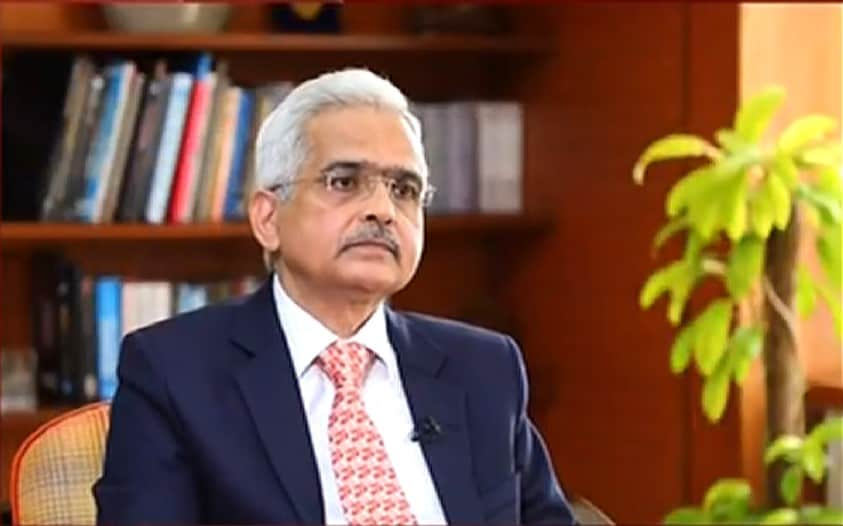

RBI to hold rates, guidance on liquidity crucial

Summary

All 60 forecasters in a Reuters poll said they see no change in the repo rate on October 8. and though price pressures have soared due to rising fuel prices the RBI is only expected to raise the repo rate in April-June 2022.

India’s monetary policy committee is widely expected to keep the repo rate unchanged to support recovering growth on Friday, but some analysts have cited a slim chance of the Reserve Bank of India delivering a token increase in the reverse repo rate.

All 60 forecasters in a Reuters poll said they see no change in the repo rate on Oct. 8. and though price pressures have soared due to rising fuel prices the RBI is only expected to raise the repo rate in April-June 2022.

“At the upcoming policy meet, we do not expect surprises on the policy rate front at a time when the economy is expected to see the much-awaited boost in consumption triggered by festive demand,” Madan Sabnavis, chief economist at CARE ratings wrote.

“While the possibility of increasing the reverse repo rate cannot be ruled out, it looks unlikely to be a part of this statement,” he added.

In the minutes of the previous policy meeting in August, external member Jayant Varma argued for the need to raise the reverse repo rate to check growing inflationary pressures.

However, RBI Deputy Governor Michael Patra said in a speech in September that inflationary pressures were still being driven by supply shocks and would ease only gradually.

Talk of an outside chance of a reverse repo hike has grown in recent days after the RBI set higher-than-expected cut-offs at the variable rate reverse repo auctions, which traders saw as a sign of the RBI’s discomfort with exiting low yield levels.

The repo rate, after being cut by 115 basis points (bps) in early 2020, has been held at a record low of 4% since May 2020, while the reverse repo rate was reduced by 155 bps to 3.35%.

Inflation as per the latest poll is forecast to be well above RBI’s medium-term target of 4%, but was projected to remain below the 6% upper threshold until at least end-2024.

Traders will closely monitor RBI’s guidance on liquidity withdrawal with surplus cash in the banking system having topped 10 trillion rupees ($134 billion) in recent weeks.

“Given the flush liquidity in the system, there are clearly reduced chances of the RBI announcing another GSAP (government securities acquisition programme) for the next quarter,” said Arun Srinivasan, head of fixed income at ICICI Prudential Life Insurance.

“Even if the RBI does make the announcement, it will be in the form of operation twists which the RBI has resorted to recently,” he added.

($1 = 74.6360 Indian rupees)

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter