How low does the Rupee go when the Middle East erupts

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

The recent flare-up between Iran and Israel has rattled global markets, leaving investors on edge about how it might shake up India’s markets and the value of the rupee.

In today’s tightly woven world, big world events like the recent flare-up between Iran and Israel rock the boat in financial markets. This latest showdown, coming right after the Russia-Ukraine crisis, is a stark wake-up call to just how much these global power struggles can mess with market stability.

To dive into the impact of the recent escalation, it is important to dig deeper into the historical trends in the currencies.

Instability in the Middle East holds significant sway over global oil markets, safe-haven assets, and currencies. As a crucial oil source, any disruption to its supply can trigger speculation-driven price hikes. These spikes historically influence global inflation rates and trade balances, particularly for countries like India heavily reliant on oil imports and, subsequently, currencies. However, it’s debatable whether these countries ( Israel, Palestine, Iran) contribute a sizable portion to the world’s oil market? Perhaps not directly, but the surrounding regions could be impacted. If major players like Saudi Arabia, Iraq, or the UAE were to face similar instability, the true impact would become evident.

A list of conflicts in the Middle East since 2000 and how long it stayed:

• Second Intifada: September 2000 to February 2005

• Second Lebanon War: July 2006 to August 2006

• Gaza-Israel conflicts or Operation Cast Lead: December 2008 to January 2009

• Israel-Gaza conflict or Operation Protective Edge: July 2014 – August 2014

• Israel- Hamas war: Oct 2023 to till date

Out of the five major historical tensions, three cases saw wars lasting hardly a month with limited impact on the financial market. The first case, the Second Intifada, endured for 4.5 years but had a limited impact on the financial market. Furthermore, the ongoing Israel-Hamas war has persisted for over six months, yet it has had a negligible impact on equities, as multiple global equities reached all-time highs during this period. Surprisingly, the yen, often considered a safe-haven currency, did not appreciate. However, gold soared to an all-time high due to central banks’ accumulation of the safe-haven asset in their reserves

Governement and central bank’s presence of mind

Over the past five years, it has been observed that governments and central banks take immediate steps to address uncertainties in the market. During the COVID-19 pandemic, the risk-off sentiment was short-lived, lasting only a couple of months. To support growth and economic activity, governments and central bankers swiftly eased their stance.

Also Read: Rupee vs US Dollar: INR falls to record low of 83.54 versus USD

Similarly, in 2022, during the Russia-Ukraine war, central banks intervened in the market to stabilise volatility and FX rates. For instance, in India, the RBI announced Sell-Buy swaps and utilized FX reserves. Additionally, during the 2023 US banking crisis, the impact on the global equity market remained minimal.

Similarly, during the Israel-Palestine war in October 2022, equities experienced modest declines of less than 2 to 3%, and oil prices remained relatively stable for the following months. Therefore, we believe that even if the Israel-Palestine-Iran conflict persists or escalates, global authorities will likely take measures to manage the situation.

Coming to the domestic factors and outlook on the Rupee during such geopolitical tension:

During wartime, crude oil prices typically soar due to concerns over supply disruptions. The possibility of Brent crude reaching $100 per barrel amidst escalating tensions in West Asia, and potentially remaining at that level in the near term, could impact key macro-indicators. According to analysis, crude oil at $100 per barrel could raise CPI inflation by 40 to 60 basis points (bps) from the RBI’s estimate, assuming full pass-through to retail consumers of automotive fuels. Additionally, it could inflate the oil import bill by $2 to $3 billion. Nevertheless, the aforementioned impacts may not fundamentally alter economic activity.

What could offset the impact of geopolitical tension?

1. RBI’s FX reserves: Over the past 1.5 years, the RBI has significantly bolstered its FX reserves, while maintaining the currency between $81.50 to $83.50 billion. After a decline to $528.37 billion in October 2022, they swiftly resumed accumulation, reaching an all-time high of $648.56 billion. In addition to foreign currency assets, the RBI has also been observed increasing its gold reserves, mirroring trends seen in other global central banks. These reserves serve as a robust pillar during periods of financial market uncertainty or significant outflows of hot money.

2. Stronger domestic fundamentals: Foreign Portfolio Investor (FPI) flows have remained robust throughout the calendar year 2024, boasting impressive inflows totaling $10 billion. Additionally, the Reserve Bank of India (RBI) holds substantial reserves, reaching a record high of $648 billion, providing a significant buffer during times of uncertainty. Furthermore, the trade balance reflects encouraging signs, standing at an 11-month low of $15.6 billion. In terms of economic indicators, inflation remains under control, hovering around 4.85%, while Industrial Production (IIP) growth stands at a healthy 5.7%. Moreover, the Current Account Deficit (CAD) and Balance of Payments (BoP) portray a balanced and favourable outlook. Lastly, both the Manufacturing and Services Purchasing Managers’ Index (PMIs) are outperforming those of peer and developed countries, underscoring the resilience and strength of India’s economic fundamentals. These factors collectively indicate a promising trajectory for the Rupee’s potential resurgence.

Outlook

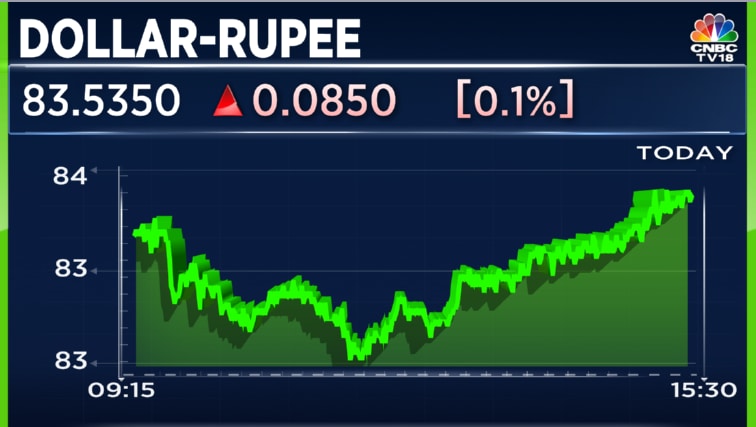

Overall, we believe that the intensity of geopolitical tensions and their impact during proactive environments is minimal. Currently, governments and central banks have established a war-proof shield for their economies, prepared to take immediate action. Furthermore, being a net importing country, India can manage higher oil prices as the RBI always maintains a buffer and revisits projections. Amid the backdrop of global uncertainty, domestic fundamentals remain resilient. Therefore, we anticipate that pressure on the Rupee will be short-lived and restricted to levels between 83.50 to 83.70. In the near term, we foresee the Rupee moving towards 83 to 82.80, and over the medium term, between 82.50 to 82.00.

Also Read: Could rising global risks trigger an equities sell-off? Taimur Baig and Mark Matthews answer

Amit Pabari is Managing Director at CR Forex Advisors. The views expressed in this article are his own.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter