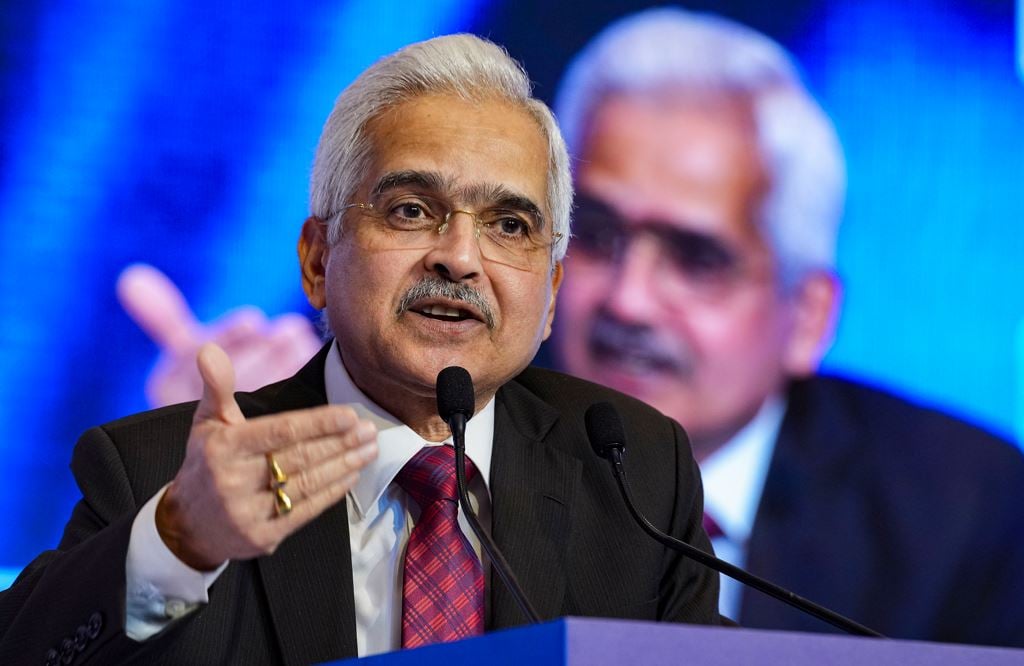

Digital lending rules have increased investor confidence in Fintechs: RBI Governor Shaktikanta Das

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

Speaking at the Mint BFSI conclave in Mumbai on Thursday morning, the RBI Governor noted that the digital lending rules as well as the follow-on guidelines on first loss default guarantee (FLDG) had instilled more confidence in investors about the prospects of the industry.

The Reserve Bank of India (RBI) Governor Shaktikanta Das said that contrary to the criticism that digital lending guidelines would stifle the growth of the fintech industry, data unambiguously shows that private investors’ confidence in the fintech industry has only increased since the implementation of the rules.

Speaking at the Mint BFSI conclave in Mumbai on Thursday morning, the RBI Governor noted that the digital lending rules as well as the follow-on guidelines on first loss default guarantee (FLDG) had instilled more confidence in investors about the prospects of the industry.

Digital lending, a sector that witnessed exponential growth post-pandemic, has been a focal point of regulatory attention, he said. The introduction of digital lending guidelines and (FLDG) rules aimed at balancing growth with regulatory oversight has not only averted crises but also bolstered investor confidence in India’s digital lending story.

“When we issued digital lending guidelines, people asked if we will stifle growth in fintech sector…Data shows unambiguously that confidence of private investors in the fintech sector has now gone up as a result… I have been told by a number of serious players in fintech space that regulatory measures have given greater confidence to investors,” Das said addressing the audience at the Mint event.

He added that the regulatory guidelines on digital lending strike a well considered balance between customer protection and business conduct on the one hand and supporting innovation on the other.

RBI released the digital lending guidelines in 2022, directing regulated entities to ensure that loan servicing and repayments are executed directly in their bank account without any third party’s pass-through or pool account. They also stated that disbursements also need to be made into the borrower’s bank account, and any fees or charges payable to lending service providers should be paid directly by the regulated entity and not by the borrower, among others.

Later in 2023, RBI also limited the amount of FLDG to 5% of the outstanding amount of a particular loan portfolio, specified upfront between the RE and fintech.

Governor Das also highlighted the significant progress made by the Indian banking sector in overcoming a multitude of challenges in recent years in the course of his speech. Not too long ago, Das said, the financial sector in India grappled with high non-performing assets (NPAs), low returns, and the presence of 11 banks under Prompt Corrective Action (PCA) as of June 2018. The banking landscape faced additional stress with the ILFS crisis, and just as the sector was adjusting to these challenges, the COVID-19 pandemic struck, causing major disruptions across various industries.

Governor Das commended the combined efforts of the RBI and banks in responding to these challenges, pointing out a series of initiatives taken by the central bank in the last five years.

“While always keeping an eye on the financial stability concerns, the Reserve Bank endeavoured to ensure that the economy got back on its feet as quickly as possible and returned to a higher trajectory of growth. Our ultimate objective is the mutual coexistence of price stability, sustained growth and financial stability that works best for the Indian economy.”

These measures, combined with the proactive responses from banks themselves, have resulted in improvements in key indicators such as capital adequacy, asset quality, and profitability over the past four years, he said.

Despite the unprecedented challenges posed by recent years, Governor Das asserted that India’s banking sector has emerged stronger, crediting the collaborative efforts of various stakeholders in the system.

The RBI Governor emphasised the necessity of timely regulatory changes, noting that while the timing of such changes is crucial, essential reforms cannot be postponed. From 2019 onwards, the RBI has been diligently working on bringing about a robust regulatory architecture.

To ensure the resilience and robustness of regulated entities (REs), the RBI has implemented structural changes and the consolidation of various departments under regulatory and supervisory arms. This, according to Governor Das, has enhanced regulatory efficiency and oversight.

The Governor stressed the importance of a consultative approach, stating that he encourages bank CEOs to speak candidly about their perspectives on regulation. He highlighted the consultative nature of the RBI’s relationship with banks and NBFC management.

Governor Das concluded by emphasising that the remarkable turnaround in the banking system has been a cornerstone of India’s success story.

“I would like to say that the remarkable turnaround in the Indian banking system has been a cornerstone of India’s success story in the recent years. Today, the Indian banking system is well-placed to support India’s growth story in the years ahead.”

While acknowledging the progress made, he cautioned against complacency and reaffirmed the RBI’s commitment to ensuring the resilience and robustness of the banking sector.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter