Jamie Dimon, Tim Cook, Jeff Bezos attend Joe Biden’s state dinner for Japan’s Fumio Kishida

Summary

JPMorgan Chase & Co.’s Jamie Dimon, Larry Fink of Blackrock Inc., Apple Inc.’s Tim Cook and Jeff Bezos of Amazon.com Inc. were among the business leaders attending the event, part of a guest list that highlighted the ties between the US and Asia’s second-largest economy.

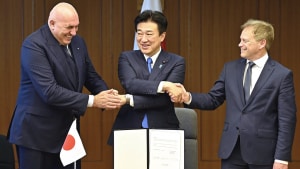

Leading technology, finance, and media executives gathered at the White House Wednesday for a state dinner honoring Japanese Prime Minister Fumio Kishida, as US President Joe Biden looked to bolster security and economic ties between the two allies with the star-studded celebration.

JPMorgan Chase & Co.’s Jamie Dimon, Larry Fink of Blackrock Inc., Apple Inc.’s Tim Cook and Jeff Bezos of Amazon.com Inc. were among the business leaders attending the event, part of a guest list that highlighted the ties between the US and Asia’s second-largest economy.

Jon Gray of Blackstone Inc., Neil Bluhm, chairman of Rush Street Interactive Inc., International Business Machines Corp. CEO Arvind Krishna, SoftBank chief Masayoshi Son and former Mitsubishi Corp. Chairman Ken Kobayashi are also attending.

Attendees are feasting on a three-course meal that includes house-cured salmon and dry-aged ribeye steak, paired with wines from Washington state and Oregon. While Kishida’s arrival missed the peak bloom of Washington’s cherry trees, many originally gifted to the US by Japan, celebrations of spring dominated the dinner with decorations of butterflies, Japanese gardens, and an artistic depiction of a koi pond. Guests will be entertained by American singer-songwriter Paul Simon.

Many of the attendees nodded to the defense issues that largely dominated Kishida and Biden’s meetings Wednesday — the first official visit by a Japanese leader since 2015 — as the leaders sought to cement their military ties in the Indo-Pacific with an eye to countering China’s growing influence in the region and increasingly assertive behavior. But the visit also saw the leaders unveil a number of initiatives to strengthen partnerships and investment in technology.

Prominent executives from Silicon Valley along with Cook and Bezos included Microsoft Corp. President Brad Smith, whose company announced Tuesday it will invest $2.9 billion over the next two years to boost its hyperscale cloud computing and artificial intelligence infrastructure in Japan.

Sanjay Mehrotra of Micron Technology Inc. and Megan Myungwon Lee, chairwoman of Panasonic Corp. of North America are also attending, alongside Los Angeles Dodgers chairman and CEO of Guggenheim Partners Mark Walter.

Biden also invited two prominent labor allies — David McCall, president of the United Steelworkers and Shawn Fain of the United Auto Workers Union. McCall’s union is opposing a politically contentious deal for Japan’s Nippon Steel Corp. to acquire United States Steel Corp. The high-profile bid has sparked an election-year firestorm with Biden earlier Wednesday reiterating his support for US workers who seek greater concessions in a possible deal.

Kishida has encouraged US investment in Japan around key technologies such as semiconductors, AI and quantum computing, during a luncheon Tuesday in Washington with business executives including Gary Cohn, vice chairman at IBM, and a onetime chief economic adviser to former President Donald Trump, Biden’s general-election rival. Also at that lunch were Pfizer Inc. Chief Executive Officer Albert Bourla, Boeing Co. defense chief Ted Colbert, and Western Digital Corp. CEO David Goeckeler.

Among the celebrities who scored coveted invitations to the state dinner are actor Robert De Niro and Olympic medalist Kristi Yamaguchi. Former President Bill Clinton and Hillary Clinton are also attending along with Treasury Secretary Janet Yellen, Federal Reserve Chairman Jay Powell and New York Governor Kathy Hochul. Also attending is Cecile Richards, the former president of Planned Parenthood.

Biden’s list also includes a number of prominent donors, including Fred Eychaner, Mindy Gray and Michael Sacks, chairman of Grosvenor Capital Management. Sacks hosted a fundraiser for Biden earlier this week in Chicago.

Also Read: India, China should urgently address ‘prolonged situation’ on borders, PM Modi says

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter