Sensex, Nifty50 fall for 2nd week dragged by financial, metal stocks; Nifty Bank’s worst week in 2 months

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

Financial and metal stocks pulled Sensex and Nifty50 lower, as geopolitical tensions, sustained FII outflows and concerns about faster rate hikes worried investors. News flow on the Ukraine-Russia conflict kept investors on edge globally. The VIX made its biggest weekly jump in three months.

Indian equity benchmarks finished a volatile week with cuts of around half a percent, dragged by financial and metal stocks, amid geopolitical tensions, sustained FII outflows and concerns about faster rate hikes. News flow on the Ukraine-Russia conflict kept investors on edge globally.

For the week ended February 18, both headline indices fell 0.6 percent — a second straight weekly loss. The Sensex shed 320 points to settle at 57,833, and the Nifty50 lost 98.5 points to 17,276.3.

Broader markets weakened for the week. The Nifty Midcap 100 index fell 2.7 percent and its smallcap counterpart 3.4 percent.

The week began with the headline indices’ biggest single-day fall in eight months followed by the biggest rebound in more than a year.

“Domestic equities were moving in tandem with developments on the Russia-Ukraine front and global inflationary pressure. Increased tensions between Russia and Ukraine sent oil prices rising and forced investors to dump risky assets. However, a ray of hope that the tension is de-escalating prompted a sharp recovery in domestic equities,” said Vinod Nair, Head of Research at Geojit Financial Services.

Fear takes centrestage

NSE’s India VIX index — known in market parlance as the barometer of fear — surged 24.3 percent to finish at the 22 mark, its biggest weekly jump in three months.

“If we were to interpret the possible reasons for the sharp shift in mood, the most touted one is Fed rate hikes, which tend to induce significant FII outflows. With FIIs on a selling frenzy in the recent months, this risk appears to be priced in,” said Yesha Shah, Head of Equity Research at Samco Securities.

FIIs this week net sold Indian shares worth Rs 5,261.5 crore ($696.9 million), according to provisional exchange data. So far in February, they have taken out Rs 15,342 crore ($2 billion) from Indian shares — a fifth straight month of outflows.

The Nifty Bank tumbled 918.1 points or 2.4 percent — its worst week in two months. SBI, ICICI Bank, HDFC Bank and Axis Bank took a hit of 2-5 percent each.

The Nifty IT eked out a weekly gain of 0.3 percent, as TCS rose 2.7 percent and Tech Mahindra 0.9 percent, but Infosys fell 0.8 percent.

As many as 23 stocks in the Nifty50 basket managed to finish the week above the flatline.

| Gainers |

Losers |

| Stock |

Weekly change (%) |

Stock |

Weekly change (%) |

| Eicher |

3.9 |

PowerGrid |

-5.8 |

| TCS |

2.7 |

JSW Steel |

-5.7 |

| HUL |

2.4 |

UltraTech |

-5.6 |

| Tata Consumer |

2.4 |

ICICI Bank |

-5.3 |

| Hero MotoCorp |

2 |

Cipla |

-5.2 |

| Reliance Industries |

2 |

Tata Steel |

-5.1 |

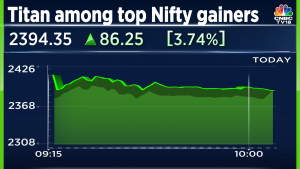

| Titan |

1.9 |

ITC |

-4.5 |

| Bajaj Auto |

1.8 |

UPL |

-3.8 |

| SBI Life |

1.5 |

NTPC |

-3.5 |

| Divi’s |

1.5 |

IndusInd |

-2.8 |

About 375 stocks on the NSE 500 — the bourse’s broadest index — suffered weekly cuts.

From the midcap and smallcap segments, losers Manappuram, Metropolis, NLC, Suprajit and KRBL were the top weekly losers, falling 14-20 percent. On the flipside, Orient Refractories, ABB Power, PNB Housing, Solara and Uflex, rising 8-24 percent, were the top gainers.

With the earnings season now behind, global cues are likely to determine market direction as the Russia-Ukraine crisis remains on investors’ radar. Fluctuations in crude oil price will also be tracked closely.

More volatility can be expected ahead on Dalal Street, ahead of the monthly F&O expiry due on February 24.

“As global cues are forcing markets to remain unstable, the domestic market is also expected to continue its volatile trend in the coming days. In such a volatile market, a prudent approach is to have a balanced portfolio with a mix of equity, debt, gold and cash,” said Nair of Geojit.

Technical view

The Nifty’s short-term trend appears to be turning bearish, even though the index is holding significant support at 16,800, according to Samco’s Shah.

“The market is stuck in an uncertain zone between 16,800 and 17,600. A breakout on either side will very certainly spark a new course of action,” she added.

Disclaimer: Network18, the parent company of CNBCTV18.com, is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter