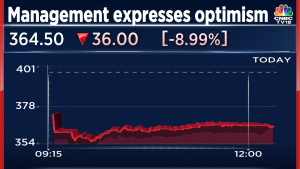

LIC Housing Finance falls over 12% after weak show but management optimistic about Q3

Summary

LIC Housing Finance’s net profit was up, but the key profitability metric, net interest margin as well as net interest income and individual loan disbursements declined.

Shares of LIC Housing Finance slumped as much as 12.8 percent on Wednesday, a day after the company announced a 23 percent year-on-year growth in net profit at Rs 305 crore for the September quarter.

Though net profit was up, the key profitability metric, net interest margin — the difference between what it earns from lending and what it spends in cost of funds — stood at 1.80 percent, down from 2 percent a year ago. The NIM declined 2.54 percent quarter-on-quarter. Its net interest income, as well as individual loan disbursements, declined.

But Y Viswanatha Gowd, MD & CEO of LIC Housing Finance, told CNBC-TV18 in an interaction that the net interest margin would see improvement in the coming quarters. “We are confident that in the quarters to come, there will definitely be revenue improvement beyond what we have planned,” he said.

Gowd also said that the company was very sure and confident of achieving 15 percent growth in the loan book for FY23.

“Quarter three, we were very optimistic with all the targets set for the people down the line for our disbursements and the recovery. I am very sure that the results for the quarter three should be far, far better than the current one on all fronts,” he said.

Also Read: Karnataka Bank shares at 52-week high after best single-day gain in 17 years

The net interest income of the subsidiary of the country’s largest insurer, LIC, declined marginally by 0.4 percent year-on-year in the September quarter to Rs 1,12.9 crore but was down 27.8 percent quarter-on-quarter.

Here is a look at the firm’s loan disbursements:

| Particulars (Rs crore) | Q2FY23 | Q2FY22 | Q1FY23 | YOY | QOQ |

| Disbursements | 16,786 | 16,110 | 15,201 | 4.2 | 10.43 |

| Individual disbursements | 14,300 | 14,330 | 13,131 | -0.21 | 8.9 |

| Developer disbursements | 407 | 353 | 309 | 15.3 | 31.72 |

| Other disbursements | 2,079 | 1,427 | 1,761 | 45.69 | 18.06 |

The company said its provisions rose to Rs 6,522 crore on an expected credit loss basis and provision coverage ratio at 44 percent for stage three accounts as against Rs 5,355 crore in September 2021.

The stage three exposure on default declined to 4.9 percent from 5.1 percent in September 2021 and almost five percent in June 2022.

The firm’s shares were trading 9.5 percent lower on BSE at Rs 362.4 at 11:04 am.

Catch latest market updates with CNBCTV18.com’s blog

With inputs from PTI

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter