The most important number to watch out for in TCS earnings

Summary

Tata Consultancy Services will be reporting its quarter one FY23 earnings on July 8, 2022.

[wealthdesk shortname=”TCS” isinid=”INE467B01029″ bseid=”532540″ nseid=”TCS” sector=”Computers – Software” exchange=”nse”]

Tata Consultancy Services (TCS) is all set to kick off the corporate earnings season, with India’s largest software exporter due to report its financial results for the April-June period on July 8. Analysts and investors will look out for the IT giant’s margin — at a time when elevated employee costs continue to impact profitability in IT thanks to high attrition, even as there is healthy demand for technology across sectors.

Dalal Street participants will also keenly track the company’s management commentary and revenue guidance.

Analysts in a CNBC-TV18 poll estimate TCS’ margin for the April-June period at 23.7 percent — which means a sequential fall of 126 basis points.

This as they expect the company’s revenue growth to come in at 1.7 percent in dollar terms. In constant currency terms, analysts estimate growth to come in at about 3.5-4 percent.

One can expect a margin contraction of at least 150 basis points for TCS in the forthcoming earnings, Sandip Agarwal, Research Analyst-Institutional Equities at Edelweiss Securities, told CNBC-TV18. “If it is 130 bps, I will be very happy because it will mean that they have been able to absorb a lot of margin pressure through operational efficiency and maybe pricing gains,” he said.

A low attrition number will be a positive surprise, Agarwal added.

Businesses across sectors are spending heavily on technology, boosting the profitability of IT companies, but elevated costs — towards talent acquisition and retention — and cross-currency headwinds are hurting them. The dollar index — which gauges the greenback against six peers — is not far from a 20-year peak hit this week.

The US accounts for 55 percent of Tata Consultancy Services’ revenue, the rest of which comes from the markets such as Europe, Australia and Japan.

So, when TCS converts revenue earned in currencies such as the euro or the pound back into the dollar, it is likely to lose in terms of a growth rate.

That is why the constant currency revenue growth is going to be higher at 3.5-4 percent.

Also Read: TCS to kick off earnings season on July 8 — Here’s what one can expect from IT companies

Usually, the IT company raises wages effective April 1 — it is expected to weigh on its margin and profit.

The TCS management said earlier that despite a worsening macroeconomic situation, tech budgets are not impacted and demand continues to be resilient. It also said that even though clients are facing a cost squeeze, they are now focusing more on digital projects, which will help in prioritising the tech budgets and cost savings.

At a time when the economy is slowing and companies are facing cost pressure, there is a possibility that deal wins and deal signing will slow down. That number will be very crucial and hiring attrition is also on top of investors’ minds.

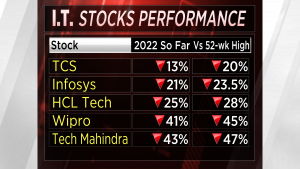

The TCS stock along with the rest of the IT pack has seen a price-to-earnings derating. TCS shares have retreated about 20 percent from their recent peak, with peak valuation multiples down to about 25 times on a year-to-date basis from 30-32 times-odd levels.

Watch the accompanying video of CNBC-TV18’s Reema Tendulkar for more details.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter