Metal stocks under pressure, Nifty Metal down 3.7%

Summary

The Nifty Metal Index has fallen nearly 7 percent in the last one month amid a decline in the broader markets. The Nifty 50 index has also fallen 5.8 percent during this period.

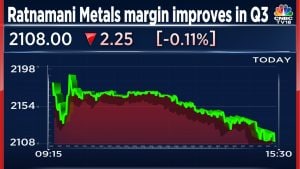

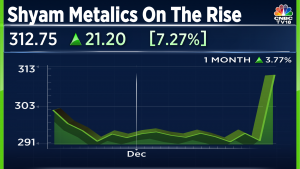

Metal stocks were under selling pressure on Thursday amid weak domestic cues, with the Nifty Metal Index falling as much as 3.7 percent in intraday trade. At 11:30 am on Thursday, of the 15 constituents of the Nifty Metal Index, all were trading in red except Hindustan Zinc Ltd, which was up 2 percent.

Among the biggest losers were Hindalco Industries Ltd (down 4.7 percent), Jindal Steel and Power Ltd (down 3.4 percent), Tata Steel Ltd (down 3.2 percent) and National Aluminium Co. Ltd (down 2.8 percent).

Other metal stocks that took a hit included Steel Authority of India Ltd (SAIL, down 2.2 percent), Hindustan Copper Ltd (down 2 percent) and JSW Steel Ltd (down 2.5 percent).

Notably, the Nifty Metal Index has fallen nearly 7 percent in the last one month amid a decline in the broader markets. The Nifty 50 index has also fallen 5.8 percent during this period.

In an interaction with CNBC-TV18 on Thursday, ICICI Securities analyst Amit Dixit said that there was some fear of recession in the metal sector, particularly in the non-ferrous space.

He pointed that all the metal mining stocks were trading nearly 13 to 15 percent lower than their historical valuation band.

ALSO READ | Trident shares fall over 3% to hit fresh 52-week low

“We are more cautious on the non-ferrous space compared to the ferrous one,….of course, macro risk notwithstanding, we believe that in case of metals, particularly ferrous, things look to be bottoming out,” said Dixit.

On the steel sector, Dixit said that the companies that are focused more on exports will benefit going ahead.

“If you talk about the (preference) order – JSPL, followed by Tata Steel, followed by JSW Steel,” he added.

Meanwhile, leading global analytics company CRISIL Ltd in a report on Thursday said that the domestic steel sector may be one of the beneficiaries of production-linked investment (PLI) schemes in the next fiscal year as it is expected to push investments in the space. This may augur well for the steel stocks in the near to medium term.

ALSO READ | Future Retail hits upper circuit after Kishore Biyani withdraws resignation

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter