SBI Life Insurance Q4 results: Net premium income rises 26%, dividend declared

Summary

SBI Life Insurance Q4 results: The solvency ratio experienced a slight dip, standing at 1.96% as opposed to 2.15% recorded in the previous year.

SBI Life Insurance on Friday (April 26) announced a net profit of ₹810 crore for the March quarter, marking a 4.4% rise from the corresponding period last year when it stood at ₹777 crore. The insurer’s net premium income surged to ₹25,116 crore compared to ₹19,896 crore in the previous year, reflecting an increase of 26%.

Similarly, the annualised premium equivalent increased by 17.1% to ₹5,330 crore from ₹4,550 crore year-on-year (YoY).

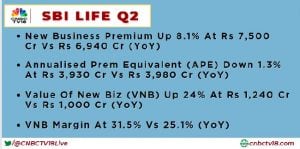

#4QWithCNBCTV18 | SBI Life reports #Q4 earnings👇

➡️Net Profit up 4.4% at ₹811 cr vs ₹777 cr (YoY)

➡️Annualised premium equivalent up 17.1% at ₹5,330 cr vs ₹4,550 cr (YoY)

➡️Value of new business up 4.9% at ₹1,510 cr vs ₹1,440 cr (YoY)

➡️VNB margin at 28.3% vs 31.7% (YoY) pic.twitter.com/JeZ5g3DTiz— CNBC-TV18 (@CNBCTV18Live) April 26, 2024

Additionally, the value of new business grew by 4.9% to ₹1,510 crore compared to ₹1,440 crore YoY, with the VNB (Value of New Business) margin standing at 28.3% versus 31.7% YoY.

However, the solvency ratio experienced a slight dip, standing at 1.96% as opposed to 2.15% recorded in the previous year.

The company’s total assets under management expanded by 27% to reach ₹3.89 lakh crore as of March 31, 2024, compared to ₹3.07 lakh crore as of March 31, 2023.

The debt-equity mix remained at 64:36, with over 95% of debt investments allocated to AAA and sovereign instruments.

In a move to reward its shareholders, SBI Life Insurance declared a dividend of ₹2.7 per share.

The company’s stock closed at ₹1,418.90 apiece on the BSE, registering a decline of nearly 1.74% from the previous close.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter