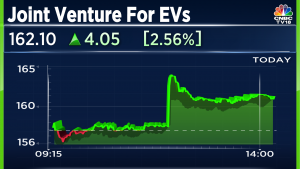

IndianOil, L&T and ReNew to form JV for development of Green Hydrogen Business

KV Prasad Jun 13, 2022, 06:35 AM IST (Published)

Listen to the Article (6 Minutes)

Listen to the Article (6 Minutes)

Summary

Additionally, IndianOil and L&T have signed a binding term sheet to form a JV with equity participation to manufacture and sell Electrolyzers used in the production of Green Hydrogen.

Indian Oil Corporation (IOC), Larsen & Toubro (L&T), and ReNew Power on Monday announced a joint venture (JV) to develop the nascent green hydrogen sector in India to enable decarbonisation push.

The tripartite venture brings together the strong credentials of L&T executing engineering, procurement, and construction projects, and IOC’s expertise in petroleum refining along with its presence across the energy spectrum, the companies said in a filing. ReNew Power will bring in its expertise in offering and developing utility-scale renewable energy solutions.

IOC and L&T have also signed a binding term sheet to form a JV with equity participation to manufacture and sell electrolysers, which use electricity to split water into hydrogen and oxygen and are used to produce green hydrogen.

Speaking about the joint venture, SN Subrahmanyan, CEO and MD, L&T, said, “India plans to rapidly march ahead in its decarbonisation efforts and production of green hydrogen is key in this endeavour.”

“We consider this partnership as a significant step in India’s quest for alternative energy. These JVs aim to enable the nation’s ‘Aatmanirbhar Bharat’ mission to rapidly build, expand and bring in economies of scale to make green hydrogen a cost-effective energy carrier and a chemical feedstock for many sectors,” Subrahmanyan said.

IOC chairman Shrikant Madhav Vaidya said the company was committed to powering India’s drive towards carbon neutrality by leveraging the power of green hydrogen.

“IOC is forging this alliance to realise India’s green hydrogen aspirations, which is in sync with the Prime Minister’s vision of making India a green hydrogen generation and export hub,” Vaidya said.

“To start with, this partnership will focus on green hydrogen projects at our Mathura and Panipat refineries. Alongside, other green hydrogen projects in India will also be evaluated. While the usage of hydrogen in the mobility sector will take its due time, the refineries will be the pivot around which India’s green hydrogen revolution will materialise substantially,” Vaidya said.

Also Read | All you need to know about National Hydrogen Policy (first phase)

Sumant Sinha, chairman and CEO of ReNew Power, said ReNew looks forward to working with L&T and IOC to build the green hydrogen business in India in alignment with the government’ broader strategic climate goals for 2030 and 2070.

“ReNew is well poised to complement the capabilities of our partners. The timing for these proposed JVs is excellent as they will help support the government of India’s recently-announced green hydrogen policy to boost India Inc’s decarbonisation journey,” Sinha said.

The planned JVs aim to enable India’s transition from a grey hydrogen economy to a greener economy that increasingly manufactures hydrogen via electrolysis powered by renewable energy.

In February, the government notified the first phase of green hydrogen policy aimed at boosting the production of green hydrogen and green ammonia. With the ever-increasing oil and gas import bills for countries like India, green hydrogen can help provide crucial energy security by reducing the overall dependence on imported fossil fuels.

Also Read | Green hydrogen push: Govt plans Rs 15,000 crore PLI scheme for electrolyser manufacturing

While nearly all hydrogen produced in India today is grey, it is estimated that the demand for hydrogen will be 12 MMT by 2030 and around 40 percent of the element produced in the country (around 5 MMT) will be green, as per the draft National Hydrogen Mission guidelines.

By 2050, nearly 80 percent of India’s hydrogen is projected to be ‘green’ — produced by renewable electricity and electrolysis. Green hydrogen may become the most competitive route for hydrogen production by around 2030.

This may be driven by potential cost declines in key production technologies and clean energy technologies such as solar PV and wind turbines.

Today, hydrogen is mainly used in the refining, steel and fertiliser sectors, which will focus on the JVs’ initial efforts. The country’s refining sector consumes approximately 2 MMT of grey hydrogen every year, with IndianOil owning one of the largest shares of its refining output.

To help decarbonise the Indian industry, the new green hydrogen policy provides for the waiver of inter state transmission charges for a period of 25 years and a banking provision of up to 30 days, which will help reduce the cost of green hydrogen significantly. This will, therefore, push the replacement of grey hydrogen with green. The Ministry of Power has also provided a single -window-clearance portal for all clearances and open access on priority to green hydrogen projects.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

KV Prasad Journo follow politics, process in Parliament and US Congress. Former Congressional APSA-Fulbright Fellow

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter