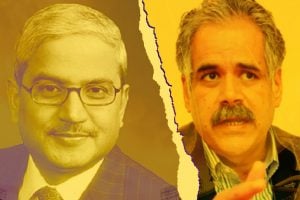

Rahul Bhatia’s net worth rises $1 bn in two months as IndiGo shares climb to record

Summary

The majority of Bhatia’s fortune is derived from his 38 percent stake in InterGlobe Aviation. Moreover, his stake is held directly, through family members and holding companies.

The fortune of Rahul Bhatia, co-founder of InterGlobe Aviation, swelled by $1 billion in just two months, after renewed interest at airlines counter bolstered IndiGo’s shares to a fresh-life time high.

Shares of InterGlobe Aviation have rallied as much as 32 percent from March end to hit a record high of Rs 2,418.50 on the NSE. In comparison, the benchmark Nifty50 surged less than 10 percent during the same period.

Analysts are of the view that the latest financial troubles at rival Go Air is likely to improve sales and market shares of InterGlobe Aviation in the coming quarters.

Additionally, the fall in crude oil prices also bodes well with the industry. The Brent, which is hovering at $75 per barrel, has fallen as much as 14 percent from its April highs. Aviation turbine fuel, a derivative of crude oil, forms a major chunk of airlines’ operating expenses.

According to Jefferies, the passenger volume of IndiGo for FY23 was 86 million and the company expects volumes to reach 100 million for FY24.

“FY24 has started on positive note for IndiGo with crude slide sustaining and competitor Go Air suspending operations, creating sudden industry supply shortage,” wrote Jefferies in an investor note.

The foreign brokerage also increased FY24 EBITDA (earnings before interest, taxes, depreciation, and amortization) estimate 29 percent to reflect “changed scenario” in the industry.

According to Bloomberg billionaires index, Rahul Bhatia, who occupies 22nd rank among Indian billionaires possess a net worth of $5.31 billion as of June 05, against $4.28 billion at the end of March 2023.

The majority of Bhatia’s fortune is derived from his 38 percent stake in InterGlobe Aviation. Moreover, his stake is held directly, through family members and holding companies.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter