The challenges that lie before Radhakishan Damani-owned DMart after stock falls 30% from peak

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

Unlike the products that it sells in its stores, DMart’s shares trade at extremely expensive valuations.

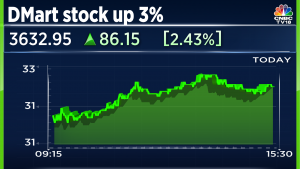

Shares of Avenue Supermarts, the company behind hypermarket chain DMart, owned by billionaire investor Radhakishan Damani, have corrected 30 percent from their peak in October 2021.

Although the stock continues to remain significantly higher than its IPO price of Rs 299, the recent correction dampens the 18x returns it delivered to shareholders from its IPO until October 2021.

Billionaire investor Radhakishan Damani, who currently has a networth of Rs 1.5 lakh crore, continues to hold a 75 percent stake in DMart through a combination of individual as well as other promoter entities. On an individual basis, he owns 23.1 percent of the company, currently valued at over Rs 53,000 crore.

From its peak, the stock is down 31 percent, and has underperformed the benchmark Nifty 50 index and the Nifty Midcap index.

DMart positions itself as a value retailer, selling everyday products at lower prices. It categorises itself into three categories – Foods, non-foods, and general merchandise.

Demand at the lower end of the spectrum has remained very week post the Covid-19 pandemic, as highlighted by many economists and FMCG companies. That is DMart’s core audience. Higher prices of food, fuel and other essential goods have squeezed household budgets.

As a result, consumers have cut back on discretionary spending. Economists and experts have been talking of a “K-shaped” recovery.

Amidst the tough macroeconomic conditions, the street is also worried about these factors:

Pace Of Store Addition

DMart has been adding stores at a slower pace. Between financial year 2019 and financial year 2023, the company has added a total of 171 stores, taking the total store count to 324.

In contrast, competitor Reliance Retail has added 966 stores, which is triple of DMart’s overall stores in the March quarter itself. Reliance Retail added 3,300 stores in financial year 2023.

Another worrying factor is that DMart’s sales per square feet has declined from Rs 35,647 in financial year 2019 to Rs 31,096 in financial year 2023.

Lower Contribution From High Gross Margin Business

The Reserve Bank of India released its bi-monthly Consumer Confidence Survey last month, which said that while consumer confidence continues to recover from historic lows of mid-2021, it still has some way to go.

But consumers are looking to spend less on apparel and merchandise, which is reflecting in lower contribution of general merchandise and apparel to DMart’s revenue. This metric has also been on a downward trajectory since financial year 2019.

The company is also facing increased competition from other retailers in the general merchandise and apparel segment. This is a high gross margin segment DMart. Gross margin is the percentage of the revenue left after subtracting the company’s direct cost.

The declining contribution of this segment to DMart’s revenue meant that gross margin in the March quarter fell to a seven-quarter low.

RoCE Remains Below Pre-Covid Levels

DMart may have not added as many stores as its peer, but it has added them nonetheless. As a result of the increased infrastructure, and lower gross margin, the company’s Return on Capital Employed (RoCE) has still not recovered past its pre-Covid levels. Return on Capital Employed is a ratio used in analysing how well a company generates profit from the capital it puts to use.

DMart Ready Expansion

DMart has been ramping up its hypermarket chain DMart Ready in recent months. The revenue run-rate for DMart Ready has increased from Rs 153 crore in the December quarter of financial year 2022 to Rs 257 crore for the March quarter this year. However, the revenue run rate has been flat on a sequential basis for the last few quarters.

Expensive Valuations

Unlike the products that it sells in its stores, DMart’s shares trade at extremely expensive valuations. Despite the recent correction, shares are trading at 74 times financial year 2024 price-to-earnings and 59 times for the same metric in financial year 2025. For all the promise of strong fundamentals and growth prospects, the valuation is still very expensive.

Despite the recent challenges, DMart remains a strong company with a loyal customer base. However, investors will need to keep an eye out on the above-mentioned factors in the coming months.

DMart will have to show that it can grow its revenue and improve its product mix. It also needs to improve its sales per square foot. The street can factor in better performance if it manages to accelerate its pace of store addition. Among the new businesses, the ramp-up of DMart Ready and in-store pharma services will be key to watch.

In case it manages to overcome these challenges, it is well positioned to return to its growth trajectory of the past.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter