RBI hits pause button, but what about already struggling home loan takers — here’s some strategies to lower EMI burden

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

The RBI kept repo rate unchanged on Thursday but the flurry of hikes in recent months has already pushed home loan interest rates higher. So, what should be your repayment strategy?

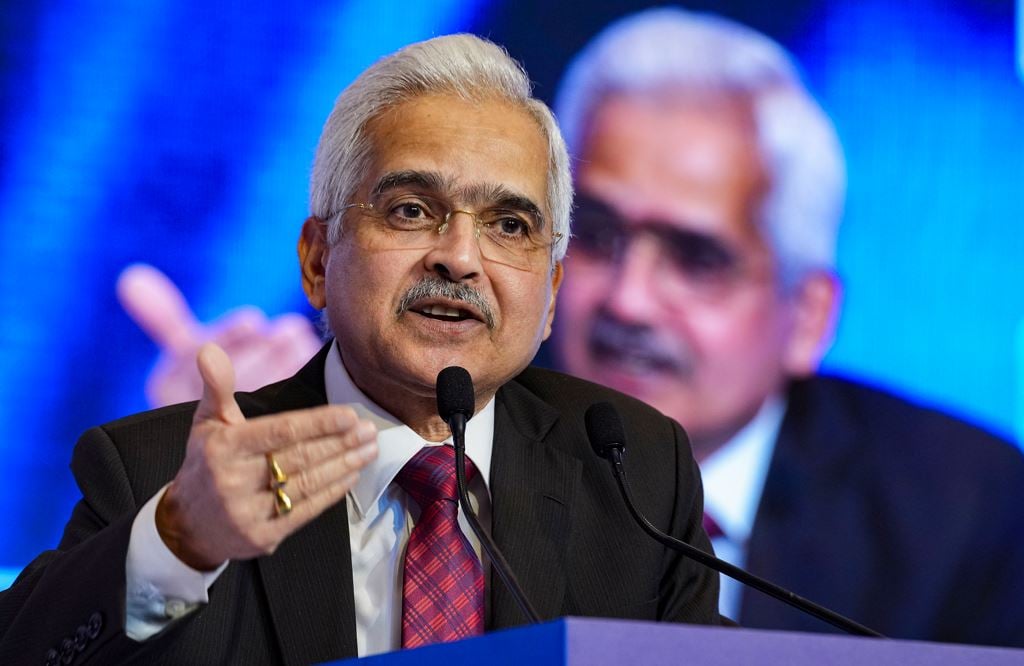

Borrowers can heave a sigh of relief as Reserve Bank of India (RBI) kept the repo rate hike unchanged at 6.50 percent in the first bi-monthly monetary policy review of the financial year 2024. This comes at a time when borrowers are reeling under the pressure of lengthening loan tenors and rising interest rates. Before hitting this pause button, the central bank raised repo rate cumulatively by 250 basis points to 6.50 percent since the beginning of the rate hike cycle in May 2022.

For most banks, the external benchmark to which their home loans are linked is the repo rate. So, with the hike in repo rate, all existing home loans on floating rates of interest became expensive.

Decoding RBI’s decision

After raising interest rate by a cumulative 250 basis points or 2.5 percent in 11 months, RBI on Thursday unexpectedly kept benchmark rate unchanged as global banking woes added uncertainty to the economic outlook. While they have kept the rate unchanged they have maintained that they are ready to act whenever required to combat inflation.

This means that if necessary MPC will not hesitate to take further action, which means that it might be a temporary pause of the current rate hike cycle if inflation print especially core inflation remains elevated.

However, the key point now is that borrowers can assess their current liabilities in the face of the 2.5 percent increase in the last one year and devise strategies to optimise overall interest outflow and tenor increases, said Adhil Shetty, CEO at BankBazaar.com.

Current home loan rate scenario

According to Shetty, it is important to understand that a 2.5 percent hike in repo rate implies that the equated monthly installments (EMIs) for borrowers have gone up by approximately 16 percent in case of a 15-year loan, 20 percent in case of a 20-year loan, and 26.5 percent in case of a 30-year loan.

Here’s a table showing increasing EMIs on Rs 50 lakh home loan (with different increased rates scenario):

(Note: The outstanding tenor is 15 years (180 months and original interest rate is 7 percent | Source: Bankbazaar)

And, how this would function in case EMI is kept same and tenure is increased.

Let’s take a look:

(Note: The outstanding tenor is 15 years (180 months and original interest rate is 7 percent | Source: Bankbazaar)

Many borrowers, especially those at the beginning of their loans have also seen their tenors increase instead of decrease over the last one year despite timely repayments.

This means borrowers are already reeling under the pressure of lengthening loan tenors and rising interest rates. The point of easy repayments has already passed. There’s no way borrowers can maintain their EMI unless they have been repaying aggressively.

At the same time, spreads on the benchmark rate have been falling over the last one year, from as high as 3.5 percent before the pandemic to 1.9 percent currently, as per Shetty.

According to Neelabh Sanyal, Co-Founder and COO at Kuvera.in, borrowing capacity for new home loans has also decreased, resulting in reduced disbursals during this period.

The way outs

Banks typically have a tenure of up to working age of 60 years in case of home loan, hence increasing the tenure might be challenging given the number of hikes in recent months. And, paying higher EMIs may not be feasible for everyone.

“So, borrowers whose loan is 2-3 years old or older, they stand to gain a good reduction on their interest rate on refinancing if they have a good repayment track record and credit score,” Shetty said.

Given the high interest scenario, the best option in such a case is to refinance at a lower rate and retain a higher EMI. This will help borrowers keep down the costs of borrowing.

Home buying sentiments

Shishir Baijal, Chairman and Managing Director at Knight Frank India said that the pause in repo rate hike is a big cheer for the real estate industry.

“The sector has weathered multiple home loan interest rate increases from a low of 6.5 percent to 8.75 percent, supported by favourable house purchase affordability and the strong desire towards home ownership. Therefore, a pause in any further rise in the lending rates should support the existing growth momentum in the housing sector,” Baijal said.

According to Anuj Puri, Chairman at ANAROCK Group, this particularly gives relief to affordable and mid segment homebuyers who feared a possible rate hike today, making property buying via home loans even harder.

Affordable housing has been under stress since the pandemic. This segment (units priced <Rs 40 lakh) saw its overall sales share dip between 2019 and 2022 and further in first quarter of 2023.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter