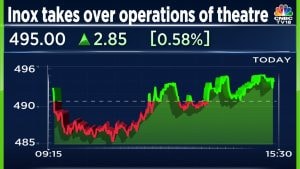

Why India’s multiplex industry is an oligopoly and may not change soon

Summary

Barring some near-term “occupancy” level challenges, emanating partly from a “lack of material Hollywood content,” the merged entity of PVRINOX’s oligopoly will remain unchallenged.

From a duopoly before the merger of PVR and Inox Leisure, the Indian multiplex industry has become an oligopoly, with the top two players now controlling around 65% of functional screens, according to domestic brokerage Nirmal Bang.

And barring some near-term “occupancy” level challenges, emanating partly from a “lack of material Hollywood content,” the merged entity of PVRINOX’s oligopoly will remain unchallenged. From an investor’s point of view, it means steady revenue growth and improved margins over a long period of time.

The reason – for starters, the entry barriers in the sector are “quite formidable,” and as per the brokerage’s industry sources, the other key competitor, Cinepolis, “does not have deep enough pockets to act as a spoiler.”

PVRINOX has built a better economic structure for itself that has helped the firm control the expansion of screens, given the competitive pressure behind it. The case in point is: that in the first quarter of FY24, PVRINOX added only a net of 28 screens. This has helped the firm pare net debt by ₹3.27 billion, along with a blockbuster second quarter of the fiscal year. It also leads to better control of fixed costs. The “better cost structure has led to breakeven levels of occupancy being brought down by 150-200bps to ~20% from 9-12 months back.”

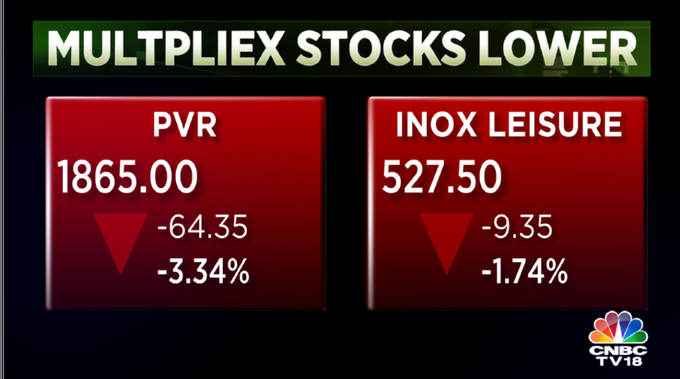

From a stock price target stance, Nirmal Bang has maintained its ‘buy’ rating on PVRINOX Ltd albeit with a slightly reduced target price of ₹2,083 per share. The PVRINOX share price target still has an upside of nearly 20% from the current market price of ₹1,753.

“We have trimmed our occupancy estimates for 3QFY24 while broadly keeping estimates for 4QFY24 and for FY25/FY26 constant, leading to a small cut in EBITDA for FY24. We maintain our BUY rating with a slightly reduced target price (TP) of ₹2,083 (based on 13x Sept’25 EBITDA),” Nirmal Bang analyst Girish Pai wrote in an equity research report on December 7, 2023.

The primary reason for trimming the occupancy level is “the success of content,”— a critical variable that is beyond PVRINOX’s control.

“The next 2-3 quarters (3QFY24–1QFY25) are going to be muted partly due to a lack of material Hollywood content. Even if Dec’23 is as strong as Aug’23 (its best thus far), we think EBITDA for 3QFY24 will likely show a steep decline QoQ (50–55%) from the record levels seen in 2QFY24,” the Nirmal Bang research report said.

The more than six-month Hollywood strike of both writers and actors, which has now ended, will impact the availability of material Hollywood content in the fourth quarter of FY24 and the first quarter of FY25 as many release dates have been deferred, impacting the occupancy level, the report notes.

In a normal year, Hollywood contributes 15-20% of the box office revenue of PVRINOX. This content genre is primarily popular in large metros and Tier-1 cities, and the oligopoly of PVRINOX has captured a large part of the Indian box office revenue, anywhere between 50 and 70%.

In contrast, PVRINOX has not been able to grab box office revenue share (only 10–20%) from successful South Indian movies as single-screen players and regional chains dominate in the region. And that explains why PVRINOX’s bulk of new screen openings are going to be in South India, which may take a few years to translate into a higher box office revenue share.

Elon Musk forms several ‘X Holdings’ companies to fund potential Twitter buyout

3 Mins Read

Thursday’s filing dispelled some doubts, though Musk still has work to do. He and his advisers will spend the coming days vetting potential investors for the equity portion of his offer, according to people familiar with the matter

Listen to the Article

Listen to the Article  Daily Newsletter

Daily Newsletter