that he intends to have tomorrow. He said it is not on any specific agenda but really to get a sense of what they make of things like capital adequacy and the economy. What would the bond markets expectations be from December 14 meeting when it comes to contentious specific issues that we have discussed Ad nauseam?

Mehta: That is what people would be little bit cautious that nothing dramatically changes on the December 14 board meeting. As one of the reporters had asked, is there a plan to change the format of the functioning of the board and stuff like that, if nothing dramatically changes or unless globally things change dramatically – oil at $60 per barrel, inflation at sub 4 percent, the market would really start looking for a rate cut.

Is that now being built in as a realistic expectation?

Mehta: Till now people were actually looking at may be no rate cut or a rate hike. The market normally runs ahead, so the market is kind of pricing something but it is still not fully priced in yet.

Your first takeaway then from what you heard from the new governor?

Virmani: When he came on, we were talking about stakeholder consultation and that is kind of the first thing he repeated so that is what I expected. What he also made clear, which come from him is that the first part of that would be the banks – the public sector banks.

Now clearly that is driven by 2-3 considerations. One is the whole issue of the PCA framework, the second is the capital adequacy of the banks and what people have been saying that they don’t have enough capital and therefore they will be constrained in their lending etc… so clearly that is the priority to make sure that kind of externals or consensus or whatever you want me to call it are not gumming up the flow of credit to the economy and then of course within that context and maybe partly related to it the whole liquidity issue.

So, that is kind of what one would have expected and certainly one would support that. Whether you take his word about being independent or not at face value clearly the way to go about it is to get all the views and then make a decision.

This point about accountability and this has been the view within government as well that while we respect the independence and the autonomy of the RBI at the end the sovereign is held accountable and hence it must have a stake and say in policy making even when it comes to the Reserve Bank of India?

Virmani: Let me start with the board question which is kind of linked to it. I don’t think there will be any big issues discussed of that grand scale of accountability and autonomy. I think there are two things one I am not sure whether he will announce that committee which has already been agreed before he meets the board or may meet but the real purpose of the interaction with the board will to get a sense of what the various members have already been saying to the earlier governor.

That would be really his priorities. It is easy to make a list of items they may have discussed but what he will try to do is just to get a sense of what other issues on the minds of these board members and how they have kind of responded to the various issues raised. So, I think that from his perspective is the purpose of that meeting.

Accelerate the process of cutting the CRR by 2 percent, this was the suggestion that was been spoken of ahead of the monetary policy committee meeting and when this question was asked of for the former governor Urjit Patel he said that there is no need to use the CRR as an instrument at this point in time, your thoughts on this?

Virmani: My understanding is that CRR is now included in the law so going below 3 percent requires changing the law. From 4 to 3 percent there is a 1 percent margin. But I want to come back to an issue which Janmejaya Sinha mentioned. The point I have been making since the start of this discussion is that there is difference between ideology and principles. Ideology is arbitrary, it is something I have in mind, I will do it no matter what happens. What Sinha has very correctly pointed out, you have to look at what is effect of specific things or specific actions, specific non actions on what will happen wherever you are.

Whether you are concerned about inflation, you are concerned about economy, or you are concerned about the motives of the lenders etc… you have to look at what will actually happen rather than have some construct ideological which determines everything. So, that is one point.

The second point is principles can be applied flexibly. I have never said that don’t go by principle. Let me tell you one principle of central bank intervention it is that you never focus on or support or oppose individual banks or individual players in the market. You look at the principle you do overall in the market.

The third one there is always an issue of phasing. I have been a policy advise and policy making for quarter century and the basic principle one learnt that you must have your objective clear but always be flexible in the timing and phasing. That depends on the real world what is happening. Things change if there is a sudden crisis somewhere you don’t keep insisting that I must do it today so from this perspective.

I am sure that Shaktikanta Das who has dealt with many different issues not necessarily that he is an initiator or he is a big policy reformer, but I think this basic principle he understands and he will do well on this aspect.

The new governor has very categorically said that he intends to follow a consultative process, he will consult with all stake holders and that process will start tomorrow with a meeting with public sector banks. In your assessment do you believe that it would be the right thing to do for the RBI to provide any relaxation for the PCA framework for the 11 banks that find themselves under that because that has been the view publicly expressed by the government and the RBI has a different point of view. Given the state of the economy, as well as the state of these 11 banks, what would you believe is the best way forward?

Gandhi: Firstly, he has said that consideration he will hold with all stakeholders and to being with meet with PBB chiefs tomorrow and he is also comfortable meeting with media. That is clear from this meeting today.

About the PCA framework, as of now it indicates at what point in time a bank may be brought under the framework. A clear transparent terms have been indicated. What as of now is not clear to all the people is that at what point in time a PCA bank may be coming out of the framework.

Right now, it is under the full discretion of the RBI. That is where I would feel that if there is clarity brought on what particular benchmark the banks can be out of the PCA or a modified PCA, I think that is what they should be thinking about.

But that decision you believe is best left with the RBI?

Gandhi: Yes, because that will give clarity to the PCA banks and the government and others that on what parameters the banks could be coming back to normalcy in terms of their credit growth and other conditions which have been put on. What kind of relaxation will be possible and at what point in time.

The question that was asked to Das was whether the RBI would be inclined to any growth stimulating measures at this point in time and we were discussing the possibility of rate cut some of the guest suggested that could be on the anvil and will at least some quarters of the market seem to suggest so. But given the fact, we are at three quarter low when it comes growth do you believe growth stimulating measures are required at this point in time?

Gandhi: Growth stimulation will not be the primary objective of the RBI because statutorily its primary duty is towards inflation targeting.

But the reason I ask you that is because the governor himself pointed it out that under the RBI Act growth is also responsibility as far as the RBI is concerned. His words were I am not bringing in anything extraneous, so what do you take away from that?

Gandhi: Primarily, the RBI has to be fully convinced about inflation as per its own target and once it is within its targeted 4 percentage point then any measure it will take will be towards supporting growth. So that is the sequence of the objective/priorities the RBI will have. Once they have complete comfort, the MPC have comfort that inflation is not fully tamed then the attention will be on growth supporting measures.

The new RBI governor addressing the media for the very first time said that he intends to follow much more consultative approach, also making it clear that there has to be accountability for the RBI – your first comments?

Sinha: The former governor had been a former finance secretary, he said my view is influenced by the chair I sit on because I see different vistas from different chairs.

I find that every governor when they come to the RBI, they sit in the RBI chair they see the vista from RBI, if they are in Delhi, they sit on a Delhi chair and they see the vista from Delhi.

So I would not be surprised that we should not be in a hurry to prejudge anyone when they are sitting in these institutions, they tend to actually take on lot of the institutions narrative.

So you are saying he is going to be converted into an RBI man and not necessarily continue from where he left off at North Block?

Sinha: I don’t know what an RBI man is but certainly he will have the views of the governor’s office than of a finance secretary.

But just on those contentious issues which have been publicly discussed so there is no secret there what would your expectation be on how he treads these troubled waters and address some of those contentious issues because the government has made its point of view very clear when it comes to liquidity, when it comes to bringing some of these banks out of the PCA mechanism, when it comes to capital reserves. The RBI under Urjit Patel had a certain point view. Given the fact that his entry into the RBI happens in a fairly unprecedented situation, what would be your expectation on how he treads these vexed issues?

Sinha: Despite what has been reported in the media, the issues are not quite as contentious as they are made out to be and sometimes the rules and interpretation of the rules provides a lot of latitude and discretion. So the PCA framework, as Mr Gandhi was talking before that there is discretion and it can be used.

Looking at quality of the different banks and where they are in their recovery. Issues around the interpretation of the PCA rules is open. Liquidity is an RBI issue and it will not allow liquidity to dry up. There maybe a little bit of worry about NBFCs and whenever there are market hiccups like IL&FS etc… the market tends to tighten and when the market tends to tighten for the NBFCs the ALM becomes tighter and they make less money.

But if start to become seriously affected if the real estate market tanks or something, I am sure the RBI will be quick off the block because then it causes systemic problem. I think that is an RBI problem more than a government’s. The RBI would not like to see that happen.

Let me start by asking you about the PCA framework because as you pointed out Gandhi also believes that a clearer roadmap should perhaps be articulated by the Reserve Bank and you also believe that there should be discretion exercise there given the performance of these 11 banks and many of them may defer in the degrees of their performance so do you believe that at this point in time there could be a possibility of relaxation for some of these banks who may have shown some degree of turnaround?

Sinha: The way I look at it is what has happened currently is that banks were finding it easier to go into the market, to go in to CPs (commercial papers), because it was easier, it was not going through the entire loan process.

Then the NBFCs were intermediating for the banks and the banks were happy with that because they were not getting under the scrutiny of any bad loans. But because the NBFCs have tightened up, because the CP market tightened up there is this general sense around what is going to happen with the CPs.

Even if the PCA framework was relaxed I am not sure that these banks will be suddenly lending that much. We have to be able to go to the real. What will actually happen, do you think if we took out all these 11 banks from the PCA framework suddenly lending would increase.

I didn’t see increase in lending before they were in the PCA framework because when they were carrying the bad loans that they are and the kind of capitalisation that they need this has actually in some way the NBFCs took out the flak and they did more efficiently.

So, we need to just recognise that some of these things become a bigger issue and then people take positions and that always is a problem. So I think some patience would be a good thing, but I don’t know any of these are magic wand which will make for a rapid change. The big issue that we have got is the large pack of bad loan and those bad loans have been there for a long time and those projects are in deep trouble so till some of those start getting resolve the economy doesn’t flow that well, the velocity of changes is low.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter