Foreign investors cutting exposure to India due to lack of growth, says Ridham Desai

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

Overseas investors have been pulling money out of India owing to lack of growth in Asia’s third biggest economy, said Ridham Desai, head of India equity research and managing director at Morgan Stanley. Desai, who was speaking on the sidelines of the Morgan Stanley Investor Summit on Tuesday, shared his views on the corporate earnings, emerging …

Continue reading “Foreign investors cutting exposure to India due to lack of growth, says Ridham Desai”

Overseas investors have been pulling money out of India owing to lack of growth in Asia’s third biggest economy, said Ridham Desai, head of India equity research and managing director at Morgan Stanley.

Desai, who was speaking on the sidelines of the Morgan Stanley Investor Summit on Tuesday, shared his views on the corporate earnings, emerging market growth and his outlook on stocks.

“Foreign investors have been pulling money out of India. Their overweight position on India has declined. We are at 2011 levels. They are still overweight but it has come down significantly. So you can tell that they have been persistently disappointed by India’s lack of growth and they are stepping aside,” he said.

On the broader market, Desai said midcap valuations need to go down a bit more before they become attractive, and said he prefers largecap stocks over midcaps citing valuations.

Watch Here: Foreign investors persistently disappointed by India’s lack of growth, says Ridham Desai

Edited Excerpt:

Q: What is the mood there? Is it very positive on India? How long do we wait for earnings growth kind of mood. Just describe what people are talking there?

A: It’s still early for me to judge that because we are just about starting. I haven’t chatted with anyone but the data is right in front of us; foreign investors have been pulling money out of India. Their overweight position on India has declined. We are at 2011 levels.

They are still overweight but it has come down significantly. So you can tell that they have been persistently disappointed by India’s lack of growth and they are stepping aside.

So I do not think I expect to hear anything different. Investors continue to be focused on bottom up ideas but on a top down basis they are finding a lot of other markets attractive and therefore India has kind of underperformed all through 2017.

It has gone a little bit up and down surprisingly in the month of May and counterintuitively India outperformed emerging markets. So let’s see how that pans out. My view is that India will outperform for the rest of the year.

Q: This earnings growth of 15 percent has been a mirage for the longest time. Everyone starts the year with 15 percent projection and scales it down to single digit by the time the year comes to an end. Do you think this time would be the same?

A: That is what happened in the late 90s and early part of 2000s and then again it happened for the last seven years; we have been in deep earnings recession.

This has been the worst earnings recession in India’s history. The drawdown in earnings from the top to the trough has been in excess of 20 percent – that exceeds previous earnings recessions, but also remember that between 2004 and 2008 analysts started the year with a forecast of 15 percent but we got 30 percent.

History tells us when the earning cycle turns we will underestimate the earnings and when the earning cycle is going down we tend to overestimate earnings.

So we have been in that kind of pattern for the past few years. Our view was, two years ago, that we may have hit the trough of earnings but then we got hit by the impact of demonetisation and then a little bit of an impact of goods and services tax (GST) and so that view has really not panned out. So we are also guilty of having overestimated earnings.

I feel now we have kind of come to a bottom. Revenue growth has been accelerating for the past six quarters and even for this quarter the revenue growth for various cuts of the market is somewhere between 12 and 15 percent. So that is a very robust revenue growth.

What has not happened as yet is that margins have not recovered and bulk of this pressure is in corporate banks. So if you ex out the corporate banks then earnings have inflected already in the upward direction. If the headline number that is still little bit short of requirement but the underlying moment in growth has turned.

So we have been all guilty of having overestimated this. The market has been looking forward. It has not troubled the market though India has underperformed for this very reason because emerging market growth has been superior to India.

Q: Do you think then this could be the year of reckoning. The year when people underestimate and things fire up simply because the RBI’s recent circular forces the last gush of dearth from corporate lending banks. As you pointed out the Q4 clearly showed consumption uptick which was beyond many analyst expectations?

A: I think growth is shaping up well, government investment is approaching all-time highs, consumption has recovered, we are seeing recovery in exports and that has sustained for a while and global growth seems to be in good shape, so there is less to worry about exports and our view is that the private capex cycle is also about to turn.

We just completed a survey of 200 companies and we published a report. We suggest that going forward into the next 12 months private capex will recover and in fact corporate sentiment, we have been doing this survey for six years, is at its best that it has been in the last six years.

So companies are quite optimistic about their prospects over the next 12-24 months. They have seen capacity utilisation rise. They are expecting capacity utilisation this year to be 83 percent. If you add another 6-7 percent growth, you go into the 90s; it takes two or three years for new capacity to come on-stream.

So very soon on the aggregate companies will be struggling for capacity. So they will have to put capex into place. So I would think that all the growth drivers are in place. The point is where the profit starts gaining share in GDP and again I am probably going to be of the view that maybe it has and we are hoping and expecting that earnings growth will turn.

Q: If the growth drivers are all in place and the earning story is expected to pick up, what is it that is disappointing foreign investors. You did start off the conversation by saying that the overweight on India has come down significantly. Do you think that is going to change anytime soon?

A: That is because on a relative basis India has underperformed in terms of growth until now. If that changes over the next 12 months then foreign investors will be back. I think it may because emerging market growth may not be as good as India.

India has relatively underperformed in terms of growth. So that may change in the next 12-18 months, but there are lots of other issues in India which foreign investors are worried about. So it is not just about earnings growth. They are worried about politics, they are worried about oil and they are worried about a slew of factors which is causing their sentiment to be a bit off-color.

Q: You are the big picture, medium and long-term guy but we are really puzzled by the underperformance of India in the last two-three days. The bypoll results day we didn’t do all that badly but Friday we fell and yesterday was really bad. We saw Wall Street kicking up in Friday (June 1) because of good jobs data. We saw all of Asia in a blaze of green yesterday. Our underperformance just stood out especially the midcaps. Year-to-date we are 11 percent down on midcaps. What is niggling this sector? What is niggling India now, in the last week or two?

A: Specifically on midcaps, here is the story; last year India’s smallcap index was up more than 60 percent in US dollar terms – that makes it the best performing index in the whole world by quite a margin and we track about 140 odd indices around the world. The smallcap index was roaring last year. Now we are seeing a bit of a pullback because valuations had become quite rich, midcaps were trading at par with largecaps; they usually don’t, they trade at a slight discount.

Since the last quarter of last year we were cautious on midcaps and yet midcaps were running away. Then we started correcting in January and that drawdown that we saw, I think and again I am talking short-term, didn’t really complete its course and I didn’t sense that we got capitulation.

So maybe now there is a bit of a capitulation happening and at some point in time mid and smallcap may find a trough but for the rest of the year it still looks like largecaps will do better than midcaps because the valuation adjustment has not yet been completed.

So to my mind it is largely to do with valuations that midcaps will become too rich. When I spoke to investors around me and even when I question myself about whether I was willing to buy a certain stock at that price which it was trading at at the end of December, the answer was no.

It just is too rich and it needs to come down and that answer became a no for a lot of people and then the liquidity goes away and then the force of the bid vanishes and that is how share prices fall and then it doesn’t come back to fair value. It usually goes below fair value and that is what we are probably going to witness over the next few months.

Q: I must say your tone has become a lot more somber than what it was the last time we spoke. I remember you being one of the most bullish guys on the street.

A: No. I will remind you in February we had a pre-Budget discussion at the Bombay Stock Exchange (BSE), you pressed me for my BSE target and I kept saying it is a very ordinary year.

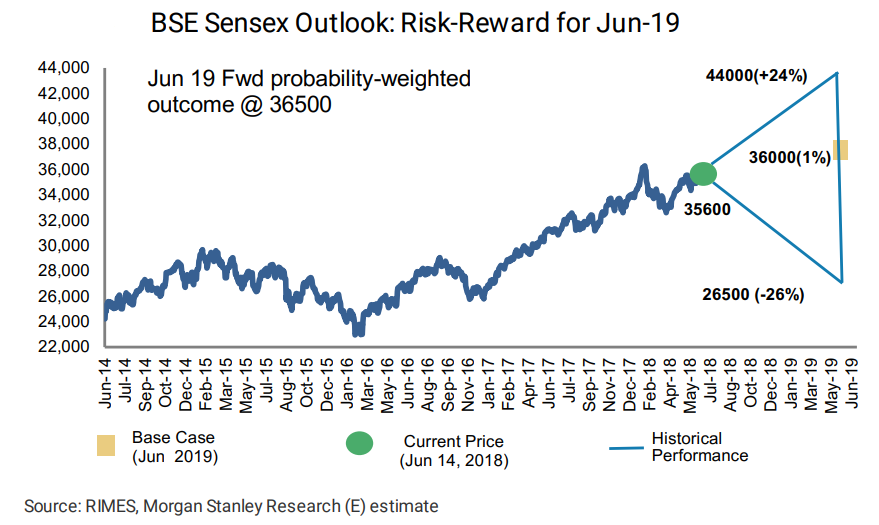

It was a very modest return year and that is what we are forecasting. At that time my index target was 35,500 for December and today it is 36,000 for next June. So we are really not looking at a runaway market even though growth is looking actually quite good.

We think the market is likely consolidating in a range, hopefully it does not go down a lot, it could if things turn really bad, but I think it is probably operating in this range where it goes up and down a bit all the while.

Q: Let us take a few specific issues. How painful are higher yields? Year-to-date (YTD) across the curve, one year CPs or even one year G-Secs to 10-year, 30-year G-Secs, yields have risen by about 140 basis points. Is this very painful or will growth overcome this as well?

A: One of the striking differences between the rise in yields in India versus say the US until recently was that in the US the yield curve was flattening. So the short end was rising faster than the long end.

In India the yield curve was steepening, so the long end was rising faster than the short end and that I think suggested that the bond markets had started to believe that growth is back and maybe there is a bit of inflation risk as we go into the second half of this year.

That is not necessarily a bad picture for equities. What happens is that when this inflexion point takes place, there is no doubt some volatility which we have been experiencing for a while now, and the market is digesting these higher yields.

However, per se I do not think higher yields are negative. The reason behind rising yields is more important. In 2013 when yields rose, it was because India faced macro stability risk; that was bad for equities. Today it is not because of macro stability risk.

In fact I would actually opine that macro stability in India right now is quite the best as we have ever been which is why we are not so perturbed about rising oil from a macro perspective.

The stock markets may worry about it, but I do not think it is such big macro risk. Had this happened say five years ago, it would have already created a much bigger currency depreciation.

Again, on the point on currency, a lot of people see the headline INR-USD and think the rupee is depreciating. Last month the rupee was the seventh best performing currency in the world. So it is not like we are underperforming on the currency because of oil.

We are certainly not underperforming. So I think macro stability is good, but bond yields rising does produce underlying volatility because of the sudden rise and that I think will persist for a while until the market has digested these higher yields.

However, I think higher yields are here to stay because growth is turning and while you have not asked the question, I am anticipating your next question, which is will the Reserve Bank of India (RBI) hike, and I think at some point in this year, later this year, there is a hike coming because growth will be strong and the RBIs tolerance for inflation is pretty low because they have a mandate. So I think that is also inevitable.

These are not bad things for the equity markets. Even between 2004 and 2007, yields were rising. Stock markets went up a lot, it was essentially because growth was coming back.

Q: I was also going to ask you how will that change your stock picking, do you move away from NBFCs, do you move away from only aggressive NBFCs, only from less collateralised NBFC lending, how does it influence your stock picking?

A: Actually higher yields will not necessarily impede loan growth. So, in my view, loan growth is actually coming back because there is greater demand for leveraging, both on corporate balance sheet as well as on consumer balance sheet. So, those who have well-capitalised balance sheets, I think will be fine.

What you have to worry about is the undercapitalised NBFCs. So those are the ones I think that will be vulnerable to multiple compression.

So that would be my response to you; I think you will need to look at the capital on their balance sheet and if the capital is adequate, the NBFCs will be fine.

Q: Since we are talking about stocks and sectors, I went through this really nice piece you had written on digital media about how to be an ace stock picker and in that you point out a certain virtues which are rare to find in this market, I mean mote, good governance, supportive macros, reasonable price; I have not seen that combination in a while. However, are there still themes, stocks, sectors where you can sort of get this list?

A: There are always stocks in the market. 1,500 stocks trade daily in the National Stock Exchange (NSE) and every day I am surprised to find five or six stocks that were ignored by the market which look like they have good mote, reasonable valuations, and decent managements. So there are always stocks for people to pick.

The problem is the size of money that you have to put to work. So if you are a high net-worth investor, which I suspect you may be, then it becomes a problem because then it may not be necessary that you find liquid enough stocks at all points in time. So that is a challenge.

For example, let us examine this point. Because of the successive disappointment on growth, the market has certainly ended up overpaying for certain businesses which have very high motes around them. Now growth is certainly going to be good for India over the next 10-12 years, and these businesses should do well.

However, may be they are already pricing in as far as share prices are concerned and therefore you have to be careful because the road to making money is not about just buying good businesses, it is about buying good businesses at a reasonable price and that has been our strategy.

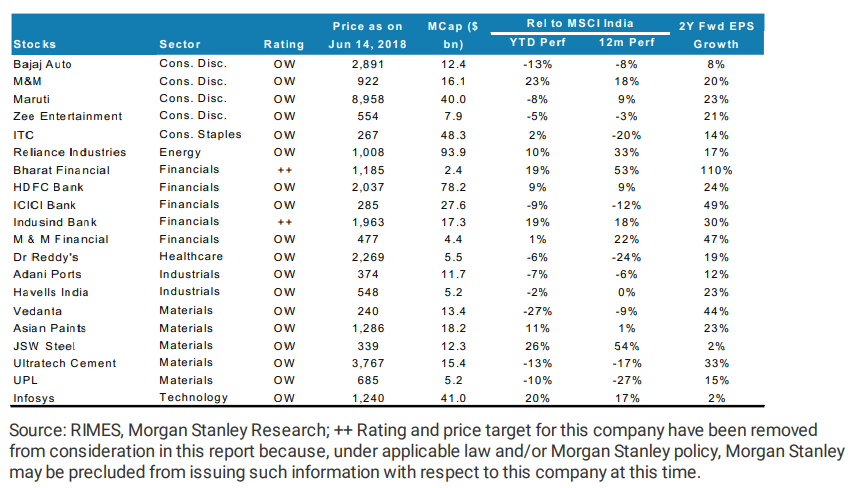

So do I have such businesses in the Nifty? I think there are plenty – the private sector banks, the auto stocks, even some consumer names, I think represent this description of businesses with good motes, decent managements, and reasonable prices.

There are quite a few liquid largecap stocks that are available, in fact there are more liquid largecap stocks than reasonably sized midcap stocks in the market right now that fits this description.

Q: Therefore you would think the accent, the preference should be for larger stocks now, Nifty set outperform midcaps?

A: Yes, I think so. I think at least until the midcap valuations have entered into what I would term as attractive territory which is say a 20-30 percent discount to largecaps and of course I am here, I am talking about aggregate numbers, it does not necessarily apply to individual stocks because individual stocks do their own thing.

However, I think the market has given up on growth last month. It is looking very suspicious of growth, it is anchoring itself with quality, quality looks quite richly valued, I would worry about buying so called high quality stocks at these valuations.

I think you need to take a little bit of risk, buy cyclicals, and buy stocks that are not so expensive because there is less clarity on growth and those may probably be the ones that will outperform in the next 12 months.

Q: I know you do not want to comment on individual stocks, but I just have to ask you because this is become such a big issue. I see ICICI Bank in your focus list, I wanted your thoughts on what you have made of this whole Chanda Kochhar issue and if there is a cleanup which eventually there will be, is it sort of a big positive for shareholders?

A: You gave me my exit at the start of that question. So I do not wish to comment on individual stocks, but I will make a comment on corporate banks. I think corporate banks have had a rough ride over the last five years, the loan cycle which ended in 2010 has left a lot of pain on their balance sheets. I think we are nearing the end of that pain. A lot of provisioning has been done, and I think the NPL cycle may have ended.

So we may be in the last leg of write offs and to that extent I think bunch of these stocks actually represent good value for investors who want to take a say one year call or a two year call on the market. So, for that reason, we are actually quite bullish on corporate banks.

Q: Where does politics fit in all this, the bypolls are indicating that perhaps the ruling party will not come back with the same majority. A lot of people will tell us that we should not read too much, should not extrapolate, but nevertheless, hypothetically if the market worries about it, will that be a cap or will that be overridden by earnings?

A: I think there is one big difference going into 2019 elections versus any of the elections of the last 30 years and the difference is that the market has to deal with the possibility and note I use the word ‘possibility’ and not ‘probability’ because I do not know, the possibility that the next government does not have the same strong mandate as the outgoing government.

Now that has not happened since 1985 because after 1985, the market has always gone to elections hoping for a stronger government because India has had a successive coalition government right through this period. So we all know that this was the first absolute majority government since 1985. So there is that chance and we do not know what that chance is.

Now depending on how the market starts factoring the percentage or the probability, I think it will affect how share prices behave.

So there is a chance here that the market starts believing that we will not get a majority government, that it will be a fragmented mandate, and it may even go to the extent of believing it is a fractured mandate and if it goes to that extreme, then I think share prices will struggle.

Then of course depending on what the actual mandate is, we will get reaction next May. So that is clearly a problem.

Now what do investors do? So I think as far as politics is concerned, and I do not claim to be an expert on politics, there are three things that we observe. The first is oddly, maybe not oddly, but in fact not surprisingly I should say, growth leads election results and the performance of incumbent government by about 15 months.

So we call this a force of incumbency which is if an incumbent government needs to win, it needs to have delivered growth about 15 months ahead of the elections.

So we are now I think entering into a kind of a growth uptrend which augurs well for the incumbent. However, having said that, the strength of this growth cycle is not as good as for the incumbent to be absolutely comfortable that it is a done deal.

The second thing I think which again has affected the way the bypolls have behaved and I think that will be a very crucial factor going into 2019, is pre-poll alliances. Now two states matter there, Uttar Pradesh and Maharashtra, because these are the two states where the electorate is fairly fragmented and pre-poll alliances can swing the seats.

Now remember, BJP has 94 out of the 128 seats in Uttar Pradesh and Maharashtra right now, so, I think we have to be very careful about how pre-poll alliances happen and that could have a telling impact on how election results will shape up. So I think these are the two factors.

The third thing which I think often is ignored by the media is what is happening on direct benefits transfer (DBT). So for the past four years, the government has spent a lot of energy and resources on building the DBT and Aadhaar platform and over the past 12 months, we have had a staggering Rs 2 lakh crore of transfers that have taken place.

I think this number probably goes up 50 percent in the next 12 months because fertiliser is now part of DBT. That is an enormous amount of transfer that is happening to poor people and I think it is going to have some impact on how people behave in the polling booths when they come in next year.

So let see how this goes. Forecasting elections is slightly worse than forecasting share prices, but both of them are in the same realm of complex systems and should not actually be forecasted, but yet of course we do that because we have a livelihood to earn. However, the warning is that complex systems should not be forecasted. So let us see how it goes.

Q: Coming back to the forecast which is easier for you to do, you said you have a base case of 36,000 for the Sensex by the end of the year, what about the bear case, do you think the decks are stacked up for the 2008 kind of fall at all or are we worrying too early?

A: I am going to guarantee you that I am going to be terribly wrong on this index forecast.

Point forecasts are stupid to make. I like to focus on the range and there is a big range here and I have seen some comments especially in social media criticising me for this wide range that I have on the Sensex, which goes from 25,000 to 40,000 and somebody said that with that type of range, I will never be wrong.

But the fact is that we could be dealing with a pretty wide range going into 2019 and it could be a year in which the market does a fair bit of swinging up and down depending on how it starts believing the election results will be. So at various points in time, with various data points, the view on the elections will change and the market will do its jig.

If you go back, 30 years on a 12-months rolling basis, the Sensex on an average does about a 40 percent swing. We haven’t had that since 2014. The Sensex has been a very well behaved person and has not been oscillating as it usually does. So could this be the year in which it does that oscillation? I think it is possible and we could get that bit of oscillation.

So yes, you point out my forecast of 36,000, which I said sometime during the show, that I think is going to go terribly wrong. So keep that in mind but I think the range is something that we should work with.

If things get optimistic, I think the market could go up 10-15 percent but if it doesn’t then I think we could be in for a 15 percent correction.

Q: Whether voters keep the faith with the current government or not, do you think investors will keep the faith with mutual funds? Are we going to see this robust flow continue?

A: I think the cat is out of the bag. We are seeing a structural shift in India. Equities is becoming an honourable asset class and I think investors will continue to put money into this asset class.

This is not speculative money, I think this is real investment that is happening. So this run-rate of $2-2.5 billion looks like par for the course. It could go up or down a little bit but I think that is the average number that we should see.

I believe that next three-four years, the numbers will grow, retirement funds are putting in money into equity markets, they didn’t do that before, I think that will also grow.

That may experience geometric progression, so I call this the 401K moment for India. In 1980, the US administration had created a rule set which basically caused 401K accounts which hare retirement accounts of US employees to start putting money into equities and in the subsequent 20 years, we saw big boom in domestic mutual funds in America, I would safely say that we are on that path for the next 20 years. So we should see a very big boom in equity flows.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter