Tejas Networks expects substantial benefits from PLI scheme over the next four years

Summary

In a post-result interaction with CNBC-TV18, Anand Athreya, MD & CEO and Arnob Roy, COO & ED of the company that designs and makes products for wireless networking talked about the company’s strategy for the future.

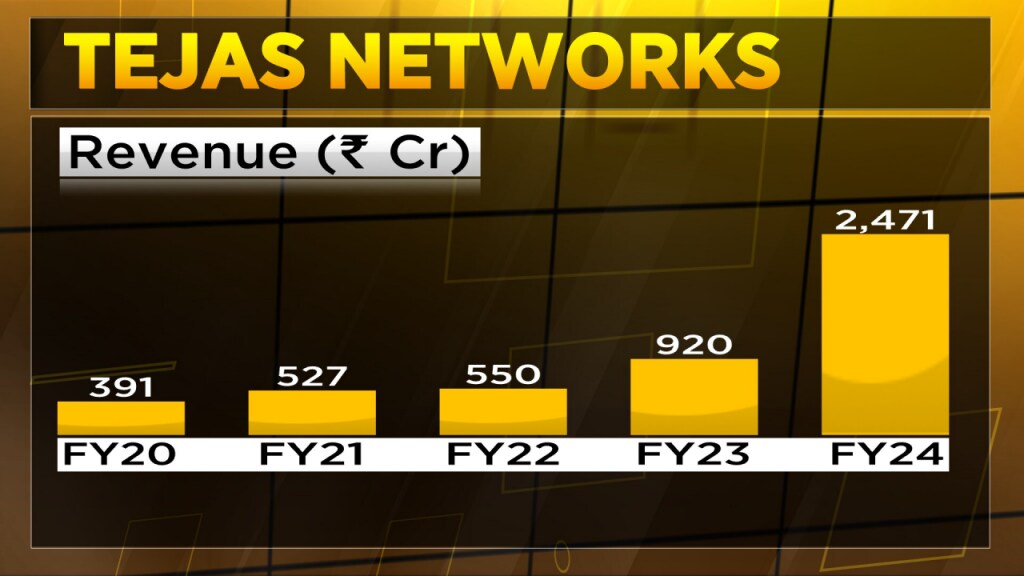

Tata Group company Tejas Networks, on April 23, reported its first profit in five quarters, at ₹147 crore.

In a post-result interaction with CNBC-TV18, Anand Athreya, MD & CEO and Arnob Roy, COO & ED of the company that designs and makes products for wireless networking talked about the company’s strategy for the future.

Roy pointed out how the company benefits from the government’s focus on producing goods within the country and the production-linked incentive (PLI) scheme.

Read the verbatim transcript of the interview below:

Q: What are you expecting to do in FY25?

Athreya: It has been a good quarter and a good year, and it has been the best quarter ever for Tejas and a profitable one too. Yes, we have strong revenue across all of our products and the pipeline is healthy. We do not give guidance on where we are going to end up, but we are insanely focused on execution and building the pipeline.

Q: Is FY25 going to be a transformational year where the topline grows in multiple?

Athreya: We have a healthy order book already in the back, and we are continuing to execute flawlessly. So, the result will take care of itself. .

Also Read | Tejas Networks shares jump 40% in two sessions to a record high post Q4 profit

Q: To understand a bit about the businesses on the international front, the growth has been at a slower pace. So, when do you see it pick up? Also, if you look at the government-led business, and the private-led business, can you give us some updates on what the growth could look like in FY25?

Athreya: We do not give guidance on growth, but all we can say is we are investing well to grow the international markets, which means we are investing in sales, partnerships, and other relationships. As we announced recently, we signed an MoU with Telecom Egypt. So, we would like to expand internationally. We intend to grow on all fronts, and we will make that investment to get there.

Q: What the impact of the PLI would be and the manufacturing of telecom equipment? What is the kind of opportunity that you see because of the replacement since so many are reducing Chinese equipment? What is the kind of opportunity that you see for your own business?

Roy: I think that is a big opportunity in terms of replacing with what we call trusted equipment, that opportunity, both not only in India, but in a lot of the foreign markets as well where those opportunities are there, and we are targeting all of that because products from India and internationally also are considered as trusted, reliable equipment kind of thing. So, yes, there is a significant opportunity for us. As regards PLI, I think PLI is a really good incentive for manufacturing investments, and we have been one of the applicants who have been approved. Our applications for FY23 as well as for FY24 have been approved and it’s for 5 years from FY23. So, for the next four years, we see a significant impact and value coming out of this PLI scheme, which is connected to not only our investments in manufacturing but also to the revenue growth that comes out of it.

For more details, watch the accompanying video

Catch all the latest updates from the stock market here

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter