What to expect from RBI’s Oct 8 policy? Experts gauge challenges for MPC

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

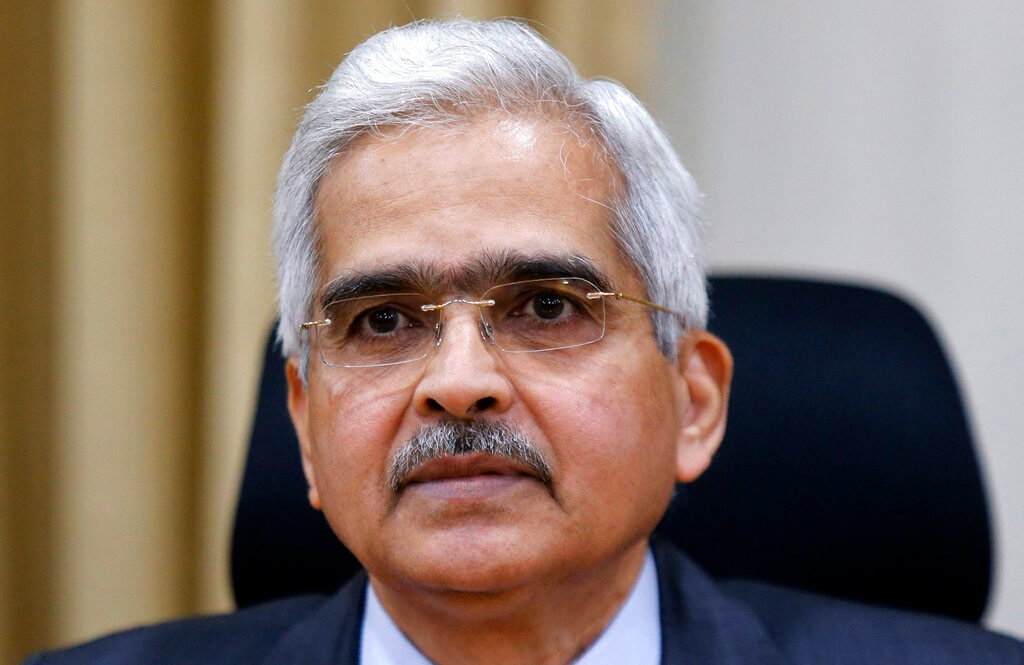

The upcoming monetary policy announcement by Reserve Bank of India (RBI) on October 8 is likely to be a crucial one because the RBI already seems to be giving a telltale sign that it is uncomfortable with the plentiful liquidity in the system. CNBC-TV18’s Citizens Monetary Policy Committee – Sajjid Chinoy, Chief India Economist at JPMorgan, Samiran Chakraborty, Chief Economist at Citi, Sonal Varma of Nomura, Soumya Kanti Ghosh, Group CEA at State Bank of India (SBI) and Former Chief Statistician Pronab Sen – meets to deliberate on what can be expected.

The upcoming monetary policy announcement by the Reserve Bank of India (RBI) on October 8 is likely to be a crucial one because the RBI already seems to be giving a telltale sign that it is uncomfortable with the plentiful liquidity in the system.

CNBC-TV18’s Citizens Monetary Policy Committee – Sajjid Chinoy, Chief India Economist at JPMorgan, Samiran Chakraborty, Chief Economist at Citi, Sonal Varma of Nomura, Soumya Kanti Ghosh, Group CEA at State Bank of India (SBI) and Former Chief Statistician Pronab Sen – meets to deliberate on what can be expected.

Citi on Thursday said that it is expecting 15 basis points (bps) reverse repo hike in the Reserve Bank of India’s monetary policy to be held on October 8. Accordingly, the reverse repo will be upped to 3.5 percent from the current 3.35 percent, Citi said.

Also Read: Citi expects 15 bps reverse repo hike in October 8 RBI monetary policy

There were two emergency measures that were taken during the COVID-19 times. One was that the corridor was widened by an additional cut in the reverse repo and the other was that the effective policy rate was pushed towards the reverse repo rate rather than the repo rate.

Chakraborty believes that the time has come for these emergency measures to be slowly recalibrated back and to that extent the 15-basis point (bps) reverse repo hike would be useful.

“From a cyclical perspective, the accommodative stance, the easy monetary policy is likely to continue for a much longer duration,” he said.

Also Read: Secular uptrend in electricity, usage likely to be 22% higher than pre-COVID period: Kotak Mahindra Bank’s Upasna Bhardwaj

According to Chinoy, one needs to be very careful when interpreting the near-term numbers.

“Because what we are going to see is over the next three months, inflation is going to gap down to the 4 percent handle, 4.5 percent in September and then in October and November go down to 4 and possibly below. They should not leave a sense of complacency because A] we have seen this gap down and B] inflation between July and December is going to be between 70 and 80 bps below the RBI’s own forecast on account of very soft food prices,” Chinoy explained.

Also Read: GST collections for September at Rs 1.17 lakh crore

“Given the abundance of liquidity – core liquidity in the system is still around Rs 11.3 lakh crore as of today. But the bottomline is that if you are looking at the corporate prices, there are loans of longer durations more than 10 years that have been given out at rates which is significantly lower than 6 percent handle. That means there is asset-liability mismatch,” Ghosh said.

Varma believes, from India’s monetary policy perspective, the external backdrop is clearly less favourable this time around.

“From India’s monetary policy perspective, yes, external is less favourable but particularly when it comes to significantly higher inflationary pressures that we are facing today – therefore even if headline comes off as it will because of food, the buildup on other price pressures particularly the feedthrough that we will see in core inflation going forward has to be the biggest consideration,” she said.

“A] Slower growth particularly coming from China, B] the inflationary impulses coming partly from China but even outside and C] clear signal from the US Fed on tapering. In terms of growth slowdown led by China – India is not as open. If China slows down and that results in global growth slowdown then there will be an impact on India through the exports channel but the spillover is relatively less at this stage. Red flag but I don’t think much to seriously panic about as of now. The taper related risks are well managed in terms of the reserves that we have well built up. So, I don’t think that is extremely worrying. The biggest worry therefore from the global front is the inflationary backdrop – the power outages, the carbon emission curbs that China is doing, a lot of that is going to push up inflation and further worsen the supply bottlenecks,” she explained.

Also Read: KV Kamath says govt’s asset monetisation program completes economic picture

According to Sen, one needs to look at issues in terms of growth.

“The first is that the government has for some reason been extraordinarily coy about the expense. We hope that this was just a breather they were taking and they would go back onto the spending path from the next quarter onwards. However, at the moment, there doesn’t seem to be very many indications of that happening other than instruction issued by the Finance Ministry to other ministries that they should now start their investment programmes. So let us keep our fingers crossed,” he said.

The second issue is that the banks are still simply not being able to increase the credit. Credit growth continues to be very poor particularly credit growth to the MSMEs. “Unless the MSME sector comes roaring back, our growth story is going to be fragile. This is where the whole reverse ratio issue props up. The reason that the corridor was widened was essentially to persuade the banks to lend more to customers and at this stage where the investment story continues to be very weak, increasing the reverse repo may send out the wrong signal all over the place and that I don’t think is a very good idea,” Sen explained.

For the entire discussion, watch the accompanying video.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

Listen to the Article

Listen to the Article

Daily Newsletter

Daily Newsletter