After all-time high, IndiGo shares rally towards Rs 3000-mark — should you book profits or buy?

Summary

If one were to go by fundamental analysts, the stock of IndiGo has the potential to gain up to 28 percent, while technical analysis suggests a level of Rs 2550. The stock has gained 20 percent so far this year, while it has risen 58 percent in the last one year.

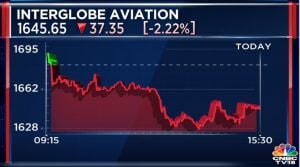

Shares of InterGlobe Aviation (IndiGo) touched all-time high in Tuesday’s trade after the country’s biggest airline by market share placed an order for 500 Airbus A320 family aircraft in a record deal, breaking Tata-owned Air India’s mega-470 aircraft order with Airbus and Boeing earlier this year. The scrip has risen over 2 percent intraday to cross the Rs 2,490 mark for the first time.

The stock has gained nearly 4 percent in the last five trading sessions. On a year-to-date (YTD) basis, IndiGo shares have jumped 20 percent, while it rose 58 percent in the last one year. InterGlobe Aviation is commanding a market capitalisation of Rs 94,300 crore on Tuesday.

If one were to go by fundamental analysts, the stock of IndiGo has the potential to gain up to 28 percent, while a technical analysis suggests a level of Rs 2550.

IndiGo’s consistent approach to aircraft management has given it rich dividend by continuously being able to sustain cycles in terms of lowest cost structure and cash accretion, said ICICI Securities in its research report, maintaining a ‘Buy’ call on the counter with a target price of Rs 3,000.

Morgan Stanley said that with this new Airbus order, the company’s pending aircraft orders reach around 1,000. Market share and margin have been two key drivers, both inching up in the near term. The global brokerage maintains ‘Overweight’ stance on the counter, with a target price of Rs 3126, implying a further upside of 28 percent from the current market levels.

Meanwhile, Citigroup has raised its target price on the stock to Rs 2900 from Rs 2400 earlier.

Risks, as per analysts, include managing cost and fleet expansion in the midst of global engine crisis.

Tech View

Technically, IndiGo witnessed a symmetrical triangle pattern breakout on the weekly charts at 2150 levels, which catapulted the stock towards 2400 levels. After making fresh lifetime high levels, the stock triggered a bearish harmonic alt shark pattern on the weekly charts, which is a reversal pattern in nature, said Gaurav Bissa of InCred Equities.

“The pattern suggests a fall to 2150 levels once the stock closes below 2350 levels. So far, the stock is trading above its major swing high levels, which is keeping the buying interest intact in the stock with multiyear ascending trendline resistance at 2550 levels,” Bissa.

Further, he noted that at current market prices, the risk reward is not suitable for fresh buying and existing shareholders should book partial profit on account of bearish harmonic pattern.

IndiGo’s landmark order for 500 Airbus aircraft

The low-cost carrier said it is the largest-ever single aircraft purchase by any airline with Airbus. With an order for 500 Airbus A320 Family aircraft, the airline has become the world’s biggest A320 Family customer.

However, the engine selection and the exact mix of A320 and A321 aircraft will be done in due course, the airline said in a statement.

The purchase agreement was signed on Monday (June 19) at the Paris Air Show 2023 in the presence of senior officials of both IndiGo and Airbus.

Combined with the previous order of 480 aircraft, IndiGo’s order-book now has almost a thousand aircraft, the airline added. The order will give IndiGo a further steady stream of deliveries between 2030 and 2035, the statement read.

At present, the airline operates more than 300 aircraft and the airline’s order-book now comprises a mix of A320NEO, A321NEO and A321XLR aircraft.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter