Six stocks that are likely to underperform as per one report

Summary

Potential downsides in the list of underperforming stocks ranges from 20 percent to as high as 35 percent.

Brokerage firm Jefferies has highlighted six stocks that it expects to underperform with potential downside ranging between 20 percent to as high as 35 percent.

The six names that emerge from across sectors like IT, Auto, Finance, Consumer, and Capital Goods, include Coforge, Bharat Forge, Mahindra & Mahindra Finance, Cummins India, Asian Paints, and Tata Power.

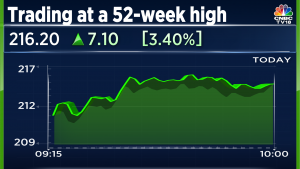

Incidentally, Mahindra & Mahindra Finance hit a 52-week high only on Monday, while Cummins India and Bharat Forge have also scaled their 52-week high levels in recent times.

Here’s Jefferies’ rationale behind each of them:

Coforge

- Rating: Underperform

- Price Target: Rs 3,340

- Potential Downside: 21 percent

Amidst deteriorating macroeconomic conditions, Jefferies expects a sharp moderation in Coforge’s revenue growth from 21 percent year-on-year to just 12 percent in financial year 2024. A recessionary environment leads to higher revenue risk for mid-sized players, given their greater share of discretionary products, according to Jefferies.

Nearly 70 percent of Coforge’s clients are below the $1 million mark, putting it at a high risk in case of a demand slowdown and possible vendor consolidation.

Challenges in Europe are another drawback for Coforge as nearly 40 percent of its revenue in the first half of the current financial year came from the continent. Despite the correction seen by the stock, Jefferies finds its valuations to be rich.

Other Factors:

- Lack of large deals may limit margin expansion

- Winning large deals may become more difficult in case of a demand slowdown

- Added overhang of a promoter stake sale. Barrings holds 40 percent stake in the company

Bharat Forge

- Rating: Underperform

- Price Target: Rs 555

- Potential Downside: 35 percent

Jefferies expects the weak US economic outlook to hurt truck demand. This was evident as class 8 truck orders declined for the second straight month in November.

The brokerage also expects the company’s export revenue growth to moderate to 18 percent this year and just 4 percent in the next financial year. However, it expects healthy domestic revenue growth led by trucks, passenger vehicles and industrials. Jefferies also expects a ramp-up in Electric Vehicle orders.

A large defence order is a key potential upside risk to Bharat Forge’s earnings, according to Jefferies.

Other Factors:

- Stock peaked 5-10 months before the peak consensus earnings estimates in the last two upturns

- Estimates are still 16 percent below consensus

- Valuations expensive even with potential for domestic artillery gun order

Mahindra & Mahindra Finance

- Rating: Underperform

- Price Target: Rs 175

- Potential Downside: 23 percent

Jefferies expects margin at M&M Financial to surprise negatively as it expects yields to moderate due to strong disbursements in lower yielding products. It also expects funding costs to rise as the full impact of higher interest rates is reflected in the cost of funds.

The brokerage termed the company’s asset quality improvement as one led by settlements and write-offs and not due to any meaningful improvement in collections.

In an interaction with CNBC-TV18, M&M Financial’s Ramesh Iyer said that the company has a target of 2.5 percent Return on Assets (RoA) for 2025, adding that rural cash flows have improved.

The stock hit a 52-week high on Monday after its November business update.

Other Factors:

- Believe divergence should gradually widen

- Credit costs could stay elevated due to higher write-offs and settlement losses

- Valuations are unattractive due to subdued RoE outlook over this year to financial year 2025.

Asian Paints

- Rating: Underperform

- Price Target: Rs 2,530

- Potential Downside: 20 percent

Grasim’s foray into the paints business and the large capex announcement by financial year 2025 has pushed Jefferies to declare this as a “Jio moment” for the paint industry.

An aggressive pricing or otherwise strategy from Grasim may disturb the market structure and have a greater impact on smaller players, according to Jefferies. However, Asian Paints is also at risk.

The entry of players like Grasim, JK Cement, Astral and Infra.market has shaken the oligopolistic structure of the Indian paints industry.

Jefferies believes that Asian Paints’ current valuations do not factor in the overhang from Grasim and that their risk-reward is unfavourable.

Cummins India

- Rating: Underperform

- Price Target: Rs 1,030

- Potential Downside: 29 percent

Jefferies has cited aggressive competition from global major Perkins, which set up its India factory in 2016, and weakening pricing power behind its underperform rating on Cummins.

The brokerage expects Cummins’ return ratios to bear the brunt of demand overestimation, capping its RoE to 18-20 percent levels, despite the recovery in the current financial year.

The current price target of Rs 1,030 reflects no earnings growth over this financial year and the next.

Tata Power

- Rating: Underperform

- Price Target: Rs 180

- Potential Downside: 20 percent

The management of Tata Power had outlined a plan to double its RoE to 12 percent by financial year 2025. However, Jefferies is concerned that competition and capex will keep the RoE below 14 percent in the medium-term.

The brokerage further states that peak positive newsflow for Tata Power is behind as asset monetisation of the company has disappointed the street.

Resolution of the Mundra tariff hike is not seeing a favourable stance from State Electricity Boards (SEBs) either.

Jefferies’ price target values the stock at 15.9 times price-to-earnings for September 2024, given the limited growth expectations ex-coal, along with muted return ratios.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter