US FDA issues 7 observations to Lupin’s Goa plant; here’re possible impacts

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

The US FDA inspected the facility from September 6 to September 18. It was a long inspection that took place for two weeks, which is a normal course of action in the case of any facility with warning letters.

Lupin is under pressure after US FDA’s seven observations for its Goa plant. There was a huge reaction in 2017 when they were issued a warning letter for this particular plant. Since then the importance of this plant has reduced, nonetheless, it is still important.

The US FDA inspected the facility from September 6 to September 18. It was a long inspection that took place for two weeks, which is a normal course of action in the case of any facility with warning letters.

The company has said that they are confident of addressing the issue but the street is deterred by the fact that they already have a warning letter on this particular plant since 2017.

However, Lupin’s stock price fell over 4 percent during the day following the issuance of the observations.

Read Here: Lupin shares slump 4% after US FDA issues 7 observations to Goa unit

Analysts say they have reduced the dependence on the facility. But the problem is, according to the analysts, that they don’t know what the observations are – they could be benign, and the company could be easily getting out of the warning conditions.

The fact is that they already have many regulatory issues outstanding. The street is fearing that these observations could be serious that the warning letter will not be lifted, and hence, the regulatory woes will continue for Lupin.

So the amount that they get from this facility might not be that much but the fact is that the overarching theme is that the regulatory issues continue.

Also Read | Lupin settles lawsuit for Glumetza drug; details here

Nithya Balasubramanian, director of Sanford Bernstein, said, “I think it is a little disappointing because we have been hearing from the company about system-wide investments that they have been making in order to improve their compliance status in the plants. However, remember that if you have a warning letter, you can still supply the existing products for which you have approvals, it is just that the new products will not get approved from those plants.”

“For Lupin, I think most of their new products, which are likely to be material in the future have been filed from their new facility in Nagpur, some of them are from the respiratory inhaler facility they have in the US. So I think from an earnings perspective, and from the perspective of them being able to launch these important new products that we see in the future, I think this particular observation has little impact on that.”

“So I would say the minimal impact on future earnings. However, I think it is just, that the overhang is likely to remain given that they are just not able to lift the warning letter status.”

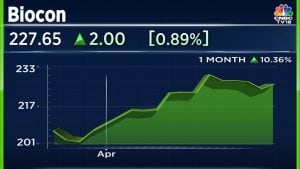

On Biocon and Serum Institute of India (SII) deal Balasubramanian said, “I think from the strategic intent perspective it makes sense. You have capabilities and large molecules, it is only natural to want to expand your target addressable market vaccines as well where the capabilities are very similar, both from a development and a manufacturing perspective.”

“Yes, I think they have also had concerns about their partner’s ability to execute and achieve the market shares anticipated with their biosimilars portfolio in the US. I think there were emerging concerns about a thinning pipeline possibly in the near term. So if you look at what they have in the pipeline. However, in normal times, the approver should have come through now. They are waiting for approvals only because FDA inspections haven’t happened right. So assuming these products do get approved in the near term, there is a fair bit of a gap in FY23-24 and 25 in terms of the biosimilars pipeline.”

“We have a couple of challenges with respect to the deal. One is, of course, the COVID vaccine opportunity. If the market is largely restricted to the booster market, we believe that will be restricted to individuals who are immunocompromised or individuals who are 65 years plus, and that kind of restricts how many products or how many doses they can sell in the second half of a FY23 and 24.”

“We think the demand will be restricted up to FY24. Beyond that the company hasn’t shared their plans on what products they have in the pipeline and what they intend to target. However, what is unclear to us right now is how between Serum Institute Life Sciences Private Limited (SILS) and Biocon Biologics Limited (BBL) how will the market demand be addressed. So, I think the lack of visibility on the commercialisation model mortality is a little bit of a concern right now.”

Watch accompanying video for more.

Also Read: Biocon-Serum Institute ties up for COVID, non-COVID vaccines

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter