What to expect from the likes of ABB, Siemens and BHEL

Summary

Margin projections vary across companies. While GE T&D, Kirloskar Oil, and ABB India could expand margins anywhere between 1% and 6%, Bharat Heavy Electricals (BHEL), Siemens and Thermax, may see some pressure.

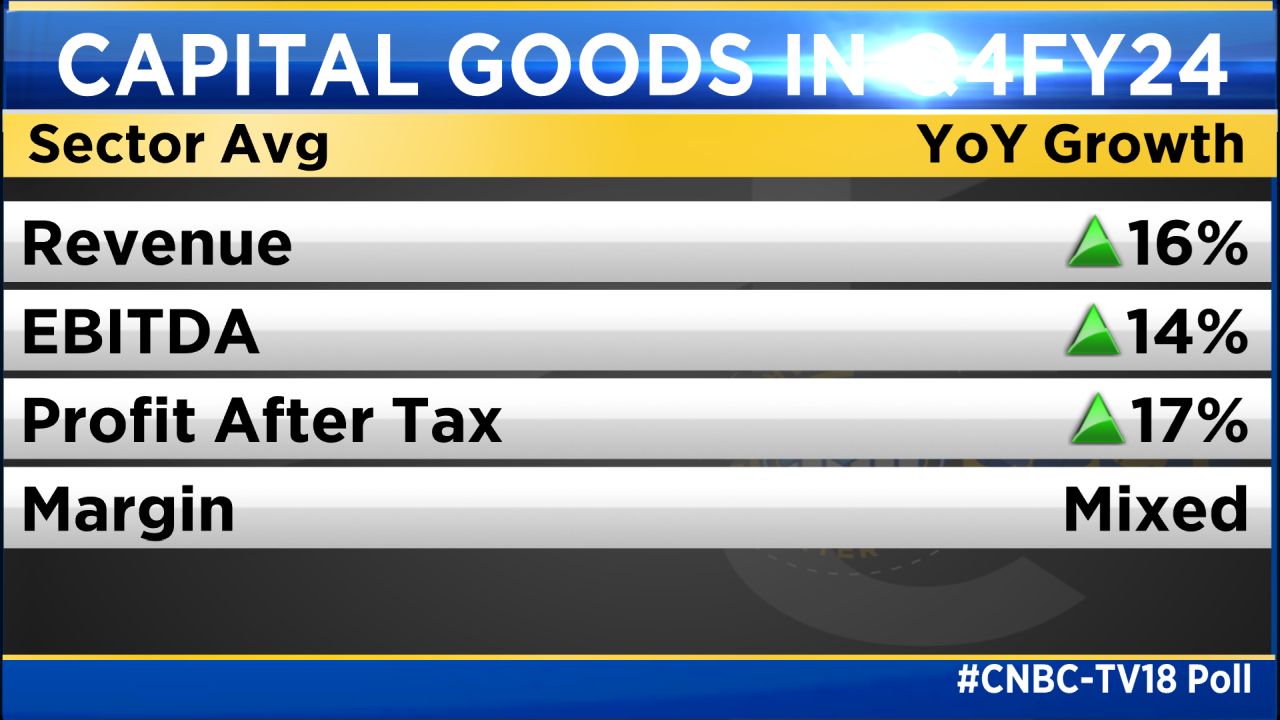

The capital goods industry is expected to report average revenue growth of 16% and profit growth of around 17% for the January to March 2024 quarter. supported by record high order books and strong execution.

Cost-saving measures and operational efficiencies may lead to a 14% improvement in the earnings before interest, tax, depreciation, and amortisation (EBITDA). However, the margin outlook remains mixed.

While the order flow has been robust in the recent quarters, a slight moderation is expected now mainly an account of the elections.

Nonetheless, steady order inflows are projected in segments like renewable energy, power, transmission and distribution as well as defence.

Private investment has been selective so far and is also seeing some green shoots. So overall, the order momentum is expected to pick up meaningfully only after July to September quarter of the current financial (FY25).

Export orders, however, are a concern given the sluggishness in most geographies, geopolitical tensions as well as trade disruption.

Margin projections vary. GE T&D, Kirloskar Oil and ABB India are expected to witness expansion anywhere between 1% and 6% in their margins. Bharat Heavy Electricals Limited (BHEL), Siemens and to some extent, Thermax, however, may see some pressure.

Except for BHEL and CG Power, net profits are expected to climb for most of the companies.

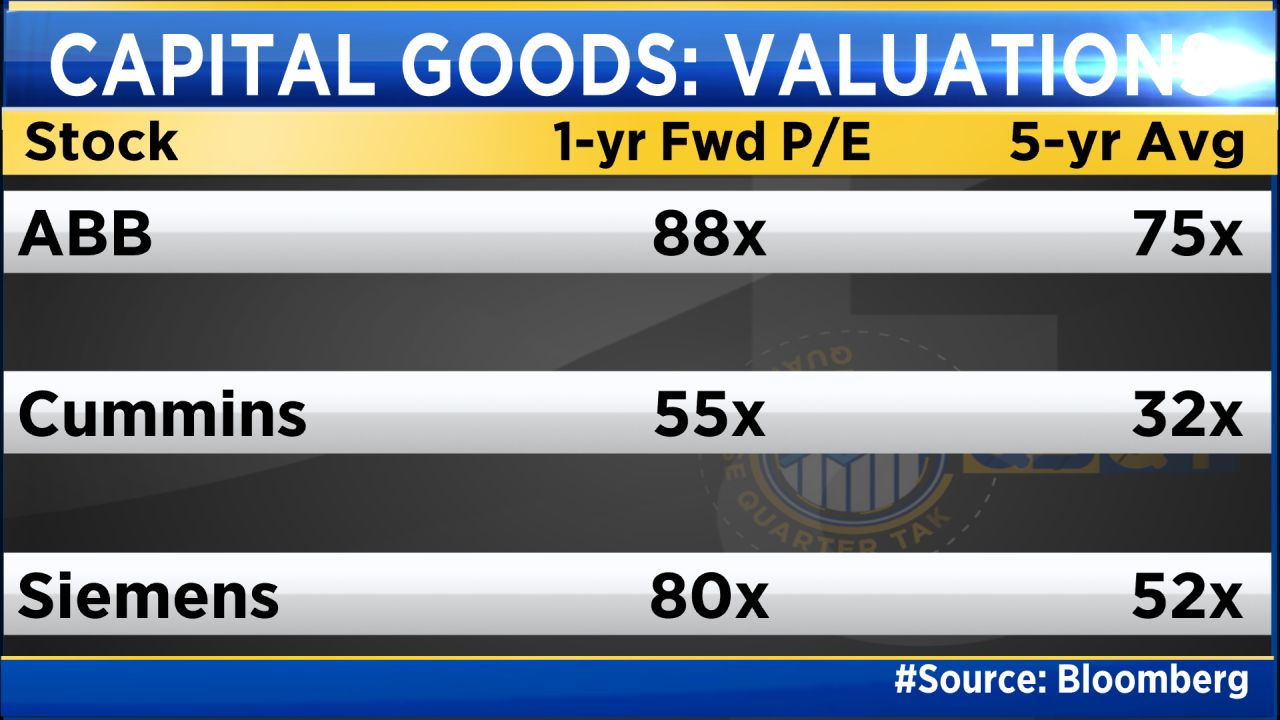

In terms of stock performance, capital goods companies have seen a very strong surge with returns exceeding nearly 75% across the board for all companies.

In fact, on a year-to-date basis as well, the stocks have gained anywhere between 18% and 114% for some counters.

However, this strong surge has, in turn, pushed current valuations above the historical averages and the question remains; can these premium valuations be sustained? Will private capex drive the next leg of growth for these capital goods companies?

Renu Baid Pugalia, Senior VP of Research at IIFL Institutional Equities is bullish on companies like Bharat Electronics (BEL), ABB India, Cummins, and small-cap companies like Data Patterns from an earnings perspective.

“Even if we see companies like KEC, Kalpataru, from the lower base, should bounce back strongly on the earnings side. But names like CG Power, Siemens and Thermax will see barely single-digit growth in earnings because of a very high base last year. So to that extent, we expect some moderation on the earnings side for some of the diversified industrials,” she said.

For more, watch the accompanying video

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter