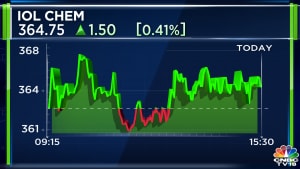

IOL Chemicals surges 12% on CDE China nod for antidiabetic drug

Summary

Metformin Hydrochloride is an antidiabetic drug used in controlling high blood sugar levels in diabetes patients.

IOL Chemicals and Pharmaceuticals Ltd shares jumped 12% on Monday after the company announced receiving approval from CDE, China, for its antidiabetic drug Metformin Hydrochloride.

In a filing to the stock exchanges, the company said that its antidiabetic drug ‘Metformin Hydrochloride’ has been approved by the Center for Drug Evaluation (CDE) of the National Medical Products Administration (NMPA) in China.

Through this approval, IOL Chemicals and Pharmaceuticals will be able to export Metformin Hydrochloride to China.

Metformin Hydrochloride is an antidiabetic drug used to control high blood sugar levels in diabetes patients.

After the announcement, the pharma stock gained as much as 12.07% to an intraday high of ₹452.9 apiece on BSE.

The stock has performed marginally lower so far this year, as it dropped 6% on a year-to-date (YTD) basis. However, shares of the company have managed to give healthy double-digit returns of nearly 40% to its investors in the last one year.

The pharma company reported a decline of 4.1% in net profit in the December quarter on a year-on-year (YoY) basis to ₹23.2 crore compared to ₹24.2 crore in the same period last year. Its revenue from operations remained flat at ₹528.8 crore in the quarter versus ₹528.8 crore in the corresponding period of the preceding fiscal.

Its earnings before interest, taxes, depreciation, and amortization (EBITDA) of ₹52.9 crore in the third quarter that ended December 31, 2023, increased by 6.4% to ₹52.9 crore over ₹49.7 crore in the year-ago period.

Shares of IOL Chemicals and Pharmaceuticals were trading 8.13% higher at ₹436.95 apiece on BSE at 2:38 PM. The scrip settled at ₹428.25, up nearly 6% at Monday’s closing.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter